Bolstered by rising individual income tax and sales and use tax collections, Arkansas' general revenue in May increased by $23.2 million over the same month a year ago to $496.2 million.

The 4.9% increase in total tax collections also meant general revenue in May exceeded the state's forecast by $11.1 million, or 2.3%, the Department of Finance and Administration said Tuesday in its monthly revenue report.

May's general-revenue collections represent a record for the month, exceeding the $473 million in 2018, said Whitney McLaughlin, a tax analyst for the finance department.

"From consistent growth in payroll withholding to improved sales tax collection, this report reflects a healthy and expanding Arkansas economy," Gov. Asa Hutchinson said Tuesday in a written statement.

"As a result of a conservative budget and a dynamic economy, the state should finish out the fiscal year with a surplus," the Republican governor said. "[Tuesday's] announcement of future layoffs by Georgia Pacific is a reminder that we need to continue building our reserve accounts to weather any future slow-down of the economy."

Georgia-Pacific Corp. announced that it will close a major part of its operations in Crossett this fall, with about 550 workers losing their jobs. The company also said it will close a particle-board plant in Hope with another 100 layoffs.

The company's announcement came a few weeks after the Arkansas Department of Workforce Services reported that the state's employment picture continued to improve in April, with the unemployment rate falling to 3.6% and jobs added for a fourth-consecutive month.

State government's fiscal 2019 ends June 30.

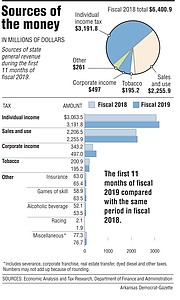

During the first 11 months of fiscal 2019, total general revenue increased by $333.4 million, or 5.5%, over the same period in fiscal 2018 to $6.4 billion, which exceeded the forecast by $195 million or 3.1%.

Tax refunds and some special government expenditures come off the top of total revenue, leaving an amount that state agencies are allowed to spend.

The net in May increased by $31.3 million, or 9%, over year-ago figures to $378.6 million, which exceed the forecast by $25.5 million or 7.2%. At $48.8 million, individual income tax refunds in May fell $12.6 million below forecast and helped boost the state's net.

During the first 11 months of fiscal 2019, the net totaled $5.27 billion -- an increase of $332.3 million, or 6.7%, over the same period in fiscal 2018. The total also exceeded the forecast by $174.4 million or 3.4%.

"It looks like we'll have a good year," said Larry Walther, director of the finance department.

The general revenue budget for fiscal 2019 is $5.63 billion -- $172.8 million more than the budget for the previous fiscal year.

Also, the Revenue Stabilization Act for fiscal 2019 -- the act that distributes general revenue to state-supported programs -- would set aside $48 million of what the governor considers surplus money for a restricted reserve account and another $16 million to help match federal highway funds.

Under a 2017 state law, Hutchinson's plan to cut individual income taxes for people with incomes below $21,000 a year took effect Jan. 1. State officials project that the cuts will reduce general revenue by about $25 million and then $50 million in all of fiscal 2020.

On Jan. 1, the sales tax on groceries also was cut from 1.5% to 0.125%. Under a 2013 law, the tax cut of about $61 million a year is financed using the savings from the end of desegregation payments to three Pulaski County school districts.

MAY'S COLLECTIONS

According to the finance department, May's general revenue included:

• A $13.6 million, or 6.2%, increase in individual income tax collections over year-ago figures to $232.4 million, which exceeded forecast by $5.1 million or 2.2%.

Individual tax withholding is the largest component of that category of tax collection.

They increased by $9.3 million, or 4.5%, over a year-ago figures to $213.6 million and exceeded forecast by $500,000.

The increased withholdings reflects that more people are working as well as working longer hours, said John Shelnutt, the state's chief economic forecaster.

• A $10.1 million, or 5%, increase in sales and use tax collections from the same month a year ago to $211.6 million, which exceeded forecast by $4.5 million, or 2.2%.

"Most of the sectors were up, both business and consumers," Shelnutt said. "Motor vehicles [sales collections were] up 2.7%. We think in retail that there was some influence from late Easter sales kicking into the next month, with our normal one-month lag of collections, so that may have taken away from [collections in April] and added to [May's collections]."

• A $100,000, or 0.7%, decrease in corporate income tax collections from a year ago to $17.1 million, which exceeded forecast by $600,000, or 3.3%.

FISCAL 2020

For fiscal 2020, which starts July 1, the general revenue budget totals $5.75 billion -- an increase of $124.1 million over the current fiscal year, with most of the increase targeted for human services and education.

The Legislature and Hutchinson enacted laws in this year's regular session on taxes.

Starting July 1, Act 822 will require out-of-state sellers without a physical presence in the state to begin collecting sales and use taxes on in-state purchases.

The finance department projects this will raise $32.4 million in fiscal 2020, over 11 months, and then $35.4 million in fiscal 2021, based on a full 12 months. The department also forecasts the bill would raise $10.8 million for cities and counties in fiscal 2020 and $11.8 million in fiscal 2021, because of local sales taxes.

Act 182 will phase in Hutchinson's plan to reduce the top individual tax rate from 6.9% to 5.9% over a two-year period, starting Jan. 1. State officials project it will reduce general revenue by $25.6 million in fiscal 2020, $74.1 million in fiscal 2021 and $97 million in fiscal 2022.

Act 822 also will phase in a reduction in the top corporate income tax rate from 6.5% to 5.9% over a two-year period, starting Jan. 1, 2021. State officials project the cuts will trim revenue by $9.8 million in fiscal 2021, $29.5 million in fiscal 2022 and $39.3 million in fiscal 2023 and beyond.

The potential impact on state tax collections of the recent historic flooding of the Arkansas River may not show up until the revenue report in June and possibly even later, because "we have a normal one-month lag in collections, so I think it is not going to affect this fiscal year" that ends June 30, Shelnutt said.

State officials have observed natural disasters in Southern states such as hurricanes in Florida and Texas and "they see an initial shock from the event, but then they see a rebuilding surge that comes right after that and then it tapers off over time," he said.

"Things go back to normal," added Walther.

Meanwhile, a report released by the Pew Charitable Trusts said most states' annual finances are better off than they were a decade ago, during the last recession.

"But the recent surge in tax revenue already has begun to sputter, raising uncertainty over how much of the gains were temporary in reaction to 2017's federal tax overhaul rather than a trend," the report said, adding that "states face a backlog of spending demands that have piled up over the past decade."

Metro on 06/05/2019