In the June 19 runoff for a Senate seat in western Arkansas, two Fort Smith Republicans are split over the state's version of Medicaid expansion and a measure that exempted military retirement benefits from state income taxes but also raised other taxes.

Former Rep. Frank Glidewell and current Rep. Mat Pitsch also are divided over a proposed constitutional amendment that would limit certain damages in civil lawsuits and allow the Legislature to rewrite court rules now written by the state Supreme Court.

Early voting in the runoff starts Tuesday.

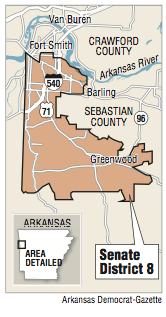

Glidewell and Pitsch are in the runoff in Senate District 8 because they each won more votes than the third person in the race, former state Sen. Denny Altes, R-Fort Smith, in the May 22 primary election. District 8 is in part of Sebastian County and includes Fort Smith, Greenwood, Hackett and Bonanza.

The winner of the runoff will face Libertarian candidate William Hyman of Fort Smith in the Nov. 6 general election for a four-year term that starts in mid-January.

The Senate seat is vacant because Sen. Jake Files, R-Fort Smith, resigned after pleading guilty in federal court in late January to felony charges of wire fraud, money laundering and bank fraud.

In an attempt to fill the seat for the remainder of the current term, Glidewell defeated Altes in a May 22 special primary election to advance to an Aug. 14 special general election to face Hyman. Pitsch was barred from running in the special primary election by a provision of the Arkansas Constitution.

THE CANDIDATES

Glidewell said voters should cast their ballots for him because he's very conservative and "has no special interest at heart other than the tax-paying citizens."

The 73-year-old retired electrical contractor served in the state House from 2005-11. He lost in a 2010 Senate primary runoff to Files. He also served as Sebastian County judge from 1997-98 and had several terms as a Sebastian County justice of the peace.

Pitsch said voters should choose him because his legislative tenure has led Fort Smith to be relevant in discussions of statewide issues.

He has served in the House since 2015 and as the House Republican leader during the previous two years.

Pitsch, 54, is executive director of the Western Arkansas Intermodal Association and is part owner of a biometric gun safe company called Arms Reach.

HIGH-PROFILE BACKING

Altes said he's backing Glidewell in the GOP runoff, while Republican Gov. Asa Hutchinson and U.S. Rep. Steve Womack, R-Ark., said they're supporting Pitsch.

"We worked together in the Legislature and have been friends forever," Altes, who is Hutchinson's former drug director, said of Glidewell.

Hutchinson, in a written statement, said Pitsch, as the House Republican leader, helped GOP candidates win races across Arkansas and "is a consistent conservative and someone I rely upon for his common sense approach."

Womack tweeted that Pitsch "works tirelessly for the River Valley region & continues to be a dynamic force at the state and local level. Mat brings relevant, effective leadership to the state senate & the people of the Fort Smith Region."

Glidewell said he didn't campaign for or endorse Hutchinson's unsuccessful Republican foe, Jan Morgan of Hot Springs, but that he voted for her in the primary.

"I like Asa. I have known him a long time," he said.

But Glidewell said state general revenue spending has increased too much under Hutchinson's leadership.

Pitsch said he voted for Hutchinson in the Republican primary, just like nearly 80 percent of Sebastian County residents who voted in that race.

ARKANSAS WORKS

Glidewell said he favors phasing out, over a two-year period, the Arkansas Works program that provides private health insurance to about 280,000 low-income Arkansans.

"I am opposed to Obamacare in any form it takes, including the private option and Arkansas Works," Glidewell said. Arkansas Works is taking increasing amounts of the state's discretionary dollars that could otherwise be spent on education, prisons or the highways, he said.

Pitsch said he doesn't consider Arkansas Works to be Obamacare.

"It is a response to the Affordable Care Act from a state that saw a unique way to improve on it," he said.

Pitsch said at least three-fourths of lawmakers have authorized the use of state and federal funds for the program in each session since the 2013 regular session and that it's part of the state's balanced budget.

"Every year, we will look at our budget and decide whether to continue it or discontinue it," he said.

But if Glidewell "wants to kill the Affordable Care Act, he needs to run for the U.S. Senate, not the state Senate," Pitsch said.

The state projects Arkansas Works will cost the state about $135 million in fiscal 2019, which starts July 1, and the federal government about $1.95 billion. The state's share of the cost is 6 percent this year, 7 percent next year and then 10 percent in 2020 under current federal law.

STANDS ON TAXES

Glidewell said he would have voted against Hutchinson's plan enacted in 2017 to exempt military retirement benefits from the state income tax because of the tax increases included in the law.

That law also cut the excise tax on soft-drink syrup, but it increased the sales tax rate on candy and soft drinks from 1.5 percent to 6 percent; levied income taxes on unemployment insurance; and imposed a sales tax on certain digital products. The tax reductions are projected to eventually pare revenue by $19.3 million a year; the increases will raise the same amount.

Glidewell said he supported exempting military retirement benefits from the state income taxes without increasing other taxes.

But Pitsch said, "We already have had people move to this state because of that bill.

"It is a balanced tax cut, but it was paid by other taxes. I supported it because of my belief that military veterans have protected us and the freedoms we enjoy, and I will always support those people."

Glidewell said he would have voted against a bill approved by the Senate but rejected by the House in 2017 that would have required out-of-state companies, without a physical presence in the state, to collect taxes on online sales. He said he opposes Internet sales taxes and that the legislation is unconstitutional.

Pitsch said he voted for the legislation to protect local businesses. He said it is unfair that local merchants must collect sales taxes as they compete against online sellers that aren't required to collect the sales taxes.

The U.S. Supreme Court is determining the constitutionality of a similar law in South Dakota, he said.

Glidewell and Pitsch said they support Hutchinson's plan to cut the state's top individual income tax rate from 6.9 percent to 6 percent, which the governor projects would reduce state tax revenue by about $180 million a year.

TORT-REFORM PROPOSAL

Issue 1 is a constitutional amendment proposed by the Legislature that would limit noneconomic damages and punitive damages in civil lawsuits with certain exceptions. It also would allow the Legislature to amend and repeal state Supreme Court rules of pleading, practice or procedure and adopt new court rules with a three-fifths vote. Lawmakers do not have a current role in court rules.

The proposal will appear on the Nov. 6 ballot.

Glidewell said he opposes Issue 1 because he doesn't want to put "an arbitrary price on human life" by limiting certain damages in civil lawsuits.

Pitsch said he supports the proposal and voted for it in the Legislature. He has said the proposal is a "Republican Party platform, very pro-business piece of legislation, and the state Chamber of Commerce supports it."

SundayMonday on 06/10/2018