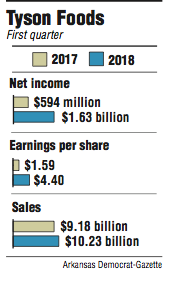

Tyson Foods on Thursday reported a record first-quarter profit of $1.63 billion, beefed up by its prepared-food division, recent acquisitions and the expected corporate tax-cut windfall.

The nation's largest food company also announced Thursday that it will pay more than $100 million in one-time cash bonuses to eligible employees in the next quarter. The Springdale-based company also held its annual shareholders meeting Thursday after an earnings call with analysts.

"Building on our momentum from a record year in fiscal '17, we're off to a strong start in fiscal '18," said Tom Hayes, Tyson's president and chief executive officer. "We delivered record adjusted [earnings per share] and our second-strongest quarter of operating income in [the first quarter], with operating cash flows of more than $1.1 billion."

Tyson's quarterly earnings per share nearly tripled year over year to $4.40, buoyed by tax benefits and other income. Recently acquired company AdvancePierre contributed hundreds of millions of dollars in revenue toward the chicken and prepared-food segments during the quarter.

Tyson also paid off $500 million of its debt, in part from its selling of a nonprotein business, Kettle. The company is projecting that it will sell its other nonprotein assets later this year, according to the report.

Total sales rose more than 5 percent to $10.2 billion, bolstered by the company's prepared-food, chicken and beef business growth. Yet total operating income declined to $927 million from $982 in the same quarter last year, which shrank the company's margins from 10.7 percent to 9.1 percent year-over-year.

Tyson's overall profit margins weakened a bit, except its prepared-food segment, which rose more than 1 percent from first quarter 2017. The company's beef, chicken and pork margins shrank compared to the same quarter last year.

Bob Williams, senior vice president and managing director of Simmons First Investment Group, equated higher feed prices and freight costs to the tighter margins.

Overall Tyson's 2018 first quarter was strong with adjusted earnings that significantly beat outside estimates, said Ken Shea, Bloomberg Intelligence's senior food and beverage analyst.

The company reported adjusted earnings of $1.81, or 20 percent higher than the outsiders' consensus of $1.50 per share, according to Bloomberg Intelligence. Tyson reported a 21-cent tax benefit to its adjusted earnings.

"Looking ahead, its main challenge may be holding margins in a price-competitive market while some costs -- freight, labor -- are edging higher," Shea said.

Mervin Jebaraj, director of the Sam M. Walton College of Business at the University of Arkansas, Fayetteville, said Tyson's earnings aren't surprising in comparison to recent reports from other companies that are reporting benefits from the corporate tax changes.

Along with earnings, Tyson announced Thursday that it would pay one-time bonuses of as much as $1,000 to qualifying full-time employees and $500 to qualifying part-time employees and invest more to educate workers and in company projects that promote animal welfare and sustainability.

Tyson said it would be distributing "more than $300 million" in savings from the latest federal-level changes that dropped its tax rate from 34 percent to 24 percent.

Tyson's investment in prepared foods also proved correct, with its retail and food service sales both outpacing the industry, according to the report.

The prepared-food performance "is a very good sign," reflecting Tyson's positive return on its investment last year, Jebaraj said.

After Thursday's earnings call, Tyson held its annual shareholders meeting at the recently renovated tech building at 319 E. Emma Ave. in Springdale.

Voting on all proposals before the board favored company recommendations.

Investors elected John Tyson, Guardie Banister Jr., Dean Banks, Mike Beebe, Mikel Durham, Tom Hayes, Kevin McNamara, Cheryl Miller, Jeffrey Schomburger, Robert Thurber and Barbara Tyson to the company's 2018 board of directors.

Then they voted to reinstate Tyson's 2000 stock incentive plan and for the ratification of PricewaterwaterhouseCoopers LLP as the company's independent registered public accounting firm for the fiscal year ending Sept. 29, 2018.

Investors also rejected two proposals that sought increased company oversight -- one on corporate lobbying, the other about water-stewardship practices. The groups that presented each proposal claim that Tyson doesn't do enough to address their concerns.

Mary Beth Gallagher, executive director of the Tri-State Coalition, the group that drafted the water-stewardship proposal, said she remains optimistic. A larger percentage of investors voted in favor of better water practices year over year, Gallagher said.

Despite Tyson's opposition to the water proposal, company executives showed their interest in sustainable practices.

In his closing remarks at the shareholders meeting, Hayes said, "That is something we are continuing to work on. I appreciate the proposal. You will know that we are very focused on making sure we grow and grow sustainably. We are already upgrading existing plants and investing a lot of capital to make sure we do that. The tail wind we're getting from tax reform is gonna allow us to accelerate investments to continue to become more sustainable."

Business on 02/09/2018