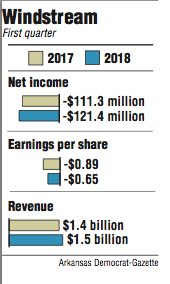

Windstream Holdings lost $121 million in the first quarter, the Little Rock telecommunications company said Thursday.

That compared with a net loss of $111 million in the same period last year.

The loss equaled 65 cents a share for the first quarter, compared with a loss of 89 cents a share in the same period a year ago. The results missed the estimate of a 62-cent loss based on a projection of 11 analysts surveyed by Thomson Reuters.

The firm's stock closed at $1.55 a share Thursday, down 8 cents, in trading on the Nasdaq exchange. There were 2.1 million shares traded, less than its average number of shares traded of 2.6 million.

"Windstream is off to a solid start in 2018," Tony Thomas, Windstream's chief executive officer, said in a conference call Thursday. "Our first-quarter results showed strong traction in our ongoing transformation of the company."

Total revenue and sales for the period were $1.5 billion, an increase of 6 percent from the same period a year ago, Windstream said.

"Our recent network investments also have driven meaningful improvements in our broadband subscriber trends, with March representing our best performance in more than five years," Thomas said.

The company's 2018 full-year guidance remains unchanged by first-quarter results, said Bob Gunderman, Windstream's chief financial officer.

In the company's fourth-quarter report released in February, Thomas said that this year Windstream plans to introduce faster, more cost-effective broadband techniques.

Windstream continues to lose money. In its past nine quarters, going back to the beginning of 2016, Windstream has lost $2.6 billion on total revenue of $12.7 billion. Its stock has dropped from $6.44 on Dec. 31, 2015, to $1.55 on Thursday, a 76 percent decline.

Windstream cautioned Thursday that there are several things that could cause results to differ materially from what might be expected, including expected cost savings from two purchases made last year, EarthLink Holdings Corp. and Broadview Network Holdings.

The integration of the two companies into Windstream also may not be successful, Windstream said.

The availability and cost of financing in the corporate debt markets also could cause results to differ materially from what the company expects.

Last year, Windstream extended the maturity of billions of dollars it has borrowed by pushing almost $2 billion in maturities out about two years, significantly reducing the amount Windstream owes on its loans until 2020.

Business on 05/04/2018