LITTLE ROCK — The worst recession in advertising since World War II will bottom out this year, but a full recovery isn't expected in the United States until late 2010 at the earliest, media forecasters say.

That news gives hope to owners of newspapers, magazines and broadcast television and radio stations - almost all of whom saw revenue tank as the national economy tumbled last year.

Businesses from automakers to clothing retailers to real estate slashed their advertising expenditures as the recession took its toll.

Drastic declines in advertising revenue put news organizations at particular risk: Advertising provides 75 percent to 80 percent of newspaper and magazine revenue and generates almost all of broadcast television and radio income.

Arkansas media have weathered the recession better than their counterparts elsewhere, but publishers and broadcasters here also have had to reduce staff and take other cost-cutting steps to stay profitable.

"All media companies that are supported by advertising are struggling due to the depressed advertising market," said Paul Smith, president of Arkansas Democrat-Gazette, Inc.

Even the Internet, which had seen fast growth in advertising revenue, lost steam in the recession. Google and Yahoo, the two big online search providers, get much of their revenue from advertising. Both laid off workers and took other cost-cutting steps as the recession worsened.

In an effort to challenge Google's dominance, Yahoo joined Microsoft last month in a deal to take advantage of the software company's new Bing search engine.

Since the first of the year, several large multimedia companies have struggled to survive, their reduced revenue unable to cover enormous debt. At least six multimedia firms are operating under bankruptcy court protection, and a handful of newspapers have shut down.

But analysts say the worst may be over.

Brian Wieser, global director of forecasting for Interpublic Group's Magna research unit, said the ad-revenue market probably hit bottom in the second quarter of this year. Interpublic is a global advertising and marketing services firm that is the parent company of numerous well-known marketing outfits.

Zenith Optimedia, a media research company, said in its forecast that the U.S. has either hit its ad-revenue nadir for this recession or should very soon.

Borrell Associates, a Virginia-based media research and consulting firm, issued the strongest prediction in a report released Aug. 4.

"We expect that the decline in newspaper revenues will end this year, and that 2010 will show a 2.4 percent rebound," company President Colby Atwood wrote in "Back from the Brink - Newspapers Stop Their Slide."

'NO CLEAR SIGNS'

Although Magna's Wieser said the ad free-fall likely ended by June 30, he doesn't expect ad revenue to start growing again for at least another year.

"We'll feel better," Wieser said. "It's like you're hitting your head against the wall. If you just start hitting your head with your fist, it feels pretty good in comparison."

In an earnings call with analysts and reporters on Aug. 5, the head of one of the world's largest multimedia companies echoed Wieser's view.

"I think the worst may be behind us," News Corp. Chairman and Chief Executive Officer Rupert Murdoch said, "but there are no clear signs yet of a fast economic recovery."

News Corp. owns several cable-television channels, including Fox News Channel; newspapers ranging from The Wall Street Journal to the New York Post in the United States and numerous others across the globe; and the entertainment company 20th Century Fox.

Ad revenue for all media dropped by 18 percent in the first three months of 2009 compared with the same period in 2008, Wieser said, and probably dropped by another 18 percent in the second quarter, although those numbers haven't been analyzed yet.

Wieser projects an overall decline of 15.5 percent for the year, thanks to improved but still lower revenue in the last two quarters.

The forecaster said total ad revenue will continue to improve in 2010 and 2011 but not return to positive growth until 2012, when he expects a 3.2 percent increase.

Zenith Optimedia, which is owned by Publicis Groupe, is forecasting an earlier bounce, projecting a 1.4 percent increase in U.S. measured media spending by advertisers in 2011.

Borrell Associates forecasts "that by 2014, newspaper income will be up a total of 8.7 percent over the 2009 figures to slightly more than $39 billion.

"That will be short of its 2008 level, but a long way from extinction - and good enough to increase newspapers' share of total ad revenue 1.5 points, from 14.4 percent to 15.9 percent," Atwood wrote.

Borrell does not count newspaper online revenue in its projections, lumping online ads regardless of type of media into a separate category.

A contrary voice comes from Veronis Suhler Stevenson, a private equity firm that invests in information, education and media businesses. VSS has issued its annual Communications Industry Forecast since 1986, using data collected since 1975 (www.vss.com/news/).

The firm predicts that over the next five years more than half of the 20 communications industry segments it tracks will grow, "with the most challenged segments clustered in traditional advertising." VSS predicts that "the bright spot for advertising going forward will be in digital and other alternative and targeted advertising businesses." THE LANDSCAPE

The recession hurt all media - television, radio, magazines,direct mail, online and alternative publications as well as newspapers - in the final quarter of 2008 and first quarter of this year.

