The Little Rock housing authority failed to follow the rules in shifting nine properties from public housing to a voucher program through private partnerships, according to a federal audit released Thursday.

Auditors found that there were "significant delays" in the conversion projects, the authority didn't properly account for "predevelopment costs," there was an unresolved conflict of interest, the executive management team didn't provide financial oversight of the program, and the board and staff didn't communicate well.

Predevelopment costs can include architectural and engineering fees, lender application fees and market studies, among other things.

Delays in completing the projects "adversely affected rehabilitation costs; occupancy rates; and the Authority's ability to provide decent, safe, and sanitary housing to its tenants," the audit says.

The 22-page report covers shortcomings that auditors found in the Metropolitan Housing Alliance's Rental Assistance Demonstration program, which allowed the public agency to partner with private companies to refurbish its public housing.

The U.S. Department of Housing and Urban Development's inspector general's office began the audit after the Little Rock Office of Public and Indian Housing expressed "concern about the amount of funds that the Authority had spent on predevelopment costs."

The audit report recommends that the housing authority take five steps to address the findings: close its ongoing projects and complete its Rental Assistance Demonstration program conversions, "support or repay" $1.9 million from non-federal funds to its program, implement financial controls, develop procedures to address conflicts of interest and design control systems so the executive staff provides more oversight of its Rental Assistance Demonstration program.

The alliance is federally funded and locally controlled. It's the largest housing authority in Arkansas and provides rental assistance to people who have low incomes.

Patricia Campbell, a regional public affairs officer for HUD, said alliance officials and Little Rock Public and Indian Housing officials will review the report and put together a plan to "reconcile the issues the OIG found."

"The Office of Public Housing may or may not agree with all the OIG recommendations," and can provide additional documents to alleviate the auditors' concerns, Campbell said.

The Little Rock housing authority was previously designated as "troubled" by HUD because it was undergoing the Rental Assistance Demonstration conversion. The program began under former President Barack Obama's administration and has continued under President Donald Trump.

Three of the authority's commissioners -- chairman Leta Anthony, Kenyon Lowe and Lee Lindsey -- did not answer phone calls requesting comment about the report. Monique Sanders and Louis Jackson declined to comment, citing busy schedules and not enough time to read the report in its entirety.

The audit covers the period from January 2015 to July 2018. Auditors worked on the report from August 2018 to March, the document says.

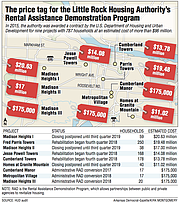

Federal officials authorized the housing authority to switch nine properties from public housing to Section 8 vouchers in 2015 at an estimated cost of more than $96.5 million. The move would affect 787 households, many designated for senior citizens.

HUD says conversions of this type usually take about 14 months. The Little Rock agency's conversions have long exceeded that time frame.

Three of the projects -- Cumberland Manor, Metropolitan Village and Madison Heights III -- were administrative conversions and didn't require significant improvements, but still took between two and three years to finish, according to the report.

The other six are ongoing. The agency partnered with Gorman & Co. for the projects in 2016.

The report notes that some work, such as environmental reviews, may have to be done again because of the delays.

The agency wasn't effective at "planning, implementing and managing its RAD program conversion," which contributed to delays, the report says.

Alliance interim director Anthony Snell said several factors caused the delays, including legal disputes at the Madison Heights properties and disruptions in the tax market with the tax reform act passed in 2017.

"Because these deals are very, very complex, it took a lot of effort for us to secure our investors," Snell said. "There are a lot of moving pieces in these transactions."

He added that he thinks all projects will be completed by the end of 2020.

The agency also received approval to exceed the $100,000-per-project cap on spending for predevelopment costs but didn't provide proper documentation of the spending, the report says.

By July 2018, the authority had spent more than $1.9 million, and the office of inspector general wrote that the agency should either pay back those funds or provide documentation proving that they were spent appropriately.

Snell said in an interview that the amount spent on the three public housing towers was actually $1.1 million and that as a part of the contract with Gorman & Co., all the agency's money was reimbursed when the contracts on the towers closed.

The report also notes that the agency had another $829,000 to spend in predevelopment costs but said there should be more financial controls in place to ensure that the money was "properly accounted for, allocated and supported."

Snell said he and others at the authority thought they had enough documents to prove the expenditures were proper and that all went through the Little Rock public housing office for approval.

"We have done that on numerous occasions -- at least two times -- and have gotten approval from the [HUD] field office for those expenditures," he said.

The conflict of interest noted in the audit occurred when the housing authority hired a construction manager; a senior manager at the company was married to an agency employee.

A housing authority response included in the report says the relationship was between a third-party vendor and a public housing site manager who was not involved in the contracting decision.

Snell said that since the audit, staff members have started working on a document for those involved to address conflicts of interest. He said the agency already has a policy in the case of requests for proposals.

The inspector general's report included the mention of the incident because the agency didn't address it until it was brought up in the writing of the report, it says.

"The Authority was required to have procedures to ensure that no conflicts of interest, whether actual or in appearance, existed and have procedures to resolve such issues," the audit says.

Snell said the fourth finding, that executive financial management staff members didn't provide oversight of the Rental Assistance Demonstration conversion, was off base.

He listed six executive staff members who he said were a part of daily conversations about the transition.

"All of the key members of our executive team were engaged and continue to be engaged in the execution of our RAD program," he said.

The report says that the executive financial managers got information on the Rental Assistance Demonstration program conversion only for "situational awareness," served only as a "conduit for information and data to and from recipients," and that management deferred "rehabilitation activities" on the program to program consultants.

"While the Authority had turned over the finance and management of the properties to developers, it remained accountable to HUD, the board and its residents for the management and accounting activities of the program," the report says.

The report cited a 2016 incident in which the board approved a resolution that said the agency would pay 75% of the predevelopment costs while its private partner paid 25% as an example of a lack of effective communication between the five-member board and agency executive staff.

But the contract actually said that each organization would pay 50%.

Snell said that was a drafting error in the resolution, left over from boiler plate language used in a previous resolution. The board corrected the error about two years later by amending the resolution.

Board members have since formed housing, technology and finance subcommittees with staff members to increase communication. Snell said they also have nearly daily contact when necessary.

The housing authority has undergone several shifts in leadership in recent months.

Rodney Forte resigned as executive director in November. Dana Arnette, one of the deputy executive directors, was fired in December. Marshall Nash, who became interim executive director on Forte's departure, resigned earlier this month.

Board members are deciding between two candidates for the executive director position, but it's not clear when they will make a decision.

"We respect the opinion of the OIG," Snell said of the report. "We feel that they may have missed the mark in some instances, but you know we have to find a way to move forward and we are working with the local field office to implement whatever programmatic changes that are necessary to move forward."

The audit is Little Rock's second since 2011. The first said the agency "generally complied" with funding requirements.

A Section on 04/26/2019