Four days after announcing plans to cut the state general revenue budget for the rest of this fiscal year, officials said Tuesday that they also took $43 million out of the budget for the next fiscal year, which starts July 1.

The cuts are planned even as the state announced record revenue for April.

"These cuts just reflect the fact that the budget for 2018 will be tight," Gov. Asa Hutchinson, a Republican, said in a written statement. "However, no layoffs are expected, and services will go on uninterrupted. I will continue to monitor the budget, as I've always done, as we enter a new fiscal year."

The announced cuts come about a month after the Republican-controlled Legislature and governor passed a $5.496 billion general revenue budget for fiscal 2018. Most of what was a $163 million increase in that budget was earmarked for the Department of Human Services.

But late Tuesday afternoon, Department of Finance and Administration officials announced a cut in the forecast for net general revenue -- the amount available for state agencies -- to $5.453 billion for fiscal 2018.

The change reflects updates in the state's economic forecast; a net revenue increase of $6.3 million from tax law changes by this year's General Assembly; and a reduction in the amount of money going to the State Central Services and Constitutional Officers Fund, the department said. Tax refunds and some special government expenses come off the top of total general revenue, leaving a net amount that state agencies are allowed to spend.

The revised forecast for fiscal 2018 projects a $230.9 million increase in gross general revenue over fiscal 2017, to $6.75 billion.

"It still shows a strong economy, a strong expansion continuing across the biennium [in fiscal years 2018-19]," said John Shelnutt, the state's chief economic forecaster. "This economic update is not that much different from the recent past and does not include some major anticipated or hoped for gains from a [Republican President Donald] Trump budget, and stimulus in business spending and investment or stimulus for infrastructure."

The state Revenue Stabilization Act for fiscal 2018 prioritizes spending into A and B categories. The $43 million budget cut will mean a 33 percent cut in the $131.5 million Category B allocation. Most of the money would go to the Department of Human Services, with other money for public schools, prisons, parks, and tourism and health.

Finance department officials Tuesday also formally reduced the fiscal 2017 budget by $70 million, to $5.263 billion. Hutchinson announced that cut Friday and said it wouldn't result in layoffs or reduced services.

To explain the fiscal 2017 budget cut, Hutchinson pointed to lagging sales and corporate income tax collections, and higher-than-expected individual income tax refunds. The 2015 Legislature passed Hutchison's plan to cut individual tax rates for Arkansans with taxable incomes between $21,000 and $75,000.

The plan was projected to cut general revenue by about $100 million a year.

Category B in the Revenue Stabilization Act for fiscal 2017 has a $127.9 million allocation. The reduction cuts Category B by 55 percent, according to the finance department.

Most of the money is for Medicaid, with the rest for education, higher education, prisons and the state's economic development agency.

"We are just now officially issuing the guidance on the revenue forecast for the current fiscal year ... but as that process rolls out, now we are working with" agencies to figure out where they will cut their budgets, said Jake Bleed, a spokesman for the Department of Finance and Administration.

Officials haven't decided whether to grant merit raises to state employees in fiscal 2017, said Larry Walther, finance department director.

The last state government budget cut was in January 2010, when then-Gov. Mike Beebe, a Democrat, announced a $106 million reduction just a few months after another $100 million cut during an economic downturn.

In addition to the budget cut, the finance department reported that general revenue in April increased by $30.6 million, or 3.9 percent, over the same month a year ago to $824.3 million and exceeded the state's forecast by $14.3 million, or 1.8 percent.

April's total general revenue collection is a record for the month. The previous April record was $817.4 million in 2013, said department tax analyst Whitney McLaughlin.

"We think the economy in Arkansas is good, especially as reflected in the withholding tax," Walther said.

"The unemployment rate is a record low. A lot of people are working out there. The actual number of people employed is up. It seems to be a good economy. I wish it was more reflected in sales tax and corporate income tax."

According to the finance department, April's general revenue included:

• A $16.7 million, or 3.3 percent, increase in individual income taxes over the same month a year ago to $522 million, which fell $9.7 million, or 1.8 percent, below forecast.

Individual withholdings are the largest category of individual income taxes. They totaled $285.3 million, a $50.3 million increase over a year ago and $26.8 million over forecast.

Withholding collections were boosted from having one more Friday payday than the same month a year ago. Another boost came from the income taxes paid by a $177 million Mega Millions jackpot winner from Texas, state officials said.

• A $2.4 million, or 1.3 percent, decrease in sales and use tax collections over the same month a year ago, to $190.2 million. The monthly collection was $11.1 million, or 5.5 percent, below forecast.

"For some reason this year, our sales tax has been just continually lagging [growth in individual income tax withholdings]. The sales tax is just acting strangely this year," said Walther.

April is the first month that Seattle-based Amazon started remitting sales taxes to the state based on its sales to Arkansans.

"It is in there, but it's not a big panacea," Walther said.

• A $22.1 million increase in corporate income tax collections over the same month a year ago to $78 million, which is $31.7 million above forecast.

Walther said the change in the corporate income tax filing due date from March 15 to April 15 increased those collections in April.

Net general revenue available to state agencies for April inched down by $400,000, or 0.1 percent, below year-ago figures to $660.9 million. That's $11.3 million above forecast, according to the finance department.

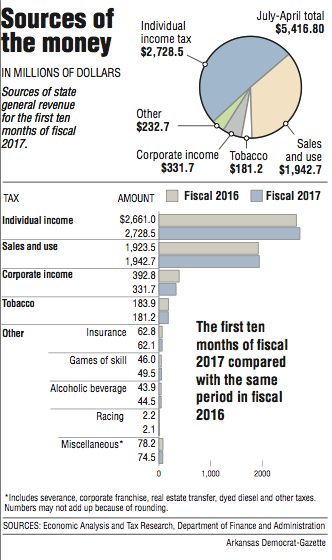

Through the first 10 months of fiscal 2017, gross general revenue totaled $5.42 billion -- an increase of $22.5 million, or 0.4 percent, over the same period in fiscal 2016, but $87.5 million below forecast.

So far in fiscal 2017, individual income tax collections have increased by $67.5 million, or 2.5 percent, over the same period in fiscal 2016 to $2.73 billion and that's $10.6 million, or 0.4 percent, below forecast.

Sales and use tax collections have increased by $19.3 million, or 1 percent, over the same period in fiscal 2016 to $1.94 billion. But that's $61.8 million below forecast.

Corporate income tax collections have declined by $61.1 million, or 15.6 percent, from the same period in fiscal 2016 to $331.7 million. That's $39.3 million, or 10.6 percent, below forecast.

In the 10-month period of fiscal 2017, net general revenue available to state agencies totaled $4.48 billion -- which is $50.1 million, or 1.1 percent, below the same period in fiscal 2016 and below forecast by $54 million, or 1.2 percent.

A Section on 05/03/2017