Valassis Co., a direct-mail company that also distributes coupons through newspapers, laid off workers early this year after reporting a $222 million loss in the fourth quarter of 2008. The loss came from the company's direct-mail division; its newspaper-coupon division reported a fourth-quarter profit of $2 million.

In the first three months of this year, according to advertising data firm TNS Media Intelligence, total U.S. advertising expenditures plunged by 14.2 percent. That followed a 4.1 percent decline for all of 2008.

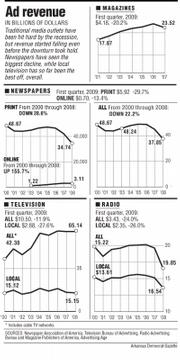

From a revenue perspective, the first quarter was particularly tough for what has come to be called traditional media. Ad revenue was down 29.7 percent at newspapers, 24 percent at radio stations, 20.2 percent for magazines and 11.9 percent at television stations, when compared with the first quarter of 2008, according to industry associations.

The Television Advertising Bureau reported that local broadcast-TV advertising was down even more - 27.6 percent - during the first quarter in the top 100 markets. This advertising excludes the commercial time sold by the national networks.

Automobile advertising, traditionally the largest category of local TV ad revenue, plummeted in the first quarter to less than half of what it was in the same period last year, the television bureau reported.

In another sign of the depth of the advertising recession, the annual negotiations for fall TV advertising spots dragged on for more than a month between television networks and advertisers. Advertisers sought discounts on commercial time in the coming fall season, and the networks made less of their inventory available.

Advertising Age reported Aug. 10 that this fall's network TV "upfront market" totals between $7.8 billion and $8.1 billion, a decline from last year's estimated $9.2 billion, amounting to a fall of anywhere from 10 percent to 20 percent at each of the five broadcast networks. The magazine noted that although the numbers are inexact, they "are often read as a barometer of the relative health of broadcast TV, and even the economy as a whole" (adage.com/mediaworks/).

The magazine also reported on Aug. 4 that the cable television pre-sold ad market likely will be down 7 percent to 12 percent from last year's $7.5 billion.

Wieser, the Magna forecaster who looks at ad revenue instead of spending, expects television and radio ad fortunes to improve sooner than newspapers and magazines.

Ad revenue at local newspapers - a category that excludes a few nationally distributed publications such as The New York Times, The Washington Post, The Wall Street Journal and USA Today - will continue to slide through 2010, Wieser said, dropping to $22.3 billion next year from $46 billion in 2005.

Wieser predicts the newspaper industry will continue to see ad revenue decrease by about 4 percent per year for the next four years. He hasn't forecast the industry beyond 2014.

Magazine ad revenue also will continue to drop, he said - from $22.4 billion in 2006 to $14.4 billion in 2010. The annual decline will range between 1.5 percent and 3 percent over the next four years, he said.

Although Wieser isn't upbeat about the newspaper business, he still thinks it has a place in the media landscape.

"Print newspapers actually do have a future in many markets, to be clear," he said. "But there's far more print than there is advertising to support it."

NEWSPAPERS

For years, annual profit margins for newspapers averaged about 20 percent of sales, which is high compared to many industries and considerably better than the 3.3 percent profit margin Wal-Mart, the nation's largest retailer, had last year.

For 2008, profit margins at large U.S. newspapers were about "flat-line breaking even," said Tim Mather, financial studies manager with the Inland Press Association.

Small newspapers fared better in a recent Inland study. Nineteen daily papers ranging in circulation from 15,000 to 50,000 actually improved their profit margins, the Inland study found.

The profit decline among the majority of newspapers was driven by an unprecedented drop in advertising revenue that began long before the current recession, partly due to migration to other media and partly to mergers that reduced the number of retail advertisers.

Ad revenue fell 29 percent from 2004 through 2008, according to Inland. That includes display and classified ads.

So far this year, at least four newspapers - the Seattle Post-Intelligencer, Denver's Rocky Mountain News, the Tucson Citizen in Arizona and Michigan's Ann Arbor News - have shutdown their print editions.

Ann Arbor became the first U.S. city to lose its only newspaper. The company that owned the newspaper replaced it with an online-only operation. The other three shuttered newspapers were secondary to other dominant papers in their cities; the Seattle and Tucson papers are now online-only.

