WASHINGTON -- The federal government racked up a $214.1 billion deficit in August, double the red ink from a year ago, an increase that the Treasury Department said could be partially attributed to quirks in the calendar.

Treasury officials said Thursday that the monthly deficit in August pushed the overall deficit for the first 11 months of the federal budget year to $898.11 billion, 33 percent higher than the same period a year ago.

With just one month to go in the current budget year, which ends Sept. 30, the government is on track to run up the biggest annual deficit in six years.

The August imbalance, which was a record for the month of August, looked worse because large benefit payments that would have been made in September got pushed into August because Sept. 1 fell on a Saturday.

In addition, Social Security payments, which are normally made on the 3rd of each month, were pushed into August because Sept. 3 was the Labor Day holiday.

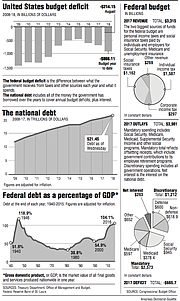

President Donald Trump's administration is forecasting that the deficit for the current federal budget year, fiscal 2018, will total $890 billion. That would represent a 33.7 percent increase from last year's deficit of $665.8 billion. It would be the largest deficit since an imbalance of $1.1 trillion in 2012.

While the 11-month total is already above the $890 billion mark, it is expected that September will show a small surplus given that so many September benefit payments were made early.

President Donald Trump won a major legislative victory when he got Congress to approve last December a tax cut of $1.5 trillion over the next decade, fulfilling a longtime Republican goal of cutting the corporate tax rate from 35 percent to 21 percent.

The tax cuts, which also included reductions for individuals, began taking effect on Jan. 1 and have played a big role in reducing the growth in tax revenue this year.

So far this year, government revenue is up 0.6 percent to $2.99 trillion. That reflects a 1 percent gain in individual taxes withheld from paychecks and a 20 percent drop in corporate tax payments.

Government outlays have far outpaced the small rise in revenue, increasing 6.7 percent to $3.88 trillion for the period October through August.

The big spending increases include a 13 percent rise in interest payments on the public debt and an 8 percent rise in Social Security payments, reflecting the growing number of baby boomers who are retiring and a 9 percent rise in payments for Medicare, reflecting rising retirements and rising costs for medical care.

Accumulating yearly budget deficits adds to the overall federal debt, which totaled $21.45 trillion as of Wednesday. That figure includes more than $5.6 trillion the government owes itself, including about $2.8 trillion borrowed from the Social Security Trust Fund, according to Treasury Department reports.

The Trump administration in July sharply boosted its deficit estimates compared with the projections it had made in February when it sent its 2019 budget to Congress. The administration now expects the deficit will top $1 trillion next year and remain above $1 trillion for three consecutive years.

The only other period when the federal government ran deficits above $1 trillion was for four years from 2009 through 2012 during President Barack Obama's administration when the government was using tax cuts and increased spending to combat the aftermath of the 2008 financial crisis and a deep recession.

A Section on 09/14/2018