A decline in August's individual income tax receipts from a year ago helped cause Arkansas' general revenue collections to dip $5.4 million from the same month last year.

Arkansas' total general revenue collections of $468.2 million last month also fell $500,000 short of expectations. However, after revenue in July set a record for the first month of the fiscal year, state agencies still have more cash available than expected so far in fiscal 2018. Department of Finance and Administration officials said Tuesday's revenue report raised no cause for concern.

Income tax collections for individuals and corporations fell below August forecasts, but not by much. Arkansas drew $205.4 million from individuals ($200,000 short) and $5.2 million from corporations ($700,000 short).

The widest gap compared with expectations for August came from sales and use taxes, which at $200.4 million fell $4.7 million below the projection from the Department of Finance and Administration.

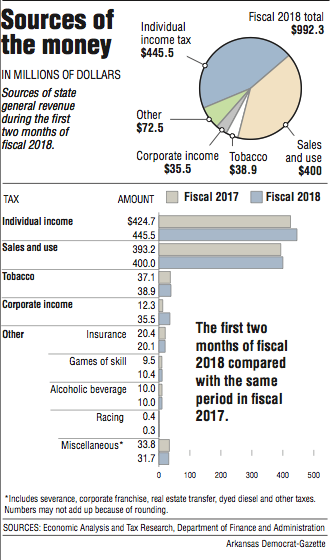

Individual income taxes as well as sales and use taxes make up the bulk of Arkansas' revenue. Shortfalls in both those categories were eased by greater-than-expected revenue from taxes on tobacco, alcohol and games of skill.

Total collections in the month declined 1.1 percent compared with August 2016, when the state collected nearly $9 million more in individual and corporate income taxes. However, sales and use tax revenue was $200,000 higher this August.

The record for revenue in August, set in 2015, is $478.1 million, according to Whitney McLaughlin, a tax analyst for the finance department.

During the first month of fiscal 2018, Arkansas took in more than half a billion dollars in tax collections, far surpassing the previous July record.

Combining the first two months of the fiscal year, Arkansas has collected $10.8 million more than officials first projected, despite sales and use tax collections that were below the mark twice.

That's in contrast to last year, when revenue lagged behind forecasts for three straight months to start the fiscal year. After having to announce budget cuts earlier this year in response to revenue shortages, Gov. Asa Hutchinson expressed tepid optimism about Tuesday's report.

"This report reflects the overall strength and growth of the state's economy," Hutchinson said in a statement. "The two-month revenue picture is above forecast, but the continued sluggishness of sales tax collections bears watching. We are encouraged by strong year-to-date growth in individual income tax collections; however we will continue a conservative approach as we administer the state budget."

Speaking to reporters Tuesday, Department of Finance and Administration Director Larry Walther called the missed sales and use tax projections a "mystery" while adding that overall collections were "pretty much on target."

Some fluctuations were expected, he said, citing the report. That includes an $8.7 million drop in August's individual income tax collections compared with the same period last year, as a result of the month having one less pay period to draw taxes from.

But sales tax collections in August were mostly flat compared with the previous year, despite the addition of taxes that online retailer Amazon began voluntarily collecting in March. Tax collections from motor vehicle sales also remained stagnant, according to Walther.

"With individual income tax and wages up, you would think people would have more disposable income and therefore would be spending more and paying more in sales tax, but we're not seeing that in the numbers at this point," Walther said.

Corporate tax collections, which totaled $5.2 million in August, are due for a boost in September as companies file quarterly reports, said John Shelnutt, the state's chief economic forecaster.

Shelnutt said "volatile" corporate income tax collections over the past two years were partially to blame for the state's up-and-down revenue stream in fiscal 2017. One factor was corporations putting their 2016 tax returns toward paying their taxes in 2017, he said, which caused higher-than-expected revenue in the first year, only to have it dip the next.

After announcing a $70 million budget cut in April because of a revenue slump, Hutchinson restored all but $10 million after revenue surged in the final months of fiscal 2017. The state ended the fiscal year with a $15.7 million budget surplus.

Arkansas is still due for a $43 million budget cut this year, as a result of forecast revisions announced in May.

"We tried to make it more conservative," Shelnutt said of forecasting this year's revenue. "I think there were some unusual events last year in a number of categories, and we're trying to track those more closely."

After deductions for tax refunds, economic development, bond payments and other funding -- which came in 1 percent above forecast in August -- Arkansas ended the month with $405.9 million in new revenue available for state agencies to spend.

A Section on 09/06/2017