The owners of both of Chicago's daily newspapers have filed for bankruptcy protection - Tribune Co. in December and Sun-Times Media Group in March. Tribune owns 23 television stations and the Chicago Cubs baseball team, plus the Chicago Tribune and eight other daily newspapers.

For the quarter that ended June 30, Gannett Co. Inc., publisher of USA Today, and Mc-Clatchy Co., parent of The Miami Herald, both reported higher earnings, but the uptick came largely from one-time events.

McClatchy's total revenue fell by 25.4 percent as ad revenue tanked by 30.2 percent. Digital advertising revenue fell by 2.9 percent, mostly on a cutback in employment ads. Excluding the employment ads, online advertising grew by 24.7 percent in the quarter, the company reported.

On Aug. 5, News Corp., owner of The Wall Street Journal and Fox News Channel, reported a $203 million loss for its fourth quarter ended June 30. Much of that loss came from a charge against earnings the company took in writing down the value of its MySpace online social-networking site.

Excluding charges, News Corp.'s profit still drooped 30 percent for the quarter compared with a year earlier. Revenue fell 11 percent to $7.7 billion.

BROADCAST MEDIA

Radio began experiencing a drop in advertising revenue in 2007, when total revenue was 2 percent lower than the previous year's total of $21.7 billion, according to the Radio Advertising Bureau.

Last year, total ad revenue fell to $19.5 billion, down about 9 percent, the radio bureau reported (www.rab.com/public/ pr/yearly.cfm).

The radio group breaks revenue into network, national, local and off-air advertising, with local advertising making up the largest share, about 70 percent.

Local ad revenue dropped by 10 percent last year, totaling $13.6 billion.

In the first three months of this year, radio stations reported total ad revenue of $3.4 billion, a 24 percent plummet from the same period last year. Local advertising for the quarter totaled $2.4 billion, a 26 percent decline from last year, the radio bureau said.

Total broadcast-television ad revenue was down only 0.4 percent in 2008 to $46.4 billion. But that was an advertising-rich presidential election year, so the numbers don't reflect the underlying health of the market, said Gary Belis, a spokesman for the Television Bureau of Advertising.

By comparison, broadcast-TV ad revenue was down 11.9 percent in the first quarter of 2009.

Network-television ad revenue dropped 4.8 percent while syndicated television saw an increase of 0.2 percent.

The recession hit local TV stations hardest in the first quarter, with revenue dropping by 27.6 percent.

Spending was down in nine of local television's top 10 categories, with automotive ads sputtering to a 52.1 percent decline in the first quarter, according to the television bureau. The only top 10 category that showed an increase was advertising for food and food products, which was up 22.3 percent.

Equity Media Holdings Corp. of Little Rock, which owned 121 local television stations, licenses and permits at its peak, has been in Chapter 11 bankruptcy reorganization since last year. It sold about half of its holdings in April.

Clear Channel Communications, the largest radio-station operator in the country with more than 1,200 stations, saw revenue fall 23 percent in its first quarter. The company has reduced staff by 2,440, or 12percent, this year. Clear Channel owns five radio stations in Little Rock.

Local TV and radio stations around the country and in Little Rock - many of them owned by large national corporations like Gannett, News Corp. and Walt Disney Co. - have reduced staff and taken other steps to reduce costs.

Cable television, which gets roughly half of its revenue from subscriptions, has not been immune to the ad recession's effect on debt-burdened companies: Charter Communications Inc., the country's fourth-largest cable company, filed for Chapter 11 bankruptcy protection this year.

INTERNET

In contrast to predictions of continued declines in advertising spending across print and broadcast media this year, Zenith-Optimedia's research analysts expect Internet advertising to grow by 10.1 percent this year.

Internet display ads were the only advertising sector that showed a substantial increase in the first three months of the year, up 8.2 percent, according to TNS.

But online counts for only 7 to 9 percent of all advertising dollars, and studies indicate Internet ads aren't very effective yet. Most online surfers say they've never clicked on an Internet ad.

Still, Brian Kratkiewicz, director of media interactive account services with Cranford Johnson Robinson Woods, said online has proved to be a valuable advertising platform for the Little Rock ad agency.

"We've had great results," he said "We've been driving people to Web sites through our banner ads very effectively."

They may not click on all those Internet advertisements, Kratkiewicz said, but they see the ads and may remember them later, just as motorists see and remember billboard ads.

