After Toyota chose Texas over Arkansas in 2003 to build its full-size pickup, Arkansas lawmakers pushed for a constitutional amendment that allowed them to issue debt to pay companies that bring jobs to the Natural State.

Amendment 82, enacted in 2004, allows the state to finance infrastructure or "other needs to attract large economic development projects" by issuing bonds as long as the total funding for all projects does not exceed 5 percent of the state's general-revenue collection from the past fiscal year.

Now, lawmakers are looking to remove that cap. The proposed amendment, which they referred to voters, is known as Issue 3 on Tuesday's ballot.

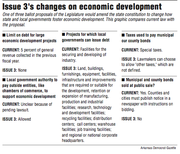

In addition to removing the upper limit on super project spending, Issue 3 would:

[ARKANSAS BALLOT: Vote in our polls for all state races here]

• Allow local governments to pay outside entities, such as chambers of commerce, to support economic development.

• Specify what sort of economic development projects local governments could issue debt to support.

• Allow lawmakers to decide what sort of taxes local governments can use to pay off the debt.

• Remove a requirement that local governments hold public sales of that debt. That means counties and cities will no longer publish notices in a newspaper with instructions for how to bid.

"During my time in the Legislature, I have become more and more aware in how the state does have a role creating an attractive climate for businesses that are looking to locate in Arkansas," said Sen. Jon Woods, R-Springdale, who sponsored the lawmaker-referred amendment. Woods decided not to seek re-election.

"The Arkansas Economic Development Commission gets bombarded with companies -- on a daily basis -- that want to locate in Arkansas. And they want to hire more people or they want to expand, and there's only so much they can do," Woods said.

While proponents like Woods say the provisions in Issue 3 will help companies create jobs in Arkansas, others are skeptical about its effect and cautious about its impact on the public debt.

Jacob Bundrick, a policy analyst with the Arkansas Center for Research in Economics at the University of Central Arkansas, said lower taxes across the board, not state or local money for specific companies, will help Arkansas grow its economy.

"A good business environment doesn't mean special incentives or favors for select companies. It means having a simple, fair and transparent tax environment that interferes as little as possible with economic decision making," he said.

"We hear from some of the proponents of Issue 3 that it will take the handcuffs off of legislators, but a lot of people aren't thinking about why the handcuffs were put there in the first place."

The 5 percent cap means the state is allowed to have about $322 million in outstanding bonds at one time. Lifting the cap means there will be no limit, but lawmakers must still approve any funds spent under Amendment 82.

Scott Hardin, a spokesman for the Arkansas Economic Development Commission, said the state has almost $200 million available to use.

General revenue increases over time. In 2005, for example, the state would have been able to issue $189.5 million worth of bonds.

Issue 3 wouldn't affect the other economic development programs administered by the Arkansas Economic Development Commission. There are more than 10, and they accounted for about $256 million in state government spending from 2012-14, according to records made available under the state Freedom of Information Act.

Amendment 82 -- which would be modified by Issue 3 -- has been invoked twice. In 2013, the Legislature authorized a $125 million bond issue for the Big River Steel mill in Mississippi County under the program. The company promised 525 jobs.

In 2015, lawmakers approved a bond issue of $87.1 million to help Lockheed Martin land a federal contract to build a next-generation military vehicle. The company had already announced that it was coming to the state in 2013. However, Wisconsin-based Oshkosh Defense received the contract, and the bonds were never issued.

"Every individual project must still go in front of the legislature in order to be approved. AEDC, the Governor's Office and the legislature will perform due diligence on each issue and we would never jeopardize the state's fiscal condition for any company," Mike Preston, executive director of the Arkansas Economic Development Commission, said in a statement.

"This is an opportunity to grow in our overall competitiveness with other states as we work to bring more jobs and capital investment to Arkansas. If this does not pass, we fall behind our competitors."

Super projects

Economic development officials often cite Texas as an Arkansas competitor for industrial jobs, as are neighboring states. Missouri, Tennessee, Mississippi and Texas all have automotive assembly plants.

