Escalating tension between Saudi Arabia and Iran means the quarreling governments are likely to use economic tactics that will lead to even lower oil prices, experts said Monday.

Friction between the nations is likely to motivate Saudi Arabia to continue to pump oil into an already flooded market in order to keep prices low. The goal would be to discourage investment in Iranian oil fields just as Tehran is looking to gain a larger share of the oil market, experts said.

"I think the skirmish we just had between Saudi and Iran, I think it leads more to Saudi is going to continue to pump to hurt Iran," said Tariq Zahir, a managing member of Tyche Capital Advisors LLC. "You might get more into a price war."

Lower oil prices will increase pressure on U.S. oil producers, such as Murphy Oil Corp., that have already idled drilling rigs, cut workforces and reduced spending.

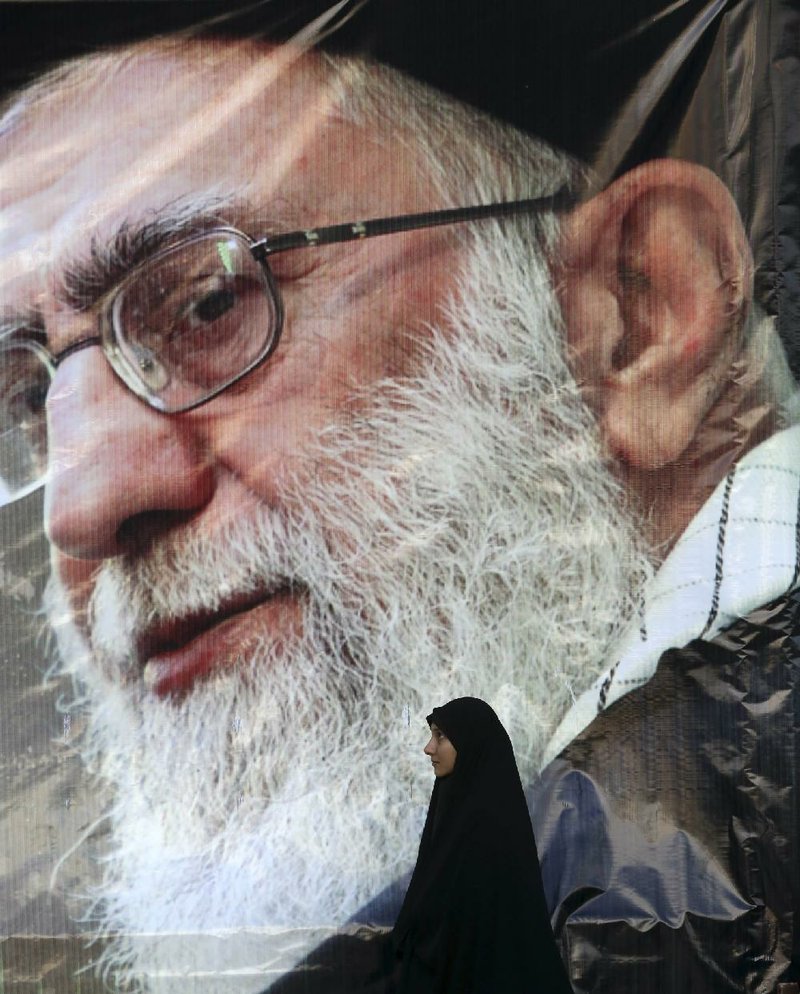

Saudi Arabia cut diplomatic ties with Iran on Sunday after protesters ransacked its embassy in Tehran in response to the execution of a Shiite cleric who had criticized the kingdom's treatment of its Shiite population.

The friction in the region escalated Monday when three Sunni-led countries -- Bahrain, Sudan and the United Arab Emirates -- joined Saudi Arabia in severing or reducing their ties with Iran, The New York Times reported.

In the past, tension between Iran and Saudi Arabia would be enough to give oil prices a boost. However, in the past year or so, geopolitical events have had little effect on the well-supplied oil market.

"Unlike yesteryear, the world, including the U.S. most importantly, is significantly less dependent on Middle Eastern oil, and world strategic stockpiles of oil are at record levels," Omar Al-Ubaydli, program director for international and geopolitical studies at the Bahrain Center for Strategic, International and Energy Studies, said in an email.

"Moreover, all sides have taken steps to ensure that in the event that violent conflict arises, oil facilities and supply routes are secure," he said, pointing to the fact that oil fields in southern Iraq have been unaffected despite the war with the Islamic State in western Iraq.

Oil prices spiked early Monday on concern the conflict between Saudi Arabia and Iran would affect crude supplies, but the rally soon faded and prices dropped. West Texas Intermediate crude, the U.S. benchmark, fell 28 cents to close Monday at $36.76 a barrel on the New York Mercantile Exchange.

"People initially were concerned that this may mean some kind of violence in the region and possible impact on supplies, but as they think about it more, they realized that probably neither Iran nor Saudi Arabia will take steps that will affect supplies directly," said Michael Lynch, president of Strategic Energy and Economic Research Inc.

"They're definitely concerned about violence in that region," he said, adding "The big question is going to be: Are traders and investors going to think that this is the bottom of the market, and are we back in a period of great geo-volatility?"

A slump in the oil market began in 2014 when a global glut coupled with weak demand drove crude prices lower. Oil was selling at more than $100 a barrel at the time. The oil rout continued into 2015, forcing prices down another 30 percent. Analysts say they don't expect oil prices to rebound significantly this year.

Record U.S. production, a result of the nation's shale oil boom, is largely responsible for the abundance of oil on the market.

The Organization of Petroleum Exporting Countries has refused to cut production, a move that analysts say is aimed at defending its market share against increased U.S. shale production.

Traditionally, OPEC, led by Saudi Arabia, would force prices higher by reducing production levels or lowering prices by releasing more oil onto the market.

OPEC members have continued pumping oil and U.S. companies have scaled back their operations in response to lower prices, but domestic production has yet to significantly decrease as companies have become more efficient at drilling and keeping costs down.

Murphy Oil of El Dorado reduced its 2015 budget by about 30 percent and its workforce by at least 23 percent. The company has not yet announced its 2016 capital budget.

"Everyone is producing away," Zahir said, adding that if prices were to suddenly go up, U.S. producers would drill more, adding oil to the market.

Once OPEC's second-largest producer, Iran said it plans to begin exporting more oil as soon as sanctions related to its nuclear program are lifted this year.

While Iran will try to regain its market share by offering attractive contracts to foreign oil companies, Saudi Arabia will do what it can to discourage foreign investment in Iranian oilfields, said Hossein Askari, Iran professor of business and international affairs for the Elliott School of International Affairs at George Washington University.

He called the brief spike in oil prices on Monday morning "a blip."

"It brought to the surface the bad relationship between Saudi Arabia and Iran but I don't think it's going to impact oil prices," Askari said.

"What you have seen here is not a spark to a war but it is something that has brought it to the front pages," Askari said. "I think something else could happen -- that some misadventure could occur ... and that could be a spark for a much widespread problem in the region."

Business on 01/05/2016