NEW YORK -- Stocks closed modestly lower Friday as oil titans Exxon Mobil and Chevron led a slump in energy stocks.

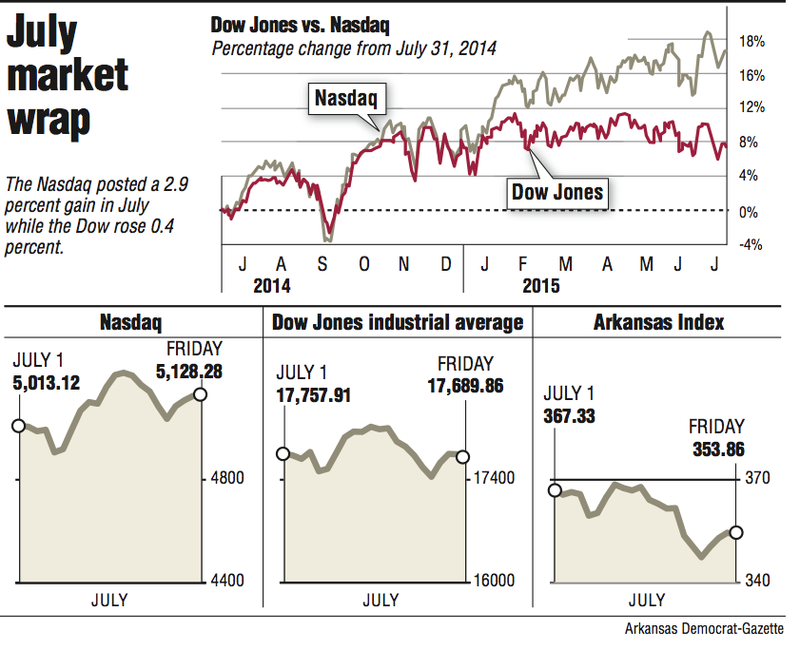

The Dow Jones industrial average lost 56.12 points, or 0.3 percent, to 17,689.86. The Standard & Poor's 500 index lost 4.71 points, or 0.2 percent, to 2,103.92. The Nasdaq composite closed little changed, down half a point to 5,128.28.

It was a seesaw week for the market, but all three major indexes closed higher by roughly 1 percent.

Shares of Exxon Mobil and Chevron, the two largest publicly traded energy companies, fell roughly 5 percent each Friday. Both companies posted major declines in their year-over-year profits largely due to the big drop in the price of oil.

In the case of Exxon, earnings fell 52 percent from a year earlier, causing the company to report its lowest quarterly profit since June 2009. Exxon shares fell $3.80, or 4.6 percent, to $79.21.

Chevron, hurt by low oil prices and a write-off of some of its assets, reported its lowest profit in 13 years. The company reported a profit of 30 cents a share, well below the $1.13 analysts expected. Chevron fell $4.55, or 4.9 percent, to $88.48.

Exxon and Chevron dragged down other energy stocks. The S&P 500 energy sector slumped 2.6 percent, its biggest drop since January.

Energy companies have been a major drag on corporate earnings in the second quarter. S&P 500 companies are on track for a 1.3 percent year-over-year decline in earnings, according to FactSet. If energy firms were excluded, corporate profits would be up 5.4 percent.

Even with oil prices down more than 50 percent from a year ago, crude has continued to fall. Oil prices declined sharply again Friday on continuing concerns over high global supplies and weak demand, helping push oil down 21 percent for the month.

Benchmark U.S. crude fell $1.40 to close at $47.12 a barrel in New York. Crude fell $12.35 a barrel during the month, from $59.47 at the end of June. Brent crude, a benchmark for international oils used by many U.S. refineries, fell $1.10 to close at $52.21 in London.

A disappointing economic report also weighed on stocks.

U.S. wages and benefits grew at their slowest pace in 33 years in the spring, the Labor Department said, evidence that the improving job market is having little effect on paychecks for most Americans. The slowdown likely reflects a sharp drop-off in bonus and incentive pay for some workers.

The lackluster wage growth suggests that companies are still able to find the workers they need without increasing pay, a sign the job market is not yet back to full health. That could cause the Federal Reserve to hold off any increase in interest rates.

Bond prices rose after the report, pushing the 10-year U.S. Treasury note down to 2.19 percent from 2.26 percent Thursday.

"I can't imagine the Fed is looking at [this data] this morning as a reason to increase rates in September," said Tom di Galoma, head of rates trading at ED&F Man Capital.

In other energy markets, wholesale gasoline rose 1.3 cents to close at $1.841 a gallon. Heating oil fell 1.4 cents to close at $1.584 a gallon. Natural gas fell 5.2 cents to close at $2.716 per 1,000 cubic feet.

In metals trading, gold rose $6.50 to $1,095.90 an ounce, and silver rose 5 cents to $14.75 an ounce. Copper fell 1 cent to $2.43 per pound.

Business on 08/01/2015