Most newspapers, magazines and broadcast news stations have a presence on the Internet. But the crux of the problem is this: Advertising on the Web so far can't come close to providing the level of revenue that media outlets need to sustain their news-gathering operations.

Nationwide, online ads accounted for $2.7 billion, or only about 9 percent, of the $30.2 billion spent on all advertising in the first quarter of this year, according to TNS. That percentage was down from previous quarters, but analysts expect online advertising to continue to grow.

Borrell Associates' report said newspaper companies' online advertising will represent an average 7.5 percent of total gross income this year.

PAYING FOR NEWS

The advertising recession is a cyclical problem for media companies, said media business analyst Rick Edmonds of Poynter Institute in St. Petersburg, Fla. It will pass, although some companies will go out of business because they are too burdened with previous debt.

The more persistent problem is fundamental, Edmonds said. Ten years ago, there was no Google or Craigslist, he said, then asked: Who knows what else will come along to further fracture advertising and the audience?

The basic question facing the news industry even before the recession was whether it could "find new ways to underwrite the gathering of news online, while using the declining revenue of the old platforms [like print and broadcast] to finance the transition [to online]," the nonprofit Project for Excellence in Journalism said in its annual report, State of the News Media 2009, this spring.

Many news organizations began laying off reporters and editors or offering buyouts as far back as five years ago to cut costs as revenue and circulation declined.

More than 7,000 journalists lost their jobs last year, resulting in 11.3 percent fewer newspaper journalists and 4.3 percent fewer television journalists, according to surveys by the Radio-Television News Directors Association and the American Society of News Editors.

According to Paper Cuts (graphicdesignr.net/ papercuts), a Web site that monitors newspaper job losses, there were 15,974 layoffs and buyouts at U.S. newspapers last year and 13,253 so far this year as of Friday. Those numbers include all newspaper employees, not just journalists.

The cost-cutting helped large newspapers stem losses in 2008 and broadcast media to remain profitable.

Beyond cost-cutting, newspapers are experimenting with new ways to raise revenue.

"Micropayments," which are payments per story similar to the pay-per-song model of iTunes and other online music services, have been tried and failed, according to the Excellence in Journalism study.

Nonprofit financing might work in some areas - such as health-care or investigative reporting - but it probably won't provide enough funding to become a "general ownership model," the report stated.

Instead, the report suggests other options be considered: The cable model, in which a payment to news producers is built into monthly Internet access fees; building online retail malls within news sites with the news organization getting a point-of-purchase fee; and developing subscription-based niche products for elite professional audiences.

In May, a group of executives from the nation's top news media companies met in Chicago to discuss charging for online access to some or all of the content produced by their news outlets. The companies represented included The Associated Press; Gannett; McClatchy; E.W. Scripps; Hearst Corp.; MediaNews Group; Lee Enterprises; Freedom Communications; and WEHCO Media, parent company of the Arkansas Democrat-Gazette.

Walter Hussman, publisher of the Democrat-Gazette, has led the movement among news executives to adopt a paid model for access to content online. The Democrat-Gazette has charged for access to its staff-produced content for seven years.

In a July 29 online discussion about requiring paid access to online content, Hussman said that charging for unique content helps his newspaper retain its status as the state's primary source of information.

News Corp. Chairman Rupert Murdoch said on Aug. 5 that he plans to charge for access to all his company's Web sites by summer 2010.

"Quality journalism is not cheap," Murdoch said in a conference call with reporters and analysts. "The digital revolution has opened many new and inexpensive distribution channels but it has not made content free."

The concept of paid access does not sit well with some bloggers and media critics.

Reacting to Murdoch, Jeff Jarvis - a City University of New York journalism professor, media consultant and investor in online ventures - said in a column for the Guardian newspaper in Britain (www.guardian.co.uk/ media) that "for most, pinning hopes for the survival of news on charging for it is not only futile but possibly suicidal."

Vivian Schiller, former head of nytimes.com when it charged for some content, told Newsweek recently that the growing sentiment among news executives to start charging for news online is "mass delusion." Schiller is now head of National Public Radio.

Chris Ahearn, president of Reuters Media, in an online column Aug. 4 called for collective problem-solving among traditional media and online media.

"With all the new tools and capabilities we should be entering a new golden age of journalism - call it journalism 3.0. Let's identify how we can birth it ... and have a conversation about how we can work together to fuel a vibrant, productive and trusted digital news industry." Information for this article was contributed by Sonny Albarado, projects editor for the Arkansas Democrat-Gazette.

Front Section, Pages 1, 12, 13 on 08/16/2009