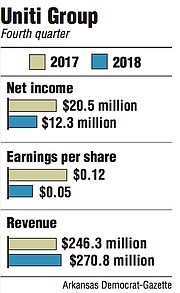

Little Rock-based real estate investment trust Uniti Group Inc. on Wednesday reported a net income of $12.3 million in the fourth quarter last year, a 40 percent drop from net income of $20.5 million in the same period of 2017.

Uniti, which was formed in 2015 as a spinoff from Windstream Holdings, earned 5 cents a share in the fourth quarter, down more than 50 percent from 12 cents a share for the same period in 2017.

Uniti shares rose 14 cents, or 1.4 percent, to close Wednesday at $10 a share on the Nasdaq exchange. Uniti released its fourth-quarter earnings report after the market closed Wednesday.

"Uniti enters this year with an exceptional portfolio of infrastructure assets we have acquired and developed over the last few years," said Kenny Gunderman, Uniti's chief executive officer. "All of our businesses are seeing strong demand as the multiyear investment cycle in communication assets remains healthy."

For the full year of 2018, Uniti had $1 billion in revenue, $8 million in net income and 4 cents in earnings per share. That compares with 2017 revenue of $916 million, a $16.6 million net loss and 13 cents in losses per share.

In 2015, after getting approval from federal and state regulators, Windstream completed the spinoff of what is now Uniti Group. Windstream Services, a Windstream Holdings subsidiary, sold the Windstream assets to Uniti. Windstream Holdings leases the assets from Uniti.

Aurelius Capital Management, a New York hedge fund, sued Windstream in 2017 claiming Windstream's spinoff of certain telecommunications network assets to create Uniti Group violated its agreements with bondholders.

On Feb. 15, U.S. District Judge Jesse Furman ruled in favor of Aurelius, saying the hedge fund was entitled to a $310 million judgment.

On Feb. 25, Windstream filed for Chapter 11 bankruptcy reorganization.

Windstream's problems have affected Uniti, which delayed its earnings report, initially scheduled for Feb. 28.

Since Feb. 15, when Furman ruled against Windstream, Uniti's share price has dropped from $19.98 to $10 a share, a loss of half its value.

When asked during a question-and-answer session with analysts how long the Windstream bankruptcy should take, Gunderman was hesitant about being specific.

He did say Uniti is optimistic about the process.

"All parties seem to want to move quickly through this [bankruptcy]," Gunderman said. "And that makes sense. Avoid as much disruption as possible. We want to do what we can to facilitate that. We think by the third or fourth quarter, there should be more clarity on where we all stand."

Gunderman said Uniti expects to pay its dividends in cash, as well as using cash to make acquisitions.

Business on 03/21/2019