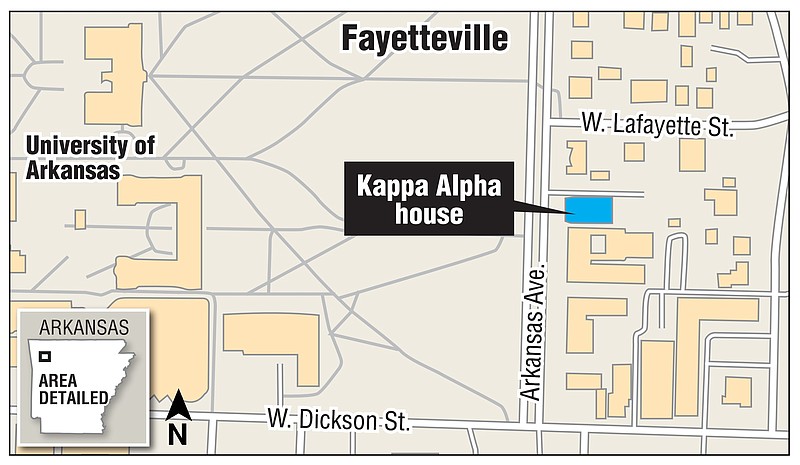

FAYETTEVILLE -- The owner of the Kappa Alpha fraternity house built on University of Arkansas-owned land is advertising an "income stream" for sale to investors at an $8.56 million asking price.

Built in 2016, the house belongs to KAAO Inc., university spokesman Mark Rushing said. It's never been assessed for taxation, according to the Washington County assessor's office.

An investor would gain what's called the leasehold interest and receive an annual "net operating income" starting at $492,275, according to an online advertisement with a posting date of June 8.

"The leasehold is just an income stream," said Marvin DeLaura with Fortis Net Lease, who is fielding inquiries from prospective buyers. "They don't really own anything at the end of the day."

Such a deal -- described as unusual by an attorney who often works with fraternal organizations -- would involve an investor not vetted by the university, or, perhaps, the university itself.

Rushing said the UA would not receive any proceeds from the deal but has the right to purchase the leasehold interest at the same financial terms offered to an investor.

The type of deal being sought is unusual compared to the typical house corporations behind fraternity or sorority housing, said attorney Sean Callan, a partner with the Cincinnati, Ohio-based Manley Burke law firm who works with fraternal organizations but is not involved with the sale being advertised.

House corporations often are formed by fraternal organizations as the legal owners of fraternity and sorority house property.

"I've not seen outside investors really invest in fraternity houses. I suppose you could, I just haven't seen that," Callan said in a phone interview, though he added that occasionally houses have third-party ownership that's neither tied to the fraternal organization or the university.

Callan noted the cost to build housing like the fraternity and sorority houses found at UA.

No building permit records exists for the house, so its construction value isn't readily available for public view.

Mortgage documents for KAAO, LLC filed with the Washington County Circuit Clerk list a loan amount of $3.5 million due to be repaid by May 31, 2025.

In recent years, UA sorority houses -- some considerably larger than than the Kappa Alpha house -- have been built at costs ranging from about $10 million to $16 million, according to information provided in 2018.

While not having knowledge of the proposed sale, Callan suggested why an investor might be sought: "Kappa Alpha Order is looking to be paid back for the improvements they put in."

Fraternity chapter leaders and a listed "manager" for KAAO, LLC did not respond to an email and phone message asking about the advertisement seeking an investor.

As advertised, the amount paid to the investor, said to start at $492,275, would be bumped up by 1.5% "to hedge against inflation," according to the advertisement.

The $492,275 figure matches what the advertisement lists as annual rent for KAAO Housing Inc., the tenant. Typically, individual sorority or fraternity members pay rent to the house corporation, and the advertisement lists the Kappa Alpha house as having 48 residents.

The acronym appears to refer to the UA chapter of the fraternity, which is known as the Kappa Alpha Order, Alpha Omicron Chapter, according to the website for the national fraternal organization.

The advertisement states that there's "an underlying 75-year ground-lease with the University of Arkansas which runs concurrently and which will not expire until 2090."

The tenant makes an annual $1 payment to the university under terms of the lease agreement, released by the university under the state's public disclosure law.

While Rushing said KAAO Inc. owns the house, the lease agreement specifies KAAO Housing Inc. as subleasing the property from an entity called Fayark LLC.

