Arkansas' three largest publicly traded banks still are considering future acquisitions while they focus on integrating recent purchases.

Simmons First National Corp. of Pine Bluff closed this month on the purchase of two large banks, Southwest Bancorp of Stillwater, Okla., with $2.5 billion in assets, and First Texas BHC of Fort Worth, with $2 billion in assets.

Conway-based Home BancShares closed in September on its largest purchase ever, Stonegate Bank of Pompano Beach, Fla., with $3.5 billion in assets.

Bank of the Ozarks closed on its most recent purchases last year -- C1 Financial of St. Petersburg, Fla., with $1.7 billion in assets, and Community & Southern Holdings of Atlanta, with $3.9 billion in assets.

The three Arkansas banks each released third-quarter earnings this month.

The number of purchases in the banking industry are bound to decrease, said Richard Hunt, chief executive officer of the Consumer Bankers Association of Washington.

"You're going to have less transactions because there are less banks," Hunt said on a recent visit to Little Rock.

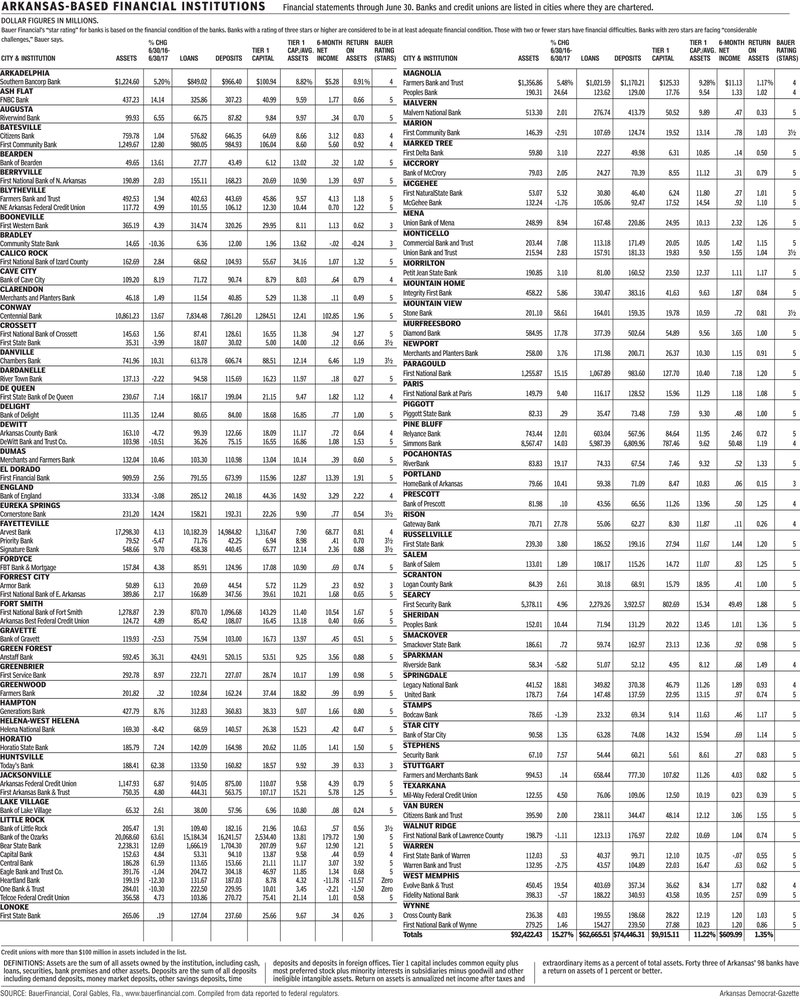

Nationally, the number of banks has dropped more than 50 percent since 1994 from 12,600 to about 5,790. In Arkansas, the number of banks fell from 274 in 1994 to only 98 in the third quarter this year, almost a two-thirds decline.

"The rule of thumb is 2-4 percent consolidation each year," Hunt said. "I do believe that if President Trump had not won, you would see more consolidation. The vast majority of banks consolidating are banks under $1 billion [in assets]."

Bank of the Ozarks is a member of Hunt's association. Hunt is interested in possibly adding Arvest Bank and Simmons Bank to the association, he said.

Executives with Simmons and Home BancShares said in recent conference calls they are more likely to buy a bank in the range of $1 billion in assets.

Simmons believes it has more opportunities for acquisitions in its existing markets, said George Makris, Simmons' chairman and chief executive officer.

"Not that we wouldn't consider one that's in a contiguous market, but we have a lot of really priority markets in our current [states]," Makris said. "That's where we would really like to grow."

Home BancShares has its eye on a bank with $8 billion to $9 billion in assets.

Home BancShares is looking for a "dent and scratch" deal, meaning one that has some problems, said John Allison, Home BancShares' chairman.

Allison said he "really, really" likes the $8 billion to $9 billion deal. "But you kind of bet the farm with the company," Allison said.

Home BancShares wouldn't show as much interest in a deal outside its current area of Arkansas, Alabama, Florida and New York.

"We still like Texas and at some point we will probably end up in Texas," Allison said.

One of the biggest advantages for Home BancShares of buying Stonegate Bank is that Stonegate can make larger loans by using Home BancShares' larger size.

"With Home's bigger balance sheet, we can go back to existing customers and increase the relationship," said Dave Seleski, Stonegate's chief executive officer before the sale and now in management with Home BancShares. "We prescreened three or four [loans] over the last couple of weeks for existing customers. That could be an additional $70 million in production that we would not have had."

The bad news for Home BancShares is that Hurricane Irma left significant damage.

"[But] the good news is that there is going to be rebuilding in the state of Florida and lots of economic activity," Allison said.

Bank of the Ozarks is facing difficulties in its search for acquisition targets.

For many years, Bank of the Ozarks' stock traded at an extremely high correlation between its stock price and its tangible book value per share and its stock price to earnings per share, said George Gleason, Bank of the Ozarks' chairman and chief executive officer.

"We can all do the math that clearly affects our ability to do [bank purchases] in our very disciplined world of seeking to do [acquisitions]," Gleason said. "It doesn't knock us out of the game but it makes the math much less compelling."

Bank of the Ozarks continues to be active in considering acquisitions, Gleason said.

SundayMonday Business on 10/29/2017