Bolstered by rising individual income tax, and sales and use tax collections, Arkansas' general revenue tax collections in August increased by $56.9 million, or 11.2%, over a year ago to $564.9 million.

Last month's collections exceeded the state's April 2 forecast by $53.9 million, or 10.6 %, the state Department of Finance and Administration said Wednesday in its monthly revenue report.

August's general revenue collections exceeded the previous record for the month of $508 million in 2019, said Whitney McLaughlin, a tax analyst for the finance department.

Gov. Asa Hutchinson said the revenue report shows that people are going back to work and that Arkansas taxpayers remain confident and continue to spend for consumer goods.

"We also know that there are parts of our economy in Arkansas that are really hurting such as many aspects of our tourism industry like lodging, convention centers and small retail businesses," the Republican governor said in a written statement.

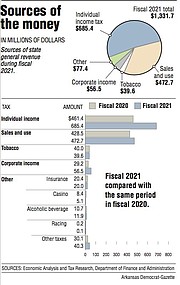

Individual-income and sales-and-use tax collections are state government's two largest sources of general revenue. General revenue collections help fund state-supported programs such as the public schools, the Medicaid program, colleges and universities and prisons.

Tax refunds and some special government expenditures are cut off the top of total general revenue, leaving a net amount that state agencies are allowed to spend.

In August, the net increased by $36.5 million, or 8.1 %, to $485.5 million, exceeding the state's forecast by $41 million, or 9.2%, the finance department reported. August is the second month of fiscal 2021, which started July 1.

During the first two months of fiscal 2021, the net increased by $239.6 million, or 26.3%, over the same period in fiscal 2020 to $1.15 billion, and exceeded the state's forecast by $93.7 million, or 8.9%.

These results include net collection increases tied to the state shifting its individual income tax filing and payment deadline from April 15 in fiscal 2020 until July 15 in fiscal 2021, the finance department noted.

Hutchinson said there is no current plan to adjust the state's general revenue forecast for fiscal 2021.

"We will continue to monitor the needs of agencies and departments of state government to assure they can adequately deliver needed services, and if additional funding is needed in a particular area, then we will work with the General Assembly to fill the gap with the reserve funds that have been set aside for such a time," he said in a written statement.

"As to my consistent goal to lower the state individual income tax rate, it is too early to tell whether we can take another step in that direction," Hutchinson said.

"The current budget numbers are very encouraging, and I would hope a portion of the current surplus can be used for income tax reduction, but the next step will be guided by the budget numbers in the coming months," the governor added.

In the fiscal session in April, the Legislature enacted a $5.89 billion general revenue budget for fiscal 2021.

The finance department's April 2 forecast will provide $5.68 billion for the fiscal 2021 budget and leave $212.2 million unfunded. On April 2, the department trimmed its original forecast for fiscal 2021 by nearly $206 million, citing a projected economic recession triggered by the coronavirus pandemic.

According to the finance department, August's general revenue included:

• A $16.5 million, or 7.2%, increase in individual income tax collections over the same month a year ago to $245.5 million, which exceeded the state's forecast by $23.9 million or 10.8%.

Withholding is the largest category of individual income taxes. They increased by $16 million, or 7.6%, over a year ago to $228 million, and exceeded the state's forecast by $20.3 million.

"That's a combination of a lot of things mixed together, the economy, the tax cuts, a payday timing factor that is positive this month and negative in September and it is a large payday timing affect," said John Shelnutt, the state's chief economic forecaster.

There is one more Thursday and one more Friday payday over the same month a year ago, he said.

• A $13.5 million or 6% increase in sales and use tax collections from a year ago to $236.2 million, which exceeded the state's forecast by $20.7 million, or 9.6%.

Sales tax collections in August continued strong growth in the consumer categories of retail and motor vehicle sales with both increasing by 11% over a year ago, Shelnutt said. The retail sales tax collections last month increased by $9.3 million over a year ago to $93.7 million, while motor vehicle sales tax collections increased by $3 million over a year ago to $31.4 million, he said.

"That's partly [federal] stimulus and people going back to work," he said.

"It was sort of a mixed bag in the business-related categories [for sales tax collections]," Shelnutt said. "Construction is still running strong. Rental leasing is strong. Wholesale is up, and restaurants are still down, especially the dine-in, full-service restaurants."

• A 9.6 %, drop in corporate income tax collections from a year ago to $3.7 million, which were below the state's forecast by $2.3 million or 37.7%.

It's a volatile source of tax collections, and "it's a quiet month for that category," Shelnutt said.

Last month, the state also received a deposit of $27.5 million in unclaimed property funds from state Auditor Andrea Lea's office -- up from $19.5 million last year -- and the finance department had expected $18.5 million, Shelnutt said.

Asked why the deposit from unclaimed property funds was larger than expected, the auditor's chief of staff, Skot Covert, said the transfer was for unclaimed property that's been held for three years.

"In [fiscal year 2017], we receipted in more than in previous years, therefore there was a subsequent increase in the funds required to be transferred to general revenue," he said in a written statement. "The increase in receipts in FY17 can be attributed to a variety of things including a change in the dormancy periods for certain types of funds as well as increased outreach and education with businesses."

In August, the state's individual income tax refunds increased by $16.1 million or 155.2% over a year ago to $26.4 million, and exceeded the state's forecast by $11.2 million or 73.8%. Refund amounts above the forecast reduce the state's net available general revenue.

The number of people participating in the Medicaid expansion program called Arkansas Works totaled 280,678 on Aug. 1 -- that's up from 250,336 on April 1, 261 975 on May 1, 271,553 on June 1 and 275,162 on July 1 -- according to the latest figures available from the state Department of Human Services.

The federal government covers 90% of the cost of the program under the federal Patient Protection and Affordable Care Act, and the state pays the remaining 10%.

Asked whether the number of people participating in the Arkansas Works program has peaked yet during the coronavirus pandemic, Department of Human Services spokesman Amy Webb said that "given the ongoing public health emergency, the current limitations around disenrollment, and the potential impacts on the economy, it's likely it has not peaked at this point."

"But it's something we are watching closely," she said in a written statement.

On Jan. 1, 2021, the state's top individual income tax rate is to dip from 6.6% to 5.9% under Act 182 of 2019. The top rate dropped from 6.9% to 6.6% on Jan. 1 of this year.

State officials projected Act 182 would reduce general revenue by $25.6 million in fiscal 2020; by $48.5 million more in fiscal 2021; and then by $22.9 million more in fiscal 2022, which starts July 1, 2021, to ultimately reduce general revenue by $97 million a year.

On Jan. 1, 2021, the state's top corporate income tax rate also is scheduled to drop from 6.5% to 6.2% for income exceeding $100,000 under Act 822 of 2019.

That top rate is to drop to 5.9% for income exceeding $25,000, starting Jan. 1, 2022. State officials projected these corporate income tax cuts would reduce revenue by $9.8 million in fiscal 2021, $29.5 million in fiscal 2022 and $39.3 million in fiscal 2023 and beyond.