DETROIT -- Elon Musk said Friday that his plan to buy Twitter is "temporarily on hold," raising more doubts about whether he'll proceed with the $44 billion acquisition.

Musk tweeted that he wanted to pinpoint the number of spam and fake accounts on the social media platform. He has been vocal about his desire to clean up Twitter's problem with "spam bots" that mimic real people, and he appeared to question whether the company was underreporting them.

But Twitter has disclosed in regulatory filings that its bot estimates might be too low, leading some analysts to believe that Musk could be raising the issue as a reason to back out of the deal.

"Twitter deal temporarily on hold pending details supporting calculation that spam/fake accounts do indeed represent less than 5% of users," Musk tweeted Friday morning, indicating that he's skeptical that the number of inauthentic accounts is that low.

Musk later tweeted that he's "still committed to acquisition." Neither Twitter nor Musk responded Friday to requests for comment.

The problem of fake accounts on Twitter is not a secret.

In its quarterly filing with the Securities and Exchange Commission, Twitter doubted that its count of bot accounts was correct, conceding that the estimate may be low. "In making this determination, we applied significant judgment, so our estimation of false or spam accounts may not accurately represent the actual number of such accounts, and the actual number of false or spam accounts could be higher than we have estimated," the filing says.

A review of Twitter's filings with the SEC shows that the estimate of spam bot accounts and similar language expressing doubts about it have been in the company's quarterly and annual reports for at least two years, well before Musk made his offer, and it would have been known to him and his advisers.

Sara Silver, a professor of business journalism and financial communication at Quinnipiac University, said it appears that Musk is using the number of spam accounts as a pretext to pull out of the deal.

"To claim that this is the reason that he's putting the deal on pause, it's not credible," Silver said. "This is not a new issue for him. It's not just entering his consciousness now."

Twitter's shares fell almost 10% on Friday. Shares of Tesla, which Musk had proposed using to help fund the Twitter deal, rose nearly 6%.

Tesla's stock has tumbled since it was revealed that Twitter had become a Musk target. Shares have lost a quarter of their value in the past month, falling from about $1,150 in early April, when Musk confirmed that he had taken a huge stake in Twitter, to about $762 on Friday. For this week alone, Tesla's shares dropped 16%.

"So it's become much more expensive for him to buy this company using his Tesla shares," Silver said.

Musk's net worth, estimated by Forbes earlier this week at $240 billion, had fallen to $223 billion as of Friday.

Tesla shares may have benefited from Twitter bot accounts over the years. A University of Maryland researcher recently concluded that such bots have been used to generate hundreds of thousands of positive tweets about Tesla, potentially buoying its stock in years when it was under pressure.

Neither Tesla nor its supporters have taken responsibility for those bots.

The sharp jump in the price of Tesla shares before the opening bell Friday signaled rising doubts about whether the acquisition of Twitter will take place.

Musk has already sold off more than $8 billion worth of his Tesla shares to finance the purchase.

Musk originally had committed to borrowing $12.5 billion with Tesla stock as collateral to buy Twitter. He also would borrow $13 billion from banks and put up $21 billion in Tesla equity.

Last week, Musk strengthened the equity stake in his offer for Twitter with commitments of more than $7 billion from a diverse group of investors, including Silicon Valley heavy-hitters like Oracle co-founder Larry Ellison.

Money from the new investors would cut the amount borrowed on the value of Tesla stock to $6.25 billion, according to a regulatory filing. The Tesla equity share could go from $21 billion to $27.25 billion.

Wedbush analyst Dan Ives, who follows both Tesla and Twitter, said Musk's "bizarre" tweet will lead Wall Street to either think that the deal is falling apart, that Musk is attempting to negotiate a lower price, or that he is simply walking away from the agreement with a $1 billion penalty.

"Many will view this as Musk using this Twitter filing/spam accounts as a way to get out of this deal in a vastly changing market," Ives wrote.

He said Musk's use of Twitter rather than a financial filing to make the announcement was troubling and "sends this whole deal into a circus show with many questions and no concrete answers as to the path of this deal going forward."

Musk's tweet came a day after the social media company fired two of its top managers. Twitter said the company is pausing most hiring, except for critical roles, and is "pulling back on non-labor costs to ensure we are being responsible and efficient."

In a memo sent to employees and confirmed by Twitter, Chief Executive Officer Parag Agrawal said the company has not hit growth and revenue milestones after it began to invest "aggressively" to expand its user base and revenue.

Information for this article was contributed by Michelle Chapman of The Associated Press.

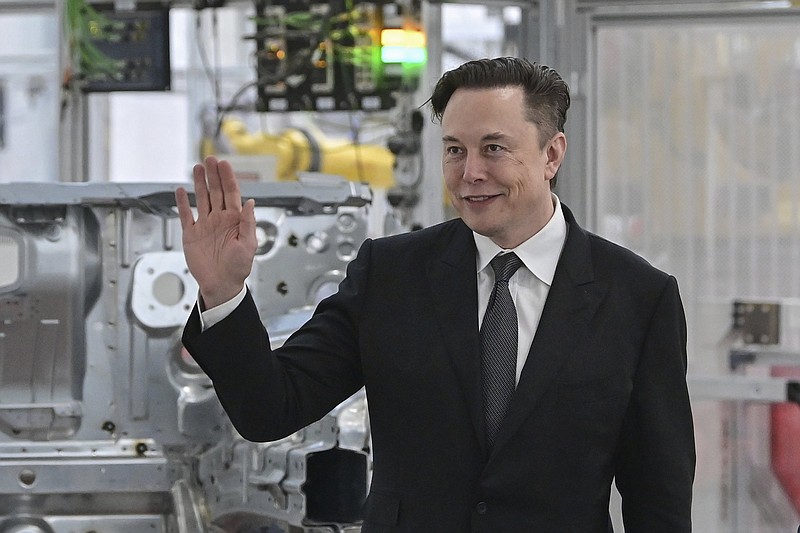

FILE - CEO Elon Musk departs from the justice center in Wilmington, Del., Tuesday, July 13, 2021. Musk says his planned $44 billion purchase of Twitter is "temporarily on hold" pending details on spam and fake accounts on the social media platform. The announcement that the Tesla billionaire tweeted Friday, May 13, 2022 is another twist amid signs of internal turmoil over his planned buyout of Twitter. (AP Photo/Matt Rourke, File)

FILE - CEO Elon Musk departs from the justice center in Wilmington, Del., Tuesday, July 13, 2021. Musk says his planned $44 billion purchase of Twitter is "temporarily on hold" pending details on spam and fake accounts on the social media platform. The announcement that the Tesla billionaire tweeted Friday, May 13, 2022 is another twist amid signs of internal turmoil over his planned buyout of Twitter. (AP Photo/Matt Rourke, File) FILE - The Twitter application is seen on a digital device, Monday, April 25, 2022, in San Diego. Shares of Tesla and Twitter have tumbled this week as investors deal with the fallout and potential legal issues surrounding Tesla CEO Elon Musk and his $44 billion bid to buy the social media platform. Of the two, Musk's electric vehicle company has fared worse, with its stock down almost 16% so far this week to $728. (AP Photo/Gregory Bull, File)

FILE - The Twitter application is seen on a digital device, Monday, April 25, 2022, in San Diego. Shares of Tesla and Twitter have tumbled this week as investors deal with the fallout and potential legal issues surrounding Tesla CEO Elon Musk and his $44 billion bid to buy the social media platform. Of the two, Musk's electric vehicle company has fared worse, with its stock down almost 16% so far this week to $728. (AP Photo/Gregory Bull, File)