Buoyed by increased sales- and corporate income-tax collections, Arkansas' general revenue in May increased by $36 million over the same month a year ago to $468.9 million.

General-revenue collections represent a record for the month of May, exceeding the previous record of $443.2 million in May 2013, said Whitney McLaughlin, a tax analyst for the Arkansas Department of Finance and Administration.

The state's total general revenue in May exceeded by $20.3 million the revised forecast that was cut several weeks ago, state officials reported Friday in the finance department's monthly revenue report.

"The revenue report reflects continued economic strength and growth in the state with more people working with better paying jobs," Gov. Asa Hutchinson said in a written statement.

"I am pleased that we are meeting the revised forecast and this last month shows revenue in excess of the forecast. This is good news but we will maintain a cautious approach with spending as we enter the last month of the fiscal year," the Republican governor said.

Tax refunds and some special government expenses come off the top of total general revenue, leaving a net amount that state agencies are allowed to spend.

The net in May totaled $339.2 million -- up by $1 million, or 0.3 percent, over the same month a year ago -- and exceeded the state's revised forecast by $57.8 million because of lower-than-expected individual income tax refunds and higher-than-expected individual income tax and sales tax collections, said John Shelnutt, the state's chief economic forecaster.

The net for May exceeded the state's previous forecast by $13.7 million, Shelnutt said.

Five weeks ago, Hutchinson announced a $70 million cut to the $5.33 billion general-revenue budget, to $5.26 billion, for fiscal 2017, which ends June 30. He cited lagging sales tax and corporate income tax collections and higher-than-expected individual income tax refunds for the cut. The governor said services wouldn't be affected and employees wouldn't be laid off.

The state projected a decline of about $100 million in general revenue in fiscal 2017 from the 2015 Legislature's enactment of an income tax cut. Hutchinson had proposed cutting individual income tax rates for Arkansans with taxable incomes between $21,0000 and $75,000 a year.

"Notwithstanding the good numbers for May, it was the right decision to revise the forecast and curtail Category B spending [in the Revenue Stabilization Act] last month. The belt tightening was appropriate," Hutchinson said Friday.

In last year's fiscal session, the Legislature and Hutchinson enacted the $5.33 billion general revenue budget for fiscal 2017, with most of its $142.7 million increase targeted for the state Department of Human Services and public schools under the Revenue Stabilization Act. The act distributes general revenue to agencies and programs. Spending is put in Categories A and B, with B the lower priority.

Sen. Larry Teague, D-Nashville, said Friday that he's not second-guessing the governor's decision to cut the budget in light of May's increased tax collections.

"I think it was the right decision," said Teague, co-chairman of the Legislature's Joint Budget Committee. "If I am going to make a mistake, I want to err on not spending money -- not spending money we don't have."

Hutchinson also has ordered a $43 million cut in the general-revenue budget of $5.49 billion for fiscal 2018, which starts July 1.

The fiscal 2017 cut is Arkansas' first since then-Democratic Gov. Mike Beebe cut the budget by $206 million in fiscal 2010 to $4.3 billion, amid an economic downturn.

Nearly half of the nation's states face budget shortfalls for the first time since the recession of 2008-09, the National Conference of State Legislatures reported.

In fiscal 2017 or in the biennium for states that enact a two-year budget, 22 states reported that they had either already addressed or would have to address a budget shortfall before the end of the fiscal year, the conference reported

"No overarching characteristic defines states facing budget shortfalls, except that revenue collections are not in line with spending plans," according to the National Conference of State Legislatures' report. "States facing FY 2017 shortfalls range broadly from energy producing states such as Alaska to agriculturally dependent states such as South Dakota."

The conference said 20 states anticipated facing a shortfall in fiscal 2018 or the upcoming biennium.

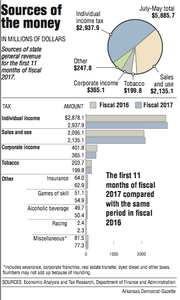

During the first 11 months of fiscal 2017, Arkansas' total general revenue increased by $58.4 million, or 1 percent, to $5.89 billion, and that's $20.3 million, or 0.3 percent, above the revised forecast, Arkansas' finance department reported Friday.

So far in fiscal 2017, individual income tax collections have totaled $2.94 billion -- a $59.9 million, or 2.1 percent, increase over those collections in the same period in fiscal 2016.

Sales and use tax collections have totaled $2.14 billion thus far in fiscal 2017 -- a $40.1 million, or 1.9 percent, increase over last fiscal year at this time. But corporate income tax collections so far in fiscal 2017 have totaled $365.1 million -- a $36.7 million, or 9.1 percent, decrease from last fiscal year at this point.

Thus far in fiscal 2017, the net general revenue available to state agencies has totaled $4.78 billion -- a $49.1 million, or 1 percent, decrease from last fiscal year at the same point.

Individual income tax refunds have increased by $90.9 million, or 27.2 percent, compared with the same period in fiscal 2016, to $424.7 million, but they are $32.4 million, or 7.1 percent, below the revised forecast.

Larry Walther, the director of the state Department of Finance and Administration, said the department projected $96 million in individual income tax refunds for last month and the refunds turned out to be $63 million.

"Our original forecast was $33 million," he said. "We made the right decision to revise the budget and we're cautious."

According to the finance department, May's general revenue included:

• A $7.6 million, or 3.5 percent, drop in individual income tax collections over a year ago to $209.4 million. The total exceeded the revised forecast by $11.3 million or 5.7 percent.

The month's individual income tax collections declined from year-ago figures because last month had one fewer payday than the same month a year ago, said Shelnutt.

Withholdings are the largest category of individual income taxes. The month's withholdings totaled $194.4 million -- a drop of $5.9 million compared to May 2016 -- and exceeded the state's forecast by $9.1 million.

"If you actually put April and May together, which was an up and a down, it shows amazing strength in the economy of above 6.5 percent underlying growth in wages," Shelnutt said.

• A $20.8 million, or 12.1 percent, increase in sales and use tax collections over year ago figures to $192.4 million that exceeded the revised forecast by $7.6 million, or 4.1 percent.

"We are seeing some positive results this month. It has been below our expectations pretty much all this year, and it is above our revised forecast and it's above what we had originally forecasted for May," Walther said.

The increase in sales and use tax collections over a year ago is higher than it would have been otherwise because the state made a court-ordered $8.2 million sales tax refund in May of last year, Shelnutt said.

• A $24.4 million, or 273.4 percent, increase in corporate income tax collections to $33.4 million that exceeded the state's revised forecast by $400,000, or 1.1 percent.

"We are hopeful that [tax collections] are getting back to normal on the corporate side, whatever normal is," Walther said. "But we had anticipated some additional payments there and we forecasted it and we pretty much hit it on the nose."

A Section on 06/03/2017