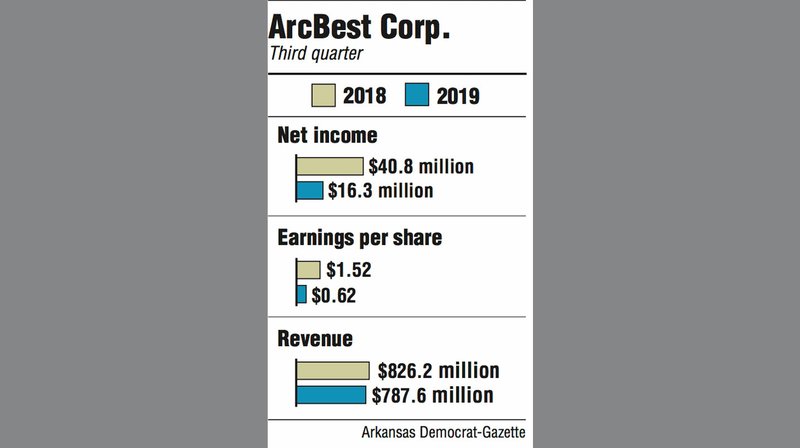

ArcBest Corp. on Thursday reported a profit of $16.3 million for the third quarter, a 60% drop from the same quarter a year ago.

Earnings per share were 62 cents for the three months ending Sept. 30, down from $1.52 a year ago. Total revenue was $787.6 million.

The report missed analyst's expectations.

The Fort Smith freight and logistics company's recent performance is tied to the current softer state of the industry. With more trucks freed up, spot rates have fallen and remained low this year, leading to declining profits and revenue.

"While below last year's record-setting levels, the third quarter represented one of the best performances achieved for that period in recent history as we continued to see rational pricing amid softer demand compared with last year," Judy McReynolds, ArcBest's chairman, president and chief executive officer, said in the report.

"Revenue for expedite and truckload brokerage services declined as available capacity increased, which has been the case throughout the year, while our managed transportation solutions revenue continued to grow as a result of our team's ability to provide valued expertise," she said.

ArcBest's asset-based, or trucking, business reported operating income of $31.7 million, down from $50.2 million a year ago.

In the report, the company said a decline in customer demand during the quarter led to fewer shipments and lower total freight tonnage compared with the same quarter a year ago. Also, lower freight levels made city pickup, dock handling and final shipment delivery unfavorable, ginning extra costs in these areas.

Asset-based revenue was $565.6 million, almost $20 million less than last year.

ArcBest's asset-light, or logistics, business reported a 68% decline, to $3.6 million, in operating income compared with the same quarter a year ago.

The main reasons for the reduction came from ArcBest's expedite and truckload brokerage services, the company said. "Current market conditions have impacted customer pricing and freight mix. This, combined with purchased transportation costs that were comparable to those experienced in last year's higher revenue environment, put pressure on third quarter margins and reduced Asset-light operating income."

Asset-light revenue was $235.7 million, about $2 million less than last year.

ArcBest's profit of 62 cents per share fell below Wall Street estimates of 87 cents per share, according to a Yahoo Finance consensus of 13 analysts. Revenue fell short of an estimated $797 million.

In closing remarks, Reynolds said, "We expect the trends that began in the first quarter, including more available capacity and softer market demand, to remain prevalent for the rest of the year."

"We will work to reduce costs where prudent while still investing in innovative technology that enables a best-in-class customer experience, and offers the optimum benefit and improved efficiency to ArcBest," she said.

ArcBest will hold a conference call at 8:30 a.m. today to discuss the results. Callers can dial (800) 931-4071 using the conference number 21930608 to tune in. The call is also available at arcb.com.

Business on 11/01/2019