State general revenue in September increased by $8.2 million over year-ago figures but fell $2.8 million short of forecast for the month, a report Tuesday showed.

Last month's general-revenue tax collections totaled $586.9 million and represented a 1.4 percent increase over September 2016, the state Department of Finance and Administration said Tuesday in its monthly revenue report. September's general revenue fell short of the record collections for September of $590.1 million in 2013, said Whitney McLaughlin, a tax analyst for the finance department.

The revenue report for last month shows the state's economy is strong, based on "very high" withholding collections from individual income taxes and the increasing consumer part of sales tax collections, said John Shelnutt, the state's chief economic forecaster.

State government's collections of individual income taxes and sales and use taxes -- its two largest sources of general revenue -- both increased in September compared with the same month a year ago, with the greater contribution coming from individual income tax collections. But both categories also came in below forecast, with the bigger shortfall coming from sales and use tax collections, reflecting reduced business spending and auto sales, state officials said.

"It is good news that net available revenues for the year exceeds our forecast," Gov. Asa Hutchinson said in a written statement.

"The fact that jobs continue to increase in Arkansas means the individual income tax payments remain strong. September was another lower than expected month in sales tax revenues and we will monitor the budget projections closely," the Republican governor said.

September is the third month in fiscal 2018, which started July 1.

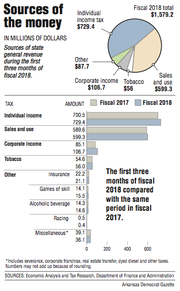

So far in fiscal 2018, gross general-revenue collections total $1.58 billion, a $59.1 million, or 3.9 percent, increase over the same period in fiscal 2017. The three months of gross revenue also exceeded the state's forecast by $8 million or 0.5 percent.

During the first three months of fiscal 2018, both individual income tax and corporate income tax collections have exceeded the forecast by $7.2 million and $7.4 million, respectively. But sales and use taxes have fallen short of forecast by $11.5 million during this three-month period.

The state is projected to collect $6.75 billion in total general revenue-- up by $205.1 million over collections in fiscal 2017, McLaughlin said.

State tax refunds and some special governmental expenditures, such as court-mandated desegregation payments, come off the top of general revenue, leaving a net amount.

The net for the month increased by $3.3 million, or 0.6 percent, over a year ago to $518.8 million and trailed the state's forecast by $7.1 million or 1.3 percent.

During the first three months of fiscal 2018, the net totaled $1.38 billion, a $46.9 million, or 3.5 percent, increase over the same period in fiscal 2017. The net collections are $2.2 million, or 0.2 percent, above the state's forecast.

For fiscal 2018, the state-funded general-revenue budget is $5.45 billion, up by $130.1 million over fiscal 2017, McLaughlin said.

Earlier this year, Hutchinson cut the fiscal-2018 budget by $40 million. He also cut the fiscal-2017 budget by $70 million because of lagging sales and corporate income tax collections, but then restored $60 million of that cut at the end of the fiscal year, after tax collections rebounded.

For fiscal 2018, revenue forecasts are subject to uncertainty over factors related to federal tax policy changes, the extent and timing of Federal Reserve rate increases and "nonwage income tax recovery," according to a recent report to the Albany, N.Y-based Rockefeller Institute of Government.

State officials across the country remain anxious about potential cuts in federal aid that could lead to great fiscal uncertainty, the institute said. "The uncertainty tied to federal policy changes puts state forecasters in a tough position and quite understandably makes it harder to forecast state revenues with any precision."

Shelnutt, the Arkansas chief economic forecaster, said, "Arkansas and other states experienced some impact from taxpayer strategy in [fiscal] 2017 from shifted tax filings and income recognition in anticipation of lower federal tax rates from tax reform. ... This is difficult to quantify with other factors and economic growth involved."

Additional caution was expressed by states and national tax research groups during a recent meeting of the Federation of Tax Administrators. Officials at that meeting raised the possibility of a second year of anticipating rate reductions and associated taxpayer strategy and tax filing shifts, Shelnutt said.

According to the finance department, September's general revenue included:

• An $8.1 million, or 2.9 percent, increase in individual income taxes over year-ago figures to $283.9 million. These collections fell $500,000, or 0.2 percent, below the state's forecast.

Withholdings is the largest category of individual income taxes. They increased by $13 million over the same period a year ago to $197.5 million and exceeded the forecast by $600,000.

"We got pretty decent growth in individual [income tax collections]," said finance department Director Larry Walther.

• A $3 million, or 1.5 percent, increase in sales and use tax collections from a year ago, to $199.4 million. The collections were $5.3 million, or 2.6 percent below the state's forecast.

Walther said sales tax collections from automobile sales declined last month by 8 percent from a year ago.

Also, Shelnutt said consumer spending in September increased "nicely" over the same month a year ago, but business spending was "down" from a year ago.

Walther said one would think that sales tax collections from consumer spending and business spending "track one another, but for the recent past they sort of reverse roles monthly.

"In other words, one month it's business is up and consumer is down, and the next month consumer is up and business is down. If they could ever get on track ... the sales tax would be a little more steady and growing as we had forecasted," he said.

• A $1.6 million, or 2.2 percent, decrease in corporate income tax collections from September 2016, to $71.2 million. These collections exceeded the state's forecast by $3.3 million, or 4.9 percent.

Walther noted that finance department officials expected corporate income tax collections in September to decline from a year ago.

A Section on 10/04/2017