The ground-lease deal, signed in 2015, specified that the fraternity house was to be built "at no cost, expense, or risk of any nature whatsoever" to the university.

Parts of the ground lease described some UA rights had over the property while the lease was in effect, including a right to inspect the property.

The ground lease also specified that the fraternity "shall not allow the display of any flags or symbols of the Confederate States of America" on the land or structures built on the land. This part of the lease likely is a nod to controversies related to the fraternity's ties to the Confederate Gen. Robert E. Lee, who is described on the national fraternity's website as the group's "Spiritual Founder."

The national fraternal organization banned displays of Confederate flags in 2001.

The UA chapter of Kappa Alpha was restarted in 2012, though the fraternity previously had a chapter chartered in 1895 at the university.

At the end of the ground lease, ownership of the house reverts to the university.

Such type of ground-lease deals are somewhat common in the southeast, Callan said.

In an email, Rushing said the university-owned land is exempt from taxation and referred questions about taxation of the house to the county and "the existing lessee."

"Whether a new lessee would be required to pay property tax on its lease of the university's land would depend on the usage, which usage is subject to the prior approval of the university," Rushing said in an email.

UA, though its spokesmen, declined to specify the usages.

"We would not want to speculate on potential uses that might be proposed and if we would approve such uses, and whether such uses may subject the leased property to property tax," spokesman John Thomas said in an email.

In 2016, the Arkansas Supreme Court sided with the university in a legal dispute with Washington County over whether 11 university parcels could be subject to property taxes, a source of revenue for local government and also local schools.

Tax breaks afforded to colleges and universities have occasionally come under scrutiny.

A state law, Act 1076 of 2017, said that tenants now are responsible for property taxes when leasing from a state entity for "an ongoing commercial residential purpose," but included numerous exceptions, including for student housing.

William Stephenson, the assessor's office chief deputy for real estate, said the university, as a state entity, does not need to seek building permits, typically a key source of information about property.

The county assessor's most recent records about ownership of the fraternity house site date back to 2002, when the university acquired it, Stephenson said.

"If improvement (buildings) rights are transferred without the land, there may not be any notification of the transaction filed with the clerk. This could be bills of sale or lease agreements," Stephenson said in an email.

"In regards to the U of A, if a property falls outside the university's immunity status we rely on them to notify us," Stephenson said.

UA System President Donald Bobbitt signed the 75-year ground lease document.

The listed contact for Fayark LLC is Scott McLain with The McLain Group, a Fayetteville firm that, according to its website, "specializes in real estate development, program & project management and project funding."

The McLain Group's website lists "Arkansas KA" alongside commercial projects such as Speedy Splash Carwash. Scott McLain's LinkedIn social media profile lists "Kappa Alpha Order" among activities while he attended Arkansas Tech University in the 1980s.

McLain did not respond to an email and phone message asking questions about the advertisement seeking an investor.

As part of terms of the ground lease, KAAO, LLC agreed to sell property at 820 W. Maple St. for $1 million to the University of Arkansas Board of Trustees.

In 2015, the city of Fayetteville's planning commission granted approval for a Kappa Alpha house to be built at that location, but instead the property was sold to the university. County records show that in 2015, KAAO, LLC paid $1 million to Mission Boulevard Baptist Church in Fayetteville for the property.

University records of the 820 W. Maple St. property sale listed McLain as "manager" for KAAO, LLC. The university released the records under the state's public disclosure law.

While the document lists McLain as the contact person to receive all notifications related to the ground-lease agreement, it was signed on behalf of Fayark LLC by an Arizona-based "exchange coordinator" with a company called National Safe Harbor Exchanges.

The ad seeking an investor also touts financial terms with "zero landlord responsibility" in what's known as a triple-net lease, which typically means that the tenant -- listed in the ad as KAAO Housing Inc. -- pays for expenses associated with the property.

The Kappa Alpha house is a red brick home with white columns on a two-story portico, built in what's known in architecture terms as a Georgian style.

The ground-lease agreement states that the university was to be provided with a "total project cost budget" for Kappa Alpha house.

The Democrat-Gazette submitted a request for this budget record under the state's public disclosure law, as well as other records showing the final cost for the Kappa Alpha house. UA responded June 22 that it "continues to search for any potentially responsive records."