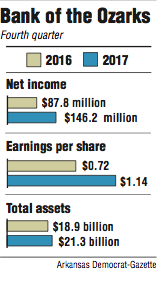

Bank of the Ozarks made a record $146.2 million in net income in the fourth quarter last year, a 66.5 percent increase from the $87.8 million earned in the same period of 2016, the bank said Tuesday.

The Little Rock bank had a profit of $1.14 a share in the quarter that ended Dec. 31, up from 72 cents a share for the fourth quarter of 2016, easily beating the average estimate of 75 cents a share projected by 11 analysts surveyed by Thomson Reuters.

The bank, the state's largest with $21.3 billion in assets, earned a record $421.9 million in 2017, up 56 percent from $270 million in the previous year.

On Dec. 31, Bank of the Ozarks had $17.2 billion in deposits and about $16 billion in loans.

The bank's real estate specialties group continued to be the catalyst for growth in loans, said George Gleason, chairman and chief executive officer.

The real estate specialties group accounted for 46 percent of nonpurchased net loan growth and all other areas of lending grew by 54 percent, Gleason said.

The largest contribution to loan growth in the fourth quarter was in New York, followed by Florida, California and Texas.

"Bank of the Ozarks continues to perform well," said Garland Binns, a Little Rock banking attorney, emphasizing its ninth-straight quarter of record profits and fourth-consecutive year of record earnings.

Gleason mentioned several strategic initiatives Bank of the Ozarks made last year that assisted in its record year. The initiatives emphasized activities that are becoming increasingly profitable and de-emphasized areas that were not highly profitable, Gleason said.

Gleason noted the evolving role of technology at Bank of the Ozarks labs, where the bank is developing technology, automation and artificial intelligence to address solutions to problems.

Personnel working at the bank's labs department increased from 17 to 25 employees last year and should grow to 33 this year, Gleason said.

The bank expects to enhance its infrastructure this year in information technology, cybersecurity, business resilience, enterprise risk management, internal audit, monitoring training and other areas, Gleason said.

Last year, Bank of the Ozarks also realigned some of its leasing division into areas of community banking and eliminated other leasing areas, Gleason said. Specifically, Bank of the Ozarks made the aviation-leasing division a separate area of community banking, but it eliminated its division for small ticket equipment portfolio, which had become unprofitable, Gleason said.

Bank of the Ozarks has a long-term commitment to make acquisitions that are immediately profitable, Gleason said.

"But the best thing about our company is that if we make acquisitions, that's great," Gleason said. "We expect that we will make many acquisitions in the future. But if we don't, we have a tremendous growth model as it is."

Bank of the Ozarks' efficiency ratio was 34.8 percent for the fourth quarter, little changed from 34.3 percent for the fourth quarter of 2016, Binns noted. That means that the bank spent $34.80 to earn $100 for the quarter.

"A general rule of thumb is that a bank with an efficiency ratio of under 50 percent is doing well," Binns said.

Business on 01/17/2018