J.B. Hunt Transport Services Inc. handily beat analysts' estimates for profit and revenue for the second quarter, but the company said factors such as increased rail costs and higher driver wages were a drag on the strong earnings results.

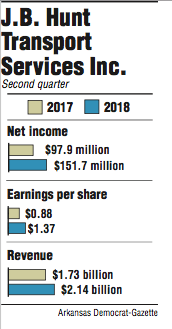

The Lowell-based trucking company Monday reported profit of $151.7 million for the quarter that ended June 30, up 55 percent compared with $97.9 million for the second quarter of 2017. Earnings per share of $1.37 for the period compared with 88 cents for the same period last year. A consensus estimate of 22 analysts predicted $1.28 per share for the second quarter.

Revenue stood at $2.14 billion for the period, including fuel surcharges, up 24 percent from $1.73 billion for the same quarter last year. The average estimate of 16 analysts had pegged revenue at $2.05 billion.

J.B. Hunt shares were trading down about 3 percent Monday morning but leveled off by the end of the day. Shares fell 70 cents, or less than 1 percent, to close at $121.13 on the Nasdaq stock exchange. Shares have traded as low as $88.83 and as high as $131.74 over the past year.

In a Monday release, the company said rate increases, volume growth and increases in revenue-producing truck counts were countered by over-the-road costs, costs associated with the new dedicated contract service deals, and higher costs to recruit drivers.

Brad Delco, transportation analyst for Little Rock-based Stephens Inc., said in response to emailed questions that the second-quarter results were strong and well above analysts' expectations. Stephens maintains some J.B. Hunt common stock and provides investment banking and other services to the company.

"The big concern for investors is centered around this being the peak of the cycle and therefore there isn't much room for things to get better," Delco wrote.

He said J.B. Hunt's integrated capacity solutions and dedicated contract services segments were the true standouts during the second quarter, but he noted all the company's divisions saw revenue growth and outperformed expectations.

The intermodal segment saw second-quarter revenue of $1.16 billion, a 16 percent increase. The segment's operating income -- profit before interest and taxes -- was $134 million, an increase of 22 percent compared with the same period a year ago.

Dedicated contract services posted revenue of $530 million, up 29 percent when compared with the second quarter of 2017. Operating income for the segment was up 20 percent at $58.5 million. Productivity, or revenue per truck per week, was up about 10 percent compared with last year.

Integrated capacity solutions, a segment that offers dry van, flatbed, refrigerated, expedited and less-than-truckload services, had revenue of $347 million, up 56 percent compared with the year-ago quarter. Operating income for the segment was $14.9 million. Volume was up 38 percent and revenue per load was up 13 percent, according to the company.

The truckload segment booked revenue of $101 million for the quarter, a 7 percent increase over the same period last year with operating income of $7.5 million, a 35 percent jump. Rate increases and a more favorable freight mix were credited with the segment's success.

During the quarter, J.B. Hunt bought back about 420,000 shares of stock for about $50 million. At the end of June, there were about 109.3 million shares outstanding, according to the company.

In late May, J.B. Hunt moved up 12 places on Fortune magazine's list of 500 largest U.S. companies by revenue to rank No. 395. The company's 2017 total revenue was $7.2 billion.

Business on 07/17/2018