BEIJING -- Investors and China watchers welcomed President Xi Jinping's pledge Tuesday to open his country's market wider to foreign competition, hoping it will ease a trade dispute with Washington that has unsettled financial markets and could jeopardize a global economic expansion.

Xi's vow to cut Chinese auto tariffs, allow more competition in banking and better protect intellectual property calmed investors who have been on edge since the world's two biggest economies last week announced plans to impose tariffs on $50 billion worth of each other's products.

Stock markets rallied worldwide on optimism for relief from what has become the most high-stakes trade confrontation since World War II.

"This is a promising signal that there can be a path forward to address [America's] concerns without a full-on trade war emerging," said Stephen Ezell, vice president of global innovation policy at the Information Technology & Innovation Foundation, a think tank that has criticized both China's aggressive trade practices and President Donald Trump's confrontational response to them.

[LIST: See all products targeted by U.S.]

At the same time, Ezell and other longtime China observers cautioned that Beijing has promised in the past to open its market and curb hardball tactics to acquire foreign technology without following through on those pledges.

"This is positive, but we need to see action," Ezell said.

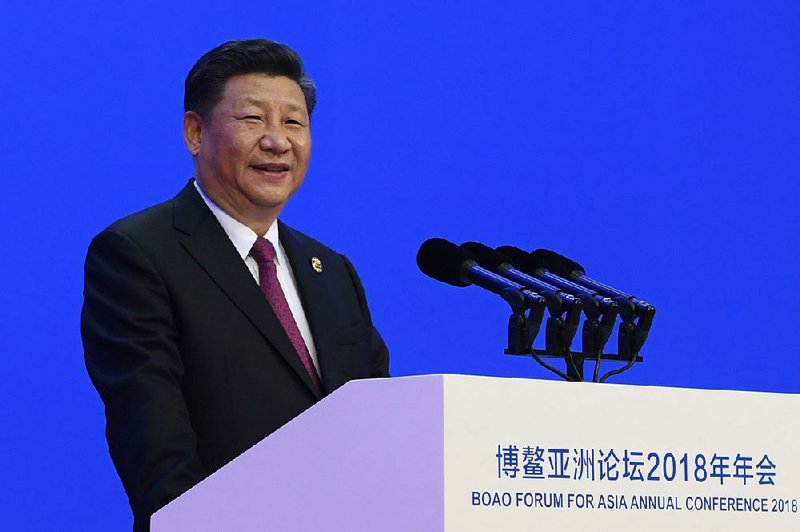

Speaking at a business conference Tuesday, Xi didn't directly mention either Trump or the trade standoff with the United States. He promised progress on areas that are U.S. priorities, including opening China's banking industry and boosting imports to China. He did not, however, address some key irritants for Washington, including a requirement that foreign companies work through joint ventures that require them to give technology to potential local competitors.

Last week, the Trump administration unveiled plans to impose tariffs on 1,300 Chinese products, worth about $50 billion a year in imports to the United States. It characterized those tariffs as a penalty for Beijing's forcing American companies to hand over technology to gain entry to China's market.

Within hours, Beijing counterpunched with similar plans to impose tariffs on $50 billion in American products, including soybeans and small aircraft. Then, Trump ordered the U.S. trade representative to consider another $100 billion in Chinese imports to tax.

David Dollar, senior fellow at the Brookings Institution, noted that the United States won't impose its tariffs until after it gives the American public weeks to comment on the plans. That leaves time for the two countries to negotiate.

"You hope that reason prevails," said Dollar, a former official at the World Bank and U.S. Treasury Department. "Every time the administration talks tough, the market drops. And every time the administration says, 'We're going to negotiate' the market goes back up."

Trump himself tweeted Tuesday that he was "very thankful" for Xi's comments and praised the Chinese president's "enlightenment."

"We will make great progress together," Trump added.

With his promises Tuesday, Xi sought to position China as a defender of free trade and cooperation despite its being the world's most-closed major economy. He hopes to contrast his softer stance with Trump's "America First" approach, which has focused on restricting imports and renegotiating trade agreements to win better terms for the United States.