Arkansas has been a potential recipient of one of the plants at least a handful of times.

As far back as 1985, then-Gov. Bill Clinton traveled to Detroit, offering millions of dollars worth of incentives for General Motors to build its new Saturn plant in the state. General Motors chose Tennessee.

In 2007, Arkansas was in the running for a $1.3 billion Toyota SUV manufacturing plant in east Arkansas, but lost out to Tupelo, Miss. Arkansas had offered Toyota $100 million in incentives to come to the state.

And Marion was under consideration in 2003 and 2006 for a Toyota plant. Arkansas offered incentives, but the Japanese company chose sites in Texas in both cases.

Voters approved Amendment 82 in 2004.

One reason was the Toyota miss, said Andy Mayberry, a former lawmaker who is again running for a House seat in East End in Saline County and is a former spokesman of the Arkansas Economic Development Commission.

He helped push for what became Amendment 82 after he left his spokesman post in 2003.

"What Toyota said in the final outcome was something that quite honestly incentives couldn't overcome. They were going to build Tundra trucks, and the market for trucks in Texas is huge," Mayberry said. "Incentives aren't going to win every battle for you. If something's close, they can tip the hat in a particular direction."

More recently, lawmakers touted Lockheed Martin's potential Humvee replacement as a car factory for Arkansas.

However, the federal government chose Oshkosh Defense, which didn't receive any help from its state to build the vehicle. It did not state a reason for its decision, but a federal report indicated that the Lockheed Martin vehicle was not as reliable as Oshkosh Defense's version of it.

And even in successful projects, incentives are not the end-all and be-all.

In a May interview, David Stickler, chief executive of Big River Steel, was asked about the importance of economic incentives.

"No one would ever make a decision to expand or locate somewhere just based on the level of economic incentives," he said. "I think too many people put that at the top of the totem pole. That's part of the equation. It certainly has never been the driving factor."

The Arkansas Legislature authorized $125 million in economic incentives for the Big River Steel project in 2013. The plant must employ 525 people at salaries averaging at least $75,000.

Proponents of Issue 3 say incentives are an important tool in a large toolbox.

Mayberry said he intends to vote for Issue 3 -- though he would prefer some sort of cap on spending -- because the state needs all available resources to attract big projects.

"If you're looking at the automotive industry, basically those supposedly don't go anywhere without that sort of incentive-based proposal," he said.

And Woods, the amendment's sponsor, said the government plays an important role in attracting business.

"Sometimes the private sector just needs a little bit of help," he said. "If they didn't need help, we wouldn't be doing this."

Eliminating the cap on debt would allow lawmakers to land bigger projects, he said.

"I tell people, 'I'm a Republican,'" he said. "I believe in less regulation, less red tape, and so why do we have a cap on bonds when the Legislature is still going to have to approve it?"

Amendment 82 once applied to companies that would create 500 jobs and invest at least $500 million in capital expenditures in Arkansas, but voters removed that requirement in 2010, and now the Legislature gets to decide what should qualify for the funds. The bonds are backed by the full faith and credit of Arkansas.

Local developers

Beyond lifting the cap on Amendment 82 super projects, Issue 3 would allow local governments to pay outside entities, like chambers of commerce, to support economic development.

That's a result of a taxpayer lawsuit in Pulaski County. In 2015, Pulaski County Circuit Judge Mackie Pierce said payments "clearly and totally" violate the Arkansas Constitution.

Little Rock's and North Little Rock's arrangements with the chambers and similar promoters -- the Metro Little Rock Alliance and the North Little Rock Economic Development Corp. -- are "window dressing" to get around the constitutional provision that bars municipalities from giving money to private businesses without getting something in return, the judge ruled.

At a news conference, Little Rock resident Jim Lynch, a plaintiff in the case, called Issue 3 "corporate welfare."

