WASHINGTON -- In a 303-121 vote, the U.S. House approved legislation Wednesday that would keep the Consumer Financial Protection Bureau from penalizing banks and title companies for several months as they adjust to new disclosure forms for people buying or refinancing homes.

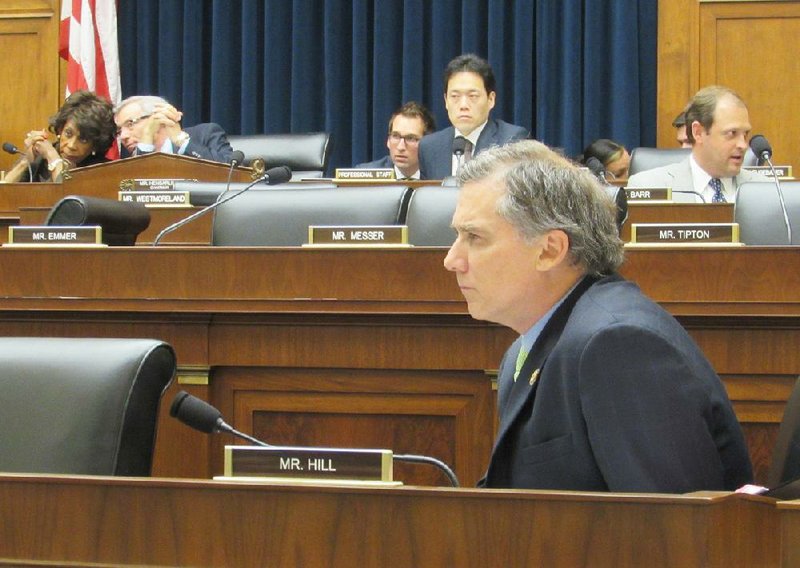

Rep. French Hill, R-Ark., who sponsored the bill, said businesses are concerned that the agency won't be lenient, despite a written promise from the bureau's director. An act of Congress, he said, would give the institutions greater confidence.

RELATED ARTICLES

http://www.arkansas…">Benghazi probe: McCarthy quip a human errorhttp://www.arkansas…">Obama gets $612B defense billhttp://www.arkansas…">House sets review of Planned Parenthood http://www.arkansas…">Crawford floats Cuba trade bill

"They can focus on getting through this confusing transitional period without fear that, on top of already suffering possibly some consumer backlash of a confusing, messed-up closing, that they're also going to have a potential for civil liability or enforcement," Hill said.

The bureau rules were proposed more than two years ago and were delayed once. They went into effect Saturday. The rules require that homebuyers receive easier-to-understand disclosure forms that clearly lay out the terms of a mortgage and also require title loan companies to show they are following certain best practices.

Industry groups say large banks and mortgage companies are likely ready for the switch but small, locally owned companies may struggle at first. More than 630,000 people buy or refinance homes each month, according to the American Land Title Association.

Hill's legislation would keep the agency from enforcing the new penalties until Feb. 1 if companies are making a "good faith effort" to comply. It also keeps people from suing for not getting the disclosure forms if the company fails to provide them before then.

Bureau Director Richard Cordray and the leaders of several other regulatory agencies issued a letter last week trying to reassure lenders and title companies that the agencies would be lenient about enforcement as the industry adapts. It doesn't provide specifics about how long that leniency will last.

The letter was too vague, Hill said.

"It just said that we'll be nice, we'll be thoughtful, if you're making the best efforts, to not pursue any action. It was not what I think would benefit consumers and Realtors and mortgage lenders and title companies, which is assurance that they won't face an enforcement action or civil liability if they are in fact pursuing best efforts to comply," the congressman said.

Hill's career has focused on banking and trusts. He led Delta Trust and Banking Corp. of Little Rock from 1999 until it merged with Arkansas-based Simmons First National Corp. in 2014. Before Delta Trust, he oversaw the trust company and broker-dealer operation at First Commercial Corp. of Little Rock, was executive secretary of President George H.W. Bush's Economic Policy Council and was deputy assistant secretary of the U.S. Treasury.

During debate on the House floor Wednesday, Rep. Carolyn Maloney, D-N.Y., said the bureau has already agreed to be lenient, so a federal law isn't needed.

"While I think this bill addresses an important issue because implementing the new, integrated forms will be complex, the truth is that the [bureau] has already given the industry significant relief on the rule. They've already done it," Maloney said. "The grace period is happening right now, and that's why this bill is just absolutely not necessary."

She and several other Democrats said they are concerned that the bill restricts Americans' ability to file civil suits if they don't receive the disclosures.

"I certainly did not come to Congress to limit in any way or roll back consumer protections," Maloney said. "This is something I am incredibly uncomfortable with."

House Financial Services Committee ranking member Maxine Waters, D-Calif., said Republicans are focusing on the grace period rather than whether consumers can sue if banks and mortgage companies aren't complying.

"I want everybody to be clear that this is not about the grace period, this is not about not giving the industry an opportunity to get its act together. Really, the debate should be about whether or not they protect consumers, and they don't," Waters said.

In a statement of administration policy from the Office of Management and Budget on Tuesday, the White House said that the president was likely to veto the bill if it reaches his desk.

"It would unnecessarily delay implementation of important consumer protections designed to eradicate opaque lending practices that contribute to risky mortgages, hurt homeowners by removing the private right of action for violations, and undercut the Nation's financial stability," it states.

Hill said he doesn't think the veto threat will affect the bill's chances in the Senate.

"We are not changing the regulation. We're purely changing the opportunity for a civil penalty or a regulatory enforcement action for the next few months so that title companies and Realtors and mortgage companies can do the best they can for homebuyers," Hill said.

Metro on 10/08/2015