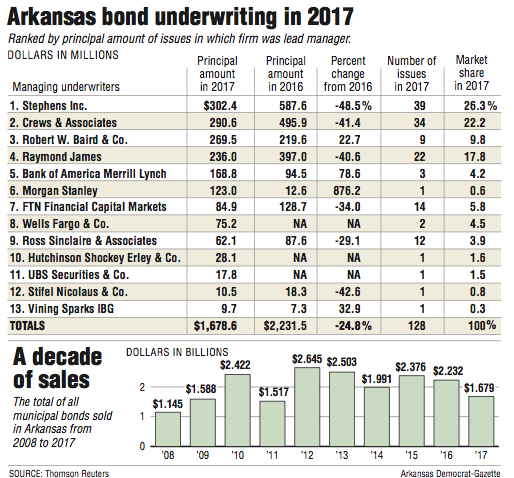

Municipal bond sales in Arkansas dropped about 25 percent last year when compared with 2016, according to rankings compiled by Thomson Reuters.

Underwriters in Arkansas handled almost $1.7 billion in bonds in 2017, down from $2.2 billion in 2016.

Two Little Rock firms led the underwriting.

Stephens Inc. was the No. 1 underwriter of tax-exempt municipal bonds in Arkansas last year with $302.4 million in bonds. Crews & Associates was second with $290.6 million in bonds underwritten.

There were 128 municipal bonds issued in Arkansas last year, down more than 40 percent compared with 2016, said Dennis Hunt, executive vice president and director of public finance at Stephens.

There were several reasons for the decline, including fewer refundings of bonds compared with previous years, Hunt said.

"Also I think any time you have a change in administrations at the national level, there is somewhat of a hesitancy of local issuers to issue new money debt," Hunt said. "That is just in anticipation that there might be something that is beneficial if we wait for a while."

There was discussion in 2016 during the presidential campaign that there would be a significant infrastructure program in 2017, Hunt said.

"I'm assuming that was a contributing factor," Hunt said.

There isn't any a definitive reason that led to the drop in bond issues last year, Hunt said.

The largest bond issues last year included the Springdale School District at $123 million, the University of Arkansas board of trustees at $95.8 million and the Little Rock School District at $92.1 million, according to Thomson Reuters.

The Pulaski County Special School District had two issues totaling $112.5 million.

"There were really a lot of base hits and doubles but not a lot of home runs last year," said Edmond Hurst, Crews' senior managing director. "Before we had projects like Big River Steel and a big state refunding."

In Arkansas, Hunt expects there will be fewer refundings in 2018 than in 2017 and more new money issues than in 2017.

Hurst doesn't anticipate that there will be more projects likely for this year compared with 2017.

"But I'm kind of excited to see what Congress comes up with for infrastructure plans," Hurst said. "My understanding is that is something they are going to be tackling soon. There is a lot of optimism that that is something Congress is going to get done."

There is a need nationally and in Arkansas for infrastructure projects, Hurst said.

"To the extent there is some nice stimulus in there, that could motivate some additional volume this year [in Arkansas]," Hurst said.

But it isn't a certainty that an infrastructure program would be financed through bonds.

There are discussions that infrastructure projects could be financed through public-private partnerships, Hurst said.

"There are different kinds of incentives besides tax-exempt bonds [that could be utilized]," Hurst said. "It could be a number of things."

The bond market also was down nationally.

The 12 largest bond underwriters handled $410 billion in municipal bonds last year, down from a record $424 billion in bonds in 2016, The Bond Buyer reported. That was based on almost 10,600 issues in 2017 compared with about 12,300 in 2016.

Bank of America Merrill Lynch was the No. 1 firm, underwriting $63 billion in 547 issues, The Bond Buyer said.

Business on 01/27/2018