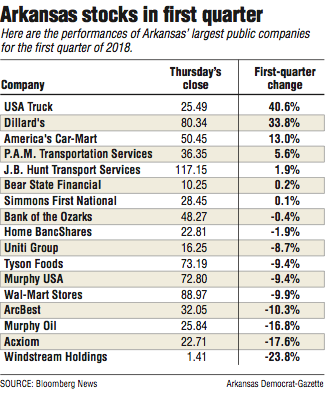

Van Buren-based USA Truck, the company with the best performing stock of Arkansas' public companies in 2017, continued to lead the state in the first quarter, posting a 40.6 percent gain.

Shares of USA Truck more than doubled in price in 2017, ending the year with a 108 percent increase.

The next two best-performing stocks on the Arkansas Index for the first quarter were Dillard's Inc., which gained 33.8 percent, and America's Car-Mart, which rose 13 percent.

Investors responded favorably to USA Truck's fourth-quarter earnings report, said Nathan Green, a financial adviser with Simmons First Investment Group Inc. in Searcy.

"Both revenue and net income showed significant year over year improvements," Green said. "The trucking and logistics segments both produced increases in operating income for the quarter."

USA Truck as a whole continued to reduce total debt by eliminating more than $13 million from the balance sheet in the fourth quarter, Green said.

Dillard's, the Little Rock-based department store chain, topped fourth-quarter expectations by increasing revenue by 6.6 percent, Green said.

"This was a positive performance for the company in a sector that continues to face significant headwinds," Green said. "The company followed up its strong earnings report by announcing a new share buyback program authorizing the company to purchase up to $500 million of its Class A stock."

Bentonville-based America's Car-Mart's revenue was up because of a combination of increased sales and increased interest income, Green said.

"Car-Mart displayed a solid combination of down payments collected going up while the average interest rate for finance receivables also increased," Green said. "This led to a strong quarter for America's Car-Mart."

Shares of seven Arkansas-based firms rose in the first quarter while 10 lost ground.

The Arkansas Index was flat for the quarter, closing down 0.31 percent for the first three months of the year.

Shares of Windstream Holdings saw the biggest fall, dropping 23.8 percent for the quarter. Acxiom fell 17.6 percent for the three-month period, and Murphy Oil lost 16.8 percent.

Little Rock-based Windstream had a disappointing fourth-quarter earnings report, losing $1.8 billion for the period. The company attributed the big loss to a one time, $1.8 billion "noncash goodwill impairment charge."

Acxiom, based in Conway, was hit hard Thursday after Facebook announced that it would stop working with third-party data collectors. Acxiom said Facebook's policy will reduce net income by as much as $25 million.

Brett Huff, an analyst with Stephens Inc., said the loss of the partnership with Facebook will affect Acxiom negatively by $3 a share. Huff lowered his target price for Acxiom from $35 to $32 a share.

Murphy Oil Corp. of El Dorado had a one-time $274 million expense for the fourth quarter in response to the federal Tax Cuts and Jobs Act, Green said.

"As a point of stability, the company directed investors to its approximately $1 billion of cash on the balance sheet at year end," Green said. "Leadership also highlighted their ongoing strategy of spending within cash flow as an anchor point for the company."

The three largest banking firms in the state finished the first quarter relatively flat. Simmons First National rose 0.1 percent for the quarter, followed by Bank of the Ozarks, down 0.4 percent, and Home BancShares, down 1.9 percent.

All three banks were fundamentally strong during the quarter, said Matt Olney, a banking analyst in Little Rock for Stephens Inc.

Share prices for the three banks were in line with an index of publicly traded banks.

As a whole, the three banks' valuation is more attractive than it has been in awhile, Olney said.

Bear State Financial, the state's fourth-largest publicly traded bank, announced last year that it agreed to be sold to privately owned Arvest Bank of Fayetteville. The deal is expected to close this week.

Business on 03/30/2018