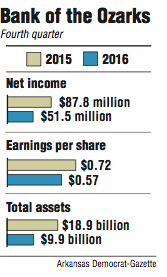

Bank of the Ozarks earned a record $87.8 million in the fourth quarter last year, a 71 percent increase from $51.5 million in the same period of 2015, the Little Rock firm said Tuesday.

The largest bank in Arkansas with $18.9 billion in assets, Bank of the Ozarks earned 72 cents a share for the quarter, up from 57 cents a share in the fourth quarter of 2015.

For the quarter, Bank of the Ozarks beat average expectations of 69 cents a share from 11 analysts surveyed by Thomson Reuters.

For the year, Bank of the Ozarks earned $270 million, a gain of 48 percent from $182.3 million in 2015. The $270 million is the highest annual net income ever for an Arkansas bank. The total for 2015 was the previous statewide high.

Bank of the Ozarks shares closed at $52.12 Tuesday, down $1.34, in trading on the Nasdaq exchange.

"The stock has not performed as well as we expected" after Tuesday's earnings report, Matt Olney, a banking analyst with Stephens Inc. in Little Rock, wrote in a research brief. Olney, who owns no stock in Bank of the Ozarks, has a buy rating on the bank.

Olney speculated that Bank of the Ozarks' poor stock showing "could potentially be related" to a recent article.

The article, in Crain's Chicago Business, "includes an unfortunate comparison to a previous Chicago-based bank, Corus Bank, that was one of the largest bank failures of the real estate downturn in 2008-2010," Olney wrote.

Bank of the Ozarks has had only two losses on loans from its real estate specialties group in the past 14 years, Olney wrote.

The bank says its priorities for making loans for the real estate specialties group are quality, profitability and growth.

"We believe this article negatively portrays [Bank of the Ozarks'] underwriting quality," Olney said.

Bank of the Ozarks had to charge off last year a record of only 0.07 percent of its $14.6 billion in loans, George Gleason, the bank's chairman and chief executive officer, said in a conference call Tuesday.

"This was our lowest annualized net charge-off ratio in our 19 years as a public company," Gleason said.

The portfolio of the real estate specialties group accounts for 92 percent of Bank of the Ozarks' total loans, Gleason said.

The Dallas-based division of Bank of the Ozarks has almost $5 billion in loans in the New York metropolitan area, the largest market for the bank, Gleason said.

But Bank of the Ozarks also has millions of dollars in real estate loans in major cities throughout the country, many of which don't have a Bank of the Ozarks office. Including among those are Seattle; Chicago; Denver; Los Angeles, San Francisco, Miami; Austin, Texas; Nashville, Tenn.; and Charleston, S.C., Gleason said.

"What I think you will see in 2017 is a tremendous increase in California," Gleason said. "We do have two offices there. Those offices are maturing. We built that team up in 2015 and it got a lot of traction in 2016. I think you will see that become a bigger part of our business in the coming year."

Bank of the Ozarks is building the infrastructure to become a bank with $50 billion in assets, Gleason said. Last year, a $50 billion bank would have ranked among the 40 largest banks in the country.

"We're building what we need to be a much larger organization than we are today," Gleason said. "And we will continue that building going forward."

Bank of the Ozarks has 249 offices in Arkansas, Georgia, Florida, North Carolina, Texas, Alabama, South Carolina, New York and California.

Business on 01/18/2017