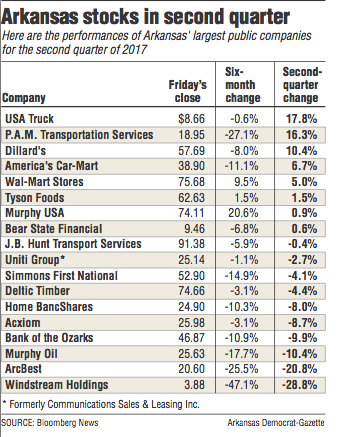

The two smallest publicly traded trucking companies in Arkansas -- USA Truck and P.A.M. Transportation Services -- had the best performing stocks in the Arkansas Index in the second quarter.

USA Truck shares rose 17.8 percent in the quarter that ended Friday. Shares of Tontitown-based P.A.M. rose 16.3 percent for the quarter.

USA Truck's shares set a 52-week low in the two weeks after its earnings release in early May, said Bob Williams, senior vice president and managing director of Simmons First Investment Group Inc. in Little Rock.

The Van Buren trucker's stock began a rebound after reports of insider buying were announced.

"The projections from the new management team to return to operating profitability in the third quarter was promising," Williams said. "Thus far, investors have responded positively in the hope that the initiatives and changes will have a constructive impact."

Last year, P.A.M. had four quarters of negative earnings surprises. But investors were rewarded in the first quarter this year with a positive report and the resultant share price increase, Williams said.

"Earnings were buoyed by higher oil prices allowing for increased fuel surcharges to be passed through to customers," Williams said. "While the announcement of a half million share buyback did not produce an immediate impact on the stock price, the shares have continued to drift higher."

It was a volatile quarter for retail company stocks, and Dillard's was no exception, Williams said. But the Little Rock retailer's stock climbed 10.4 percent in the past three months.

"After delivering slightly better than expected quarterly results, the share price promptly plunged," Williams said. "In the two days after reporting earnings, the shares lost as much as 27 percent. Subsequently, the price rebounded later in the quarter as short sellers covered their positions."

Only eight of the 18 companies in the Arkansas Index had positive returns for the quarter.

"Negative earnings reports seem to be the common theme this quarter," Williams said. "Wall Street is all about managing expectations. Overpromising and underdelivering on results can result in negative consequences for share prices."

Murphy USA of El Dorado was up 20.6 percent, the best gain for the first six months of the year.

Windstream Holdings of Little Rock had the biggest fall, dropping 28.8 percent in the second quarter. Windstream also had the worst performance through the first six months of the year, falling 47.1 percent.

"Windstream continues its strategy of adding more fiber-rich assets and diversifying its business," Williams said. "Despite this, the company remains defined as a high dividend yield story in the defensive rural telecom sector. The shares remain under pressure by short sellers after a disappointing quarterly earnings report."

Fort Smith-based ArcBest lost 20.8 percent for the quarter, the second worst drop.

Earlier this year, the company introduced a new corporate structure to better serve customers and unify functions under the ArcBest brand, Williams said.

"Shareholders were punished in early May as the sellers piled on following a disappointing earnings report," Williams said. "Trucking is a fiercely competitive industry and with anemic freight demand, ArcBest's management has adapted remarkably well. Like others, ArcBest wrestled with more smaller shipments as volume grew but tonnage fell."

El Dorado-based Murphy Oil fell 10.4 percent for the second quarter.

Despite its management's efforts over the past several years to move into a stronger and more competitive business model, Murphy Oil has not seen those efforts reflected in its share price for the most recent quarter, Williams said.

"Oil prices continued to be the primary driver influencing the stock price," Williams said.

Three of the four banks on the Arkansas Index were down for the second quarter.

Shares of Little Rock's Bank of the Ozarks fell 9.9 percent for the period, Home BancShares of Conway fell 8 percent, and Pine Bluff's Simmons First National dropped 4.1 percent. Shares of Little Rock-based Bear State Financial rose 0.6 percent.

Garland Binns, a Little Rock banking attorney, said he knew of no specific reason why the three larger banks' stocks were off for the quarter.

The banks themselves are doing well, Binns said.

"All four banks have great loan portfolios," Binns said. "The efficiency ratios of the Arkansas banks are outstanding. In general, those banks will continue to perform well."

The Arkansas Index of the 18 largest publicly traded companies in the state was down 1.3 percent for the second quarter and down 5.2 percent for the first six months of the year.

Business on 07/01/2017