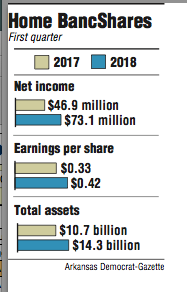

Home BancShares earned a record $73.1 million in the first quarter, a 56 percent improvement over the same period last year, the Conway-based bank said Thursday.

Home BancShares, parent company of Centennial Bank offices in four states, earned 42 cents a share, better than the projected earnings per share of 41 cents estimated by a Thomson Reuters survey of eight analysts who follow the bank.

The bank's stock closed at $22.22 Thursday, up 31 cents, in trading on the Nasdaq exchange.

Home BancShares had $10.4 billion in deposits on March 31 and $10.3 billion in total loans, both basically unchanged from Dec. 31. The bank had $14.3 billion in total assets on March 31, compared with $10.7 billion in assets a year earlier.

While the bank had record profits, there was no growth in loans, said Matt Olney, a banking analyst in Little Rock with Stephens Inc.

Loan balances were flat compared with the average expectation of analysts who follow Home BancShares of 5 percent growth in loans, Olney said in a research brief.

Loan growth of $64 million within Centennial's New York City division were offset by a decline of $69 million in Centennial's nonpurchased loans, said Olney, who has a buy rating on Home BancShares.

John Allison, chairman of Home BancShares, had anticipated in recent months that the bank would grow its loans but was disappointed with the lack of growth.

"If the world thinks everything hangs on loan growth, it doesn't all hang on loan growth," Allison said in a conference call Thursday. "Everybody's telling me, 'Johnny, you've got to have loan growth, you've got to have loan growth.' Well, in the long run, we'll win."

The bank believes the stock has been trading at an undervalued level, so it is buying some of it back.

In the first quarter, the board of directors authorized an additional 5 million shares that Home BancShares can buy back. Under the buyback program, Home BancShares bought almost 304,000 of its shares in the first quarter.

The low stock price has stalled Home BancShares' efforts to acquire other banks, Allison said.

"We're not doing any [mergers or acquisitions] because of the stock price," Allison said.

Still, Home BancShares is having discussions with some companies, Allison said.

Home BancShares would also consider buying a loan portfolio from a lender, Allison said.

"We are looking," Allison said. "We're actively engaged in due diligence as we speak. About $350 million to $400 million. If it works out it could be a lot of business for us."

The record earnings for the quarter were an indication that Home BancShares has recovered from the effects of Hurricane Irma in 2017, said Garland Binns, a Little Rock banking attorney.

There is a lot of rebuilding activity in the Florida Keys, Allison said.

"I like our reserves, what we put back [in case of losses]," Allison said. "I'm beginning to believe we might not lose that kind of money in the Keys. It's really what happens to those customers."

Restaurants are closing early because they don't have workers, Allison said. And workers aren't there because they don't have housing, he said.

"So it kind of feeds on itself," Allison said.

Allison remains confident about the bank's performance for all of 2018.

The first quarter was not a bad start, Allison said.

One week in March, the bank approved more than $300 million in loans, Allison said.

"This will be the best year by far our company has ever had," Allison said. "And I think it continues to get better."

Centennial Bank has 158 offices -- 76 in Arkansas, 76 in Florida, five in Alabama and one in New York City. Centennial closed 12 branches in Florida in the first quarter in connection with the completed purchase of Stonegate Bank.

Business on 04/20/2018