Simmons First National Corp. reported a 48% increase in third-quarter earnings, a period in which the bank coordinated multiple moving pieces that included $20 million in loan losses and a $42.9 million gain from the sale of Visa Inc. stock.

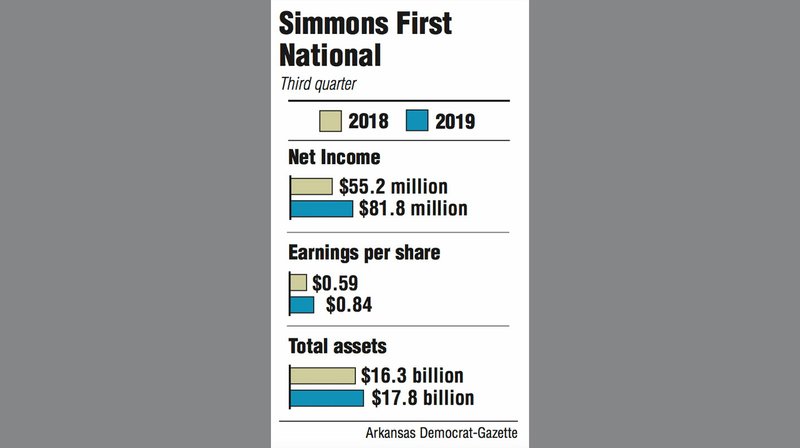

The Pine Bluff holding company is parent to Simmons Bank of Arkansas. Simmons reported net income of $81.8 million in the quarter ended Sept. 30, compared with net income of $55.2 million in the same quarter in 2018.

Earnings per share came in at 84 cents, above analysts' consensus forecast of 64 cents, and up 42% from the 59 cents reported in the 2018 third quarter.

"We're awfully pleased with our results in the third quarter," said George Makris Jr., chairman and chief executive officer of the holding company.

To help boost earnings in the quarter, Simmons gained $42.9 million by selling Visa Inc. Class B shares the bank owned.

That gain was hindered by $20 million in loan losses: a $5.1 million loss related to the sale of $114 million in commercial real estate loans and another $15 million loss related to Simmons' share of a loan to White Star Petroleum, a natural gas exploration and production company in Oklahoma City.

"We've been bitten pretty hard by the White Star loss and we certainly don't want to go through that again," Makris said Tuesday on a conference call with industry analysts. "I'm not sure that we've ever had a loss as significant as what we experienced with White Star."

Simmons executives, Makris said, have examined the bank's energy portfolio and the CEO is "pretty confident" there are no other surprises lurking like the White Star situation. Simmons picked up the White Star loan when the bank acquired Bank SNB.

Stephens Inc. analyst Matt Olney noted that the earnings report fell a little short and that the bank announced a stock buyback program to help ease the sting. "As a result of the disappointing results, [Simmons] announced a stock repurchase authorization of $60 million of common stock," Olney wrote in a report issued Tuesday.

The stock-repurchase program, approved by Simmons' board of directors last week, was announced Tuesday along with quarterly earnings.

Third-quarter results also included $2.1 million in net after-tax merger-related, early retirement program and branch costs.

Little Rock banking analyst Randy Dennis, president of DD&F Consulting Group, estimated Simmons' earnings per share were 70 to 71 cents absent the one-time items.

"All in all, it was a decent quarter when you cut through a lot of the noise," Dennis said, noting the one-time items in the quarter. "Their earnings were better than expectations, and that's a good thing."

Banking industry earnings have been squeezed in the quarter because of two interest-rate cuts by the Federal Reserve. The target range for the federal funds rate is 1.75%-2%. The federal funds rate refers to the interest rate that banks charge other banks for lending them money and it also affects the interest rates banks charge consumers on credit cards, mortgages and bank loans.

Also Tuesday, Simmons First declared a regular 16 cents per share quarterly cash dividend payable Jan. 6 to shareholders of record as of Dec. 16. The dividend represents a 1-cent-per-share increase, or 6.7%, above the dividend paid for the same period last year.

On the call with analysts, Simmons said it is on target to complete its acquisition of Landrum Co. of Missouri on Oct. 31, with systems conversion scheduled for the first quarter of 2020. Landrum is parent company of Landmark Bank, which has 39 branches in Missouri, Oklahoma and Texas. "We are excited about the expanded market presence in several states because of this merger," Makris said.

Simmons has made 10 acquisitions over the past five years. It's time, Makris said, to step back and evaluate all the factors that come with acquisitions: systems and processes, more employees, new markets and branches as well as additional products and services. "Over the next few months, we will evaluate our new organization and make adjustments consistent with our longer-term strategy," he said.

While avoiding specifics, Makris said "everything's on the table" in the evaluation process. The bank, he said, would examine the location of its branches and evaluate the potential for leaving markets.

Simmons stock closed at $24.66 on Tuesday, up 61 cents.

The bank closed the quarter with $17.8 billion in assets, up 9% from a year ago. Total deposits increased $1.4 billion over the same quarter last year to $13.5 billion primarily from a merger with Reliance Bank.

Another key indicator, net interest margin, declined to 3.81% from 3.98% in 2018's third quarter.

Simmons has 216 branches in Arkansas, Colorado, Illinois, Kansas, Missouri, Oklahoma, Tennessee and Texas.

Business on 10/23/2019