Tyson Foods Inc. on Monday posted upbeat earnings for its second quarter, bolstered by its beef, pork and prepared foods businesses.

Tyson managed to beat analyst estimates, overcoming market headwinds, operational and seasonal challenges. The Springdale-based meatpacker also confronted the challenge that African swine fever could have on its business.

"This is an unusual, perhaps, unprecedented time for the protein industry," Noel White, Tyson president and chief executive officer, said Monday during the company's teleconference with analysts. "In my 39 years in the business I have never seen an event that has the potential to change global protein production and consumption patterns as African swine fever does," White said.

White said Tyson and others in the industry are working to prevent the spread of African Swine Fever to North America. It has already led to the cull of hundreds of millions of hogs in China and surrounding Asian countries.

In the short term, Tyson stands to benefit from a reduction in the foreign supply of hogs, as Chinese meatpackers report record losses.

"A worldwide decrease in pork supply could put pressure on our prepared foods business by increasing raw material costs, while offering significant upside to our pork, chicken and beef businesses," he said.

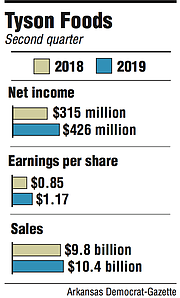

The country's largest meatpacker beat Wall Street earnings estimates of $1.14 per share, according to a FactSet consensus of 14 analysts.

Tyson shares rose $1.96, or 2.6%, to close Monday at $77.05. The shares have traded as high as $77.26 and as low as $49.77 the past 52 weeks.

Ben Bienvenu, a Stephens Inc. analyst covering agribusiness, said Tyson's upward stock activity reflects the company's forward-looking comments more than the actual reported results.

"We think the markets are focused on what's to come with Tyson and think the company is set up really well to perform," Bienvenu said.

Tyson's sales and net income for the quarter ending March 31 improved compared to the same quarter a year ago. Sales rose to $10.4 billion in the second quarter from $9.8 billion a year ago. Net income rose to $426 million, or $1.17 per share, up from $315 million, or 85 cents per share, a year ago.

Tyson's prepared foods business, comprised of breakfast sandwiches and other high-margin products, reaped record second quarter results and "the beef and pork segments executed well, despite several significant weather events," White said.

"Although parts of our chicken segment had challenges, we are past what is typically our toughest quarter and we're driving changes to improve our results," he said.

Some challenges came from the tray-pack segment of the business and from grain hedging losses, which ate into Tyson's chicken margins, Bienvenu said. The quarter's chicken margins fell to 4% from almost 8%, resulting in a lower profit of $141 million compared to $231 million a year ago.

Another challenge facing Tyson is a near 6,000-ton recall of chicken strips. As of Saturday, the U.S. Department of Agriculture expanded Tyson's initial recall, issued March 21, from 69,093 pounds of frozen, ready-to-eat chicken strip products to 11,829,517 pounds. The food inspection agency did so after receiving additional complaints of metal pieces found in product processed at a Rogers plant from Oct. 1 through March 8, with "three alleging oral injury."

Meanwhile, beef, pork and prepared foods saw income gains year over year. With ample domestic cattle and pork and steady demand, White said Tyson would be able to grow business margins for the fiscal year to 7% for beef and more than 6% for pork, respectively.

"It is difficult to predict when [African swine fever] could positively impact our business," White said. Later in the call, he estimated the disease has wiped out about 11 million tons of pork product, or 5% of the global market. In response, U.S. hog prices are rising higher than product prices and will continue to do so through Tyson's third and fourth quarters, White said. Increased raw material costs are expected to put pressure on Tyson's prepared foods business the rest of the year.

Tyson said it is waiting for permission to open five chicken processing plants in Thailand and Europe, and expects the deal to close in the third quarter. Post-acquisition results from organic chicken producer Tecumseh Poultry; renderer American Proteins; and Keystone Foods, a McDonald's supplier acquired last fall, were reflected in Tyson's chicken earnings for the quarter.

Tyson also plans to debut and test its line of alternative protein products in limited markets this summer and expand distribution in the fall.

"I believe there is no company better positioned than Tyson Foods to handle what lies ahead," White said.

Business on 05/07/2019