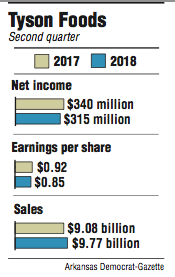

Tyson Foods on Monday reported a 7 percent drop in its second quarter profit compared with 2017 because of "choppy" headwinds such as increased freight, labor and weather-related costs.

Springdale-based Tyson reported a profit of $315 million, or 85 cents a share. Sales rose about 7 percent to $9.77 billion.

Tyson's quarter ending March 31 has proven difficult in years past because of tighter meat supplies and wintry weather.

"We knew we were facing challenging conditions," said Tom Hayes, Tyson's president and chief executive officer, during Monday's conference call with industry analysts.

Tyson's expanding prepared foods segment softened the blow, but seasonal headwinds continued to eat at company earnings. These included a national pork glut that hurt Tyson's pork margins, weather conditions that forced temporary plant closures and higher transportation costs, Hayes said.

"I think we're doing everything we can to get on top of drivers. What I don't know about is fuel [costs]," Hayes said.

During the conference call, Hayes said the rise in freight costs had a net effect of about 14 cents per share for the quarter. Tyson shares dipped in early trading Monday but regained footing by midday. The shares rose 25 cents to close Monday at $67.22.

Higher fuel costs coupled with higher freight rates and an industry-wide driver shortage formed a strong headwind for Tyson. Estimated transportation costs rose to $250 million for fiscal 2018, up from first-quarter estimates of $200 million, Hayes said during the call. Other issues mentioned were reduced egg hatching rates year-over-year and increased feed costs.

Hayes and Stewart Glendinning, Tyson's executive vice president and chief financial officer, said during the call they expect seasonal costs to ease by the fourth quarter.

Overall sales this quarter were bolstered by a roughly 11 percent volume increase in Tyson's prepared foods segment that produces pre-packaged, frozen and convenience store goods. Commodity sales, meanwhile, did not do as well.

"It seems the commodity business was struggling more than the other for sure," said Alan Ellstrand, associate dean of the Walton College of Business at the University of Arkansas, Fayetteville. "There were some big drops in operating income. Pork was off quite a bit."

Commodity sales volume for Tyson's chicken and beef segments both increased by roughly 2 percent, as pork segment sales volume declined by 1 percent. Tyson attributed pork losses to declining average sales prices as livestock costs fell, which led to a period of "margin compression."

"It reflects how difficult it is in the commodity business," Ellstrand said. "When feed costs are going up, it's hard to move the needle much on pricing, because there's no value added; by contrast, prepared foods did really well."

Tyson's rebranding efforts to become more of a protein company have led to the selling of several nonprotein businesses. These include Tyson's Sara Lee, Kettle and Van's brands, as well as its pizza crust business. Tyson completed the sale of Kettle in the first quarter of 2018, and used $125 million in proceeds to pay down debt. Tyson plans to close the other transactions later this fiscal year.

For Tyson's 2018 outlook, the company has set a sales target of $40 to $41 billion and has met half of that goal so far. Capital expenditures, stemming from infrastructure replacements and operational upgrades, are projected at $1.3 billion.

During the call, Glendinning said Tyson plans to repurchase shares in the second half of fiscal 2018, but did not specify when or how much the company will spend.

Hayes said the company would not be significantly affected by the 25 percent additional tariff on U.S pork imposed by China. He said less than 0.5 percent of Tyson's total pork sales go to China.

Hayes did mention the ripple effects of trade spats, saying "we continue to urge political leaders to provide certainty in the market."

Business on 05/08/2018