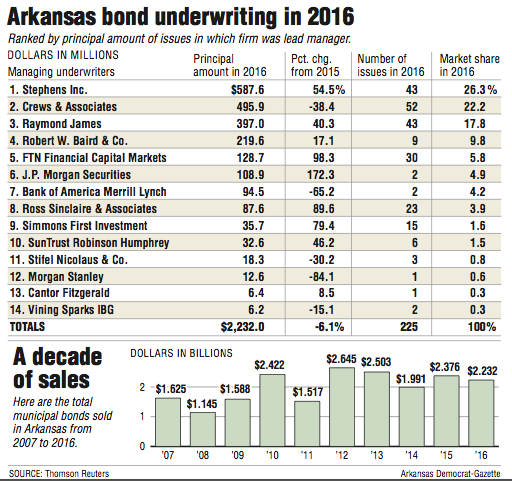

Stephens Inc. was the No. 1 underwriter of tax-exempt municipal bonds in Arkansas last year, according to Thomson Reuters.

Stephens underwrote $587.6 million in bonds in 2016, more than a 50 percent gain from 2015.

Bond sales in the state totaled more than $2.2 billion last year, a decline of about 6 percent from 2015.

Last year was a good year for refinancing opportunities, said Dennis Hunt, executive vice president and director of public finance at Stephens.

"We had an extremely favorable interest rate environment until November 2016," Hunt said. "That resulted in a number of issuers entering the bond market in the state of Arkansas."

Before the November presidential election, bond rates were around 2 percent, Hunt said. After the election, they rose to about 2.8 percent and are now around 2.4 percent, he said.

Crews & Associates, which is owned by First Security Bancorp of Searcy, was second with almost $496 million in bonds underwritten. Crews finished first in 2014 and 2015.

The majority of Crews' business last year was refinancing, said Nathan Rutledge, senior managing director for public finance at Crews.

"As the economy picks up and things change, hopefully in the future there will be more new money projects as communities see a little bit more growth," Rutledge said.

Crews saved its customers in Arkansas more than $70 million because of refinancing, Rutledge said.

Municipal bonds are secured by the tax revenue of a city, county, state or other government entity, or revenue from a nonprofit organization or other qualified borrower.

Arkansas municipal bonds are attractive to investors because interest earned is typically exempt from federal income tax and from state income tax when bought by an Arkansan. In contrast, interest earned on corporate bonds is taxable.

Most of the bond issues last year were governmental issues, Hunt said. But Arkansas Children's Hospital did two large bond issues last year, one that was a refinancing of an existing bond and the other for funding associated with its new hospital in Northwest Arkansas, Hunt said.

The state's largest bond last year was a $114 million bond issued by the University of Arkansas at Fayetteville for financing of an expansion of Donald W. Reynolds Razorback Stadium, Hunt said.

If interest rates rise, inevitably there will be fewer bond issues this year, Rutledge said.

"Even though that's a bit of a negative for our business, that's a positive for the economy," Rutledge said. "That means the world would be doing better, and our communities would be doing a little bit better. So hopefully in time, if those communities are doing better, they would start having some new money [bond] projects."

Any expectations for the environment for municipal bond issues this year are "somewhat buffered by what the interest rate market does," Hunt said.

"With a new president and administration and many of the plans that are on the table, interest rates could increase significantly in 2017, which would have an impact on the number of bond issues that are done," Hunt said. "But if everything stays the same, I would envision that we would have something probably similar to 2016 in 2017."

For the fifth-consecutive year, Bank of America Merrill Lynch was the leading municipal bond underwriter in the country with almost $66 billion in deals, a $16 billion gain from 2015, The Bond Buyer reported.

Bank of America underwrote 518 issues, almost 50 more than it handled in 2015.

Bank of America was the lead underwriter on four deals over $1 billion, The Bond Buyer said.

Citi was second with almost $49 billion in bond underwriting last year.

There was a total of $423.9 billion in 12,271 bond deals underwritten in the United States last year, up $46 billion from 2015.

Business on 01/12/2017