Arkansas Federal Credit Union has an unusual business strategy that includes buying a bank in the state.

"That is in our short term strategic plan," Rodney Showmar, Arkansas Federal's chief executive officer, said in a recent email. "We have already spoken to two banks, that I'm not at liberty to name, about just such an arrangement."

A recent article in American Banker said credit unions nationally have agreed to buy seven banks in the past 18 months, a considerable increase in what was once a rare practice.

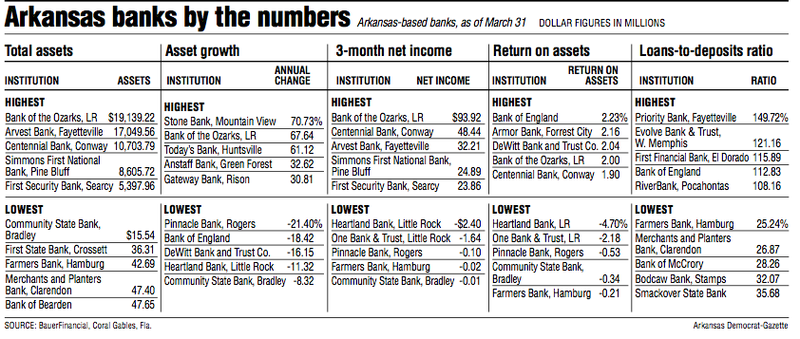

Arkansas Federal, based in Jacksonville, is the largest credit union in the state with $1.1 billion in assets. It would consider buying a bank with less than $200 million in assets, Chief Financial Officer Eric Mangham said. Exactly half of Arkansas' 100 banks have less than $200 million in assets.

"What would be ideal for us is a bank with a lot of deposits and not a ton of loans, since we have a lot of loans and we need deposits," Mangham said.

Arkansas Federal Credit Union has $904 million in loans and $882 million in deposits.

Of the 50 banks in the state with less than $200 million in assets, 23 have more than $100 million in deposits and less than five of those have twice as much in deposits as loans.

In the seven deals since last year in which credit unions bought banks, the banks' assets averaged $82.6 million, according to S&P Global Market Intelligence.

"We plan on being the first credit union in Arkansas to buy a bank when the proper opportunity, that fits into our strategy, presents itself," Showmar said.

The rationale for Arkansas Federal to bid on banks is acquiring loans and deposits and entering new markets at a lower cost, Mangham said.

For various reasons, some bankers are interested in selling their banks.

"And as a credit union, we could be another bidder, providing more price competition to the seller of the bank and [possibly] allowing us to enter into the marketplace," Mangham said.

Arkansas Federal's immediate focus is banks in Arkansas, Mangham said.

The credit union's current membership is focused in Little Rock, so it is more interested in banks close to Little Rock that don't have branches near Arkansas Federal branches, Mangham said.

A credit union buying a bank is a lot more complicated than a bank buying a bank, from a regulatory perspective, Mangham said.

"You still have to qualify everybody for membership," Mangham said. "That's why it makes more sense in areas that are closer to where you're at. It would be good if we could find someone who is local or someone in an underserved market, like possibly south Arkansas."

Arkansas Federal has more than 775 membership groups that allow depositors to join the credit union. Included in the larger groups are employees of Arkansas state government and the Little Rock Air Force Base in Jacksonville, Mangham said. And Arkansas Federal has signed up many of the major businesses and associations in the state, he said.

"One of the things we are interested in are financial institutions that have good locations," he said.

Credit unions are tax exempt and banks are required to pay taxes.

Bankers have long argued that credit unions should also be taxed, said Garland Binns, a Little Rock banking attorney.

"I don't think we're going to see a trend [of credit unions buying banks]," Binns said.

It would just have to be the right match for a credit union to buy a bank, Binns said. Should a credit union acquire a bank, it would be because the credit union needs deposits to make loans, he said, adding that would be the same mindset a bank would have in buying a credit union.

A credit union is like a mutual savings and loan, Binns said. Neither have any equity shareholders. A credit union's members own the credit union. Credit unions, therefore, only have cash and no stock to buy another institution. For that reason, small, privately owned banks can see a credit union as a favorable buyer, the American Banker said.

But not all bank shareholders want to sell their institution in an all-cash transaction, Peter Duffy, a managing director at Sandler O'Neill and Partners, an investment banking firm based in New York, told the American Banker.

Regulators, management teams and shareholders generally prefer at least a partial payment of stock, Duffy said. More than half of all bank sales involve some stock consideration, Duffy told the banking-focused newspaper.

Arkansas Federal is not in a rush to make an acquisition, Mangham said.

"At the same time, if something came up we could be very interested," he said. "We're keeping our eyes open to find something of interest to us. But if we don't see something for two years, so be it."

SundayMonday Business on 07/09/2017