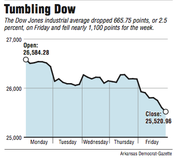

The Dow Jones industrial average tumbled nearly 666 points Friday in the biggest plunge since June 2016, as the worsening bond rout stirred angst that the Federal Reserve will accelerate its rate-increase schedule.

Solid jobs data that underscored the strength of the economy sent bond bulls scurrying and rattled equity investors who haven't seen a week this bad in two years. The tandem selling accelerated after Dallas Fed President Robert Kaplan suggested officials may need to raise rates more than three times this year to cool the advance. The 10-year Treasury yield popped above 2.85 percent for the first time since January 2014.

"Once we started going north of 2.5 percent, and you put that together with an overbought market, it had the ingredients of a sell-off, especially since January was so strong," said Jeff Zipper, regional investment strategist at U.S. Bank Private Wealth Management.

"Yields have risen, inflation evidence is rising rather broadly. It's that combo of factors that's starting to mount," said Jim Paulsen, chief investment strategist at Leuthold Weeden. "And then you get a report, and that's the straw that breaks the camel's back, and that's kind of what we got into today."

There was nowhere to hide on the stock market, with all 11 S&P 500 sectors lower. The index's five-day rout reached 3.9 percent -- marking its first pullback of at least that much in a record 404 days. Energy shares sank 4.1 percent as earnings disappointed and crude slumped.

The S&P 500, which hit a record a week ago, fell 59.85 points, or 2.1 percent, to 2,762.13. The Dow lost 665.75 points, or 2.5 percent, to 25,520.96. The Nasdaq slid 144.92 points, or 2 percent, to 7,240.95. The Russell 2000 index of smaller-company stocks gave up 32.59 points, or 2.1 percent, to 1,547.27.

"People are finally starting to reprice reflation; it's about time," Jeanne Asseraf-Bitton, head of global cross-asset research at Lyxor Asset Management, said. "Global economic growth is strong and corporate earnings are very solid, so there's no reason to question the equity bull market. The rise in bond yields is good, it's just the speed at which it's happening that is making investors nervous. Bottom line: This is a healthy correction."

U.S. hiring picked up in January and wages rose at the fastest annual pace since the recession ended, as the economy's steady move toward full employment extended into 2018. Equities are being tested by the surge in bond yields, with some fund managers saying 3 percent U.S. 10-year rates would signal a bond bear market.

The level is seen by many stock watchers as a potential trigger for a correction in equities.

The market slide may have been overdue, particularly after the strong start for stocks this year where the S&P 500 had its best January in two decades. Some investors saw a potential buying opportunity.

The global economy is still strong, corporate profits and sales have been better than expected this reporting season, and buyers for stocks still remain, all reasons to be optimistic about stocks, said Nate Thooft, senior portfolio manager at Manulife Asset Management.

"It's appealing, these 2 to 3 percent pullbacks," said Thooft, who had been trimming some of his stock holdings after the market's big January gains. "We look at this and say, 'Maybe it's your first day to buy a little bit.'"

While earnings overall have been strong, some big companies have posted disappointing results.

Google's parent company Alphabet slumped 5.3 percent after the search giant reported results that missed analysts' forecasts. The stock slid $62.39 to $1,119.20.

Apple declined 4.3 percent after the technology company said it sold 77.3 million iPhones in the last quarter, below the 80 million analysts expected. The stock slid $7.28 to $160.50.

Traders welcomed Amazon's latest results. The e-commerce giant rose 2.9 percent after its fourth-quarter profit increased by more than $1 billion. Amazon shares gained $39.95 to $1,429.95.

Oil futures declined. Benchmark U.S. crude slid 35 cents, or 0.5 percent, to settle at $65.45 a barrel on the New York Mercantile Exchange. Brent crude, used to price international oils, fell $1.07, or 1.5 percent, to close at $68.58 a barrel in London.

In Europe, a bond sell-off deepened across the continent, and equities dropped for a fifth-straight day, the longest streak since November. Disappointing results from companies including Deutsche Bank AG and BT Group PLC paced losses.

Germany's DAX slid 1.7 percent, while France's CAC 40 lost 1.6 percent. The FTSE 100 index of leading British shares gave up 0.6 percent. Bund yields reached a fresh two-year high, while the euro and British pound weakened. Japanese debt gained and the yen declined after the Bank of Japan intervened to stem the rise in rates.

In Asia, Japan's benchmark Nikkei 225 fell 0.9 percent and South Korea's Kospi slid 1.7 percent. Hong Kong's Hang Seng index dipped 0.1 percent.

Information for this article was contributed by Jeremy Herron, Masaki Kondo, Cormac Mullen and Robert Brand of Bloomberg News, and by Alex Veiga of The Associated Press.

A Section on 02/03/2018