"The chamber, you know it's a free country, they can organize and collect dues from their members and, quote, promote economic development," he said. "That's fine, except our $300,000, you can never tell what they used it for, and the judge found it was simply a cash payment from City Hall to a private organization to do what they were already doing."

Little Rock paid $350,000 annually to the Little Rock chamber and its subsidiary, the Metro Little Rock Alliance; North Little Rock paid more than $265,000 annually to its North Little Rock chamber and the development corporation.

But local economic development organizations say the contracts make sense for taxpayers and local governments.

"It's just a great bill. We're in a bad situation right now to have to vote on something like this," said Lamont Cornwell of the Saline County Economic Development Corp. "With the lawsuit, it just kind of put a hiatus on everything. There's so much uncertainty."

He said he has a contract with the cities and counties that contribute to his agency and he has to report back to them under the terms of the contract, which ensures checks and balances in his work promoting Saline County to employers.

"The main thing [Issue 3] gets us is the ability to compete with other states. Right now, we still can't compete with what's offered in Mississippi or Texas," Cornwell said. "If we don't pass Issue 3, we'll be dead in the water with manufacturing facilities, industrial locations. Right now, if an industrial plant wants to locate in your area, you've pretty much got to have incentives, and most of them want free land, and they're getting it in other states."

Woods said the amendment would unleash local governments.

"There's companies that sometimes would have relocated to Arkansas, but the city couldn't quite pull it off, or the state couldn't quite pull it off, because we didn't have the resources," he said. "We identified a major need."

The proposed amendment would also define what sort of projects for which local governments can issue debt.

Currently, the projects are facilities "for the securing and developing of industry."

Under Issue 3, they would become land, buildings, furnishings, equipment, facilities, infrastructure and improvements that are required or suitable for the development, retention or expansion of manufacturing, production and industrial facilities; research, technology and development facilities; recycling facilities; distribution centers; call centers; warehouse facilities; job training facilities; and regional or national corporate headquarters.

"When a local community has no defined ability to spend funds for economic development purposes, it is at an immediate disadvantage versus communities that have this ability," Preston said. "It gives local economic developers the ability to compete for a variety of projects."

Issue 3 does not change a requirement that cities and counties hold an election to issue bonds, but lawmakers could authorize the use of other tax revenue to pay off economic development bonds. There isn't a limit on the amount of local bond debt. Under the proposed amendment, bonds would no longer need to be sold publicly.

Bundrick, with UCA's Arkansas Center for Research in Economics, said he worried about cities getting into a bidding war with public debt.

"That's going to drive up the tax burden for our taxpayers," he said. "If we're using a lot of debt, the worst scenario, is we risk bankruptcy. This is something that we've seen before."

Arkansas was the only state to go bankrupt during the Great Depression, he said.

"We issued a lot of debt at the local level. There was a big flood. Then we got hit with the Great Depression," Bundrick said. "Localities weren't able to service their debt, so the state took it over. The state wasn't able to service it, and in 1933 we went bankrupt."

But "the cities and counties have their hands tied," Woods said. "I use Russellville as an example. They're sitting on $7 million right now, and they've got a lot of companies looking to locate there, but they don't want to use their tax money and get dinged on the legalities of whether they can use that money or not."

Russellville Mayor Randy Horton said he doesn't believe the city has missed out on any projects because of the current economic development law.

"I can't remember an opportunity coming up that we couldn't use it for," he said. "When you get an opportunity, sometimes whoever the prospect is, they're asking for something that you just can't do, and as I read the new law, you still won't be able to."

For example, a city can't pay a business's private costs out of public money. Horton said he supports Issue 3, but wants the Legislature to place strict limits on how the money is used to prevent waste.

"When it does come down to funding, you need to be responsible," he said. "There's been cases -- I'm not sure this is Arkansas -- but a prospect will come in, dangle a carrot in front of a municipality, boy, it looks like this is going to be the game changer for our little town, but you have to do bonds or otherwise borrow money. Then, if the jobs don't show up or the investors don't show up, you're still stuck with whatever the financing was."

SundayMonday on 11/06/2016