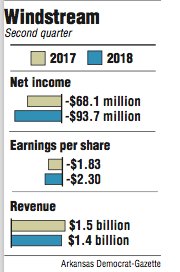

Windstream Holdings Inc. reported a net loss of $93.7 million in the second quarter, a 38 percent decline from a $68.1 million loss in the same period of 2017, the Little Rock telecommunications company said Thursday.

Windstream lost $2.30 a share, beating the average estimate of a $2.66 loss projected by 11 analysts surveyed by Thomson Reuters.

Investors were obviously pleased with the report. Windstream shares jumped 99 cents, or 25 percent, to close Thursday at $4.88 in trading on the Nasdaq exchange.

Windstream had net growth in the second quarter in broadband subscribers, the first quarter that has happened in three years.

The company added 2,300 broadband subscribers in the quarter, said Tony Thomas, Windstream's chief executive officer.

"This continued an upward trend that we have experienced for the past several quarters," Thomas said in a statement. "It demonstrates that our network investments are paying off and enables us to say with confidence that we expect to grow our consumer broadband base in 2018."

Windstream didn't use any promotions to attract the new broadband customers, Thomas said in a conference call discussing the second quarter results.

"It was really just improved execution by the team," Thomas said.

One analyst asked about discussions concerning fiber sales.

Windstream has had a number of conversations on fiber sales, said Bob Gunderman, Windstream's chief financial officer.

"We continue to be very active and we continue to be very disciplined on valuation as well," Gunderman said. "We still feel very comfortable that the value of what remains of the fiber portfolio that we own outright and, frankly don't use, is upwards to $200 million in addition to what we've already monetized."

Most of the discussions are with some carriers wanting to expand their routes as opposed to a single company interested in buying out the entire portfolio, Gunderman said.

Revenue for the quarter was $1.4 billion, compared with $1.5 billion in the second quarter last year.

Windstream's interest expense for the second quarter was $224.4 million, including interest expense associated with the master lease agreement with Uniti Group of $117.4 million and $235.9 million for the three-month and six-month periods ending June 30.

Windstream spun off Uniti Group in 2015.

For the first six months of the year, Windstream has lost $215 million, up 20 percent from $179.4 million through the first half of 2017.

Revenue for the first six months of the year was $2.9 billion, up about 1 percent compared with the same period of 2017.

Business on 08/10/2018