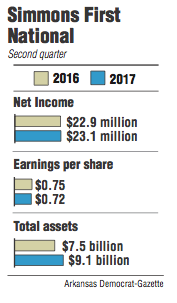

Simmons First National Corp. earned $23.1 million in net income in the second quarter compared with a profit of $22.9 million in the same period last year, the Pine Bluff bank said Wednesday.

Simmons earned 72 cents a share, missing the average estimate of 80 cents a share of five analysts surveyed by Thomson Reuters.

The bank's stock rose 35 cents a share to close Wednesday at $52.55 in trading on the Nasdaq exchange. Simmons released its quarterly report after the market closed.

Simmons had "solid results" in the quarter, said George Makris, Simmons' chief executive officer.

"Our loan growth continues to be strong," Makris said in a prepared statement. "We continue to expand our risk management programs in anticipation of surpassing $10 billion in assets within the next few months. All in all, we feel we are well-prepared for continued growth both [internally] and through acquisitions."

Simmons had loans of $6.2 billion on June 30, an increase of $1.2 billion, or 24 percent, from the same date last year. Simmons had growth of $270 million in loans in its markets in Springfield, Mo.; Northwest Arkansas; the Kansas City, Mo., area; St. Louis; and Little Rock, the bank said.

Total deposits were $7.1 billion at the end of the second quarter, an increase of $1.1 billion, or 17.8 percent, compared with a year earlier. Most of the growth was from deposits gained in acquisitions.

The bank had assets of $9.1 billion on June 30, up from $7.5 billion on June 30, 2016.

Simmons had an efficiency ratio of 56.04 percent in the second quarter, down slightly from 57.33 percent in the same period last year. That means it costs Simmons $56.04 to earn $100.

Simmons is focused on closing on its two announced acquisitions, said Matt Olney, a banking analyst with Stephens Inc. in Little Rock.

The bank filed the merger applications for Southwest Bancorp Inc. in Stillwater, Okla., and First Texas (Bank Holding Co.) in Fort Worth on July 14, Simmons said.

"It's a long process," said Olney, who owns no stock in Simmons. "The question now is is that something that will be wrapped up at the end of this year or go into early next year."

Simmons anticipates a closing date as early as October or as late as January, the Pine Bluff bank said in its news release.

Olney said it is unlikely Simmons will proceed with another purchase until after it closes the Texas and Oklahoma bank deals.

"Maybe next year you could see them come back in the market [for another acquisition]," Olney said.

Simmons will hold a conference call at 11 a.m. today to discuss the quarter. To access the call, dial (866) 298-7926 and provide identification code 4025-2860.

Simmons has branches in Arkansas, Kansas, Missouri and Tennessee.

Business on 07/20/2017