"China's door of opening up will not be closed and will only open wider," Xi said at the Boao Forum for Asia on the southern island of Hainan.

Xi said Beijing will "significantly lower" tariffs on auto imports this year and ease rules that limit foreign global automakers to owning no more than 50 percent of joint ventures in China.

[DOCUMENT: Read full proposal from U.S. trade representative]

He promised to encourage "normal technological exchange" and "protect the lawful ownership rights of foreign enterprises."

Skeptics pointed out that China has made promises before and then not adhered to them.

The office of the U.S. trade representative noted in a report in January that "China repeatedly failed to follow through" on commitments it made in U.S.-China dialogues. In 2010 and 2012, for instance, China declared that foreign companies were free to decide for themselves when to share technology with Chinese partners or other businesses. Instead, the report found, Chinese regulators "continue to require or pressure foreign companies to transfer technology as a condition for securing investment or other approvals."

"China refuses to play by the rules of international trade," said U.S. Sen. John Boozman, R-Ark. "The escalation in trade rhetoric alone is negatively affecting markets and creating uncertainty, especially for Arkansas's number one industry -- agriculture. We can appropriately hold China accountable for its unfair trade practices without holding our agricultural industry hostage."

Other lawmakers on congressional agriculture committees said Tuesday they're skeptical that the White House can fix any economic harm for farmers arising from a trade dispute with China by giving them temporary aid through the Agriculture Department.

"We don't need another subsidy program, we need to sell our product," said Sen. Pat Roberts, R-Kan., chairman of the Senate Agriculture Committee, said at a meeting of agricultural reporters in Washington. "If we do that, we don't need some sort of crazy-quilt program."

Trump promised U.S. farmers on Monday that they will emerge better -- even though Beijing has threatened to impose tariffs targeting U.S. agricultural products -- in part by directing the Agriculture Department to find ways to shore up finances that could be harmed by lower exports.

One option could be to use the department's authority under the Commodity Credit Corporation, a federal entity that funds farm subsidies, to buy surplus U.S. crops, Steve Censky, deputy secretary of the USDA, said Monday.

Such a move would set a bad precedent by politicizing farm payments, said U.S. Rep. Collin Peterson of Minnesota, the top Democrat on the House Agriculture Committee.

"I am against a one-time bailout of a situation created by the administration," Peterson said. Farmers "want their markets left intact and not screwed up by some policy. Giving them money isn't necessarily going to buy them off."

He said farmers currently enrolled in subsidies based on overall revenue should be allowed to switch into programs sensitive to falling prices, the likely outcome of any trade war. Peterson also called for a 10 percent increase in the so-called target price for crops such as corn, soybeans and cotton.

Also Tuesday, China filed a challenge with the World Trade Organization against Trump's earlier tariff increase on steel and aluminum in a separate dispute. Beijing, which has issued a $3 billion list of U.S. goods including pork and apples for possible retaliation, requested 60 days of consultations. If that fails, China can ask for a ruling from a WTO panel.

But the stakes are higher in the dispute over China's aggressive technology policies. Chinese officials deny that they compel foreign companies to hand over technology. But business groups from outside China argue that joint venture and licensing rules make coerced transfers of technology unavoidable.

If the U.S. and China both raise tariffs, American automakers won't suffer that much. But German luxury automakers BMW and Mercedes will.

BMW exports about 87,000 luxury SUVs from a factory near Spartanburg, S.C. Mercedes ships up to 75,000 more from Tuscaloosa County, Ala.

Analysts say if the tariffs are doubled to 50 percent as China has threatened, BMW and Mercedes could be forced to move production to China or elsewhere. That could cost American jobs.

Information for this article was contributed by Paul Wiseman, Joe McDonald, Ken Thomas and Tom Krisher of The Associated Press and by Alan Bjerga of Bloomberg News.

RELATED ARTICLE

http://www.arkansas…">Beijing's proposals a balm for stocks

Business on 04/11/2018