Communications Sales & Leasing Inc. reported a loss of $4.1 million during its 2016 third quarter, the Little Rock company said Monday.

CS&L also said it plans to acquire Network Management Holdings LTD, a private company that owns and operates 359 wireless communications towers in Mexico, Nicaragua and Colombia.

The company said it expects to initially pay $65 million for the purchase of the 359 towers. CS&L also will acquire another 114 towers under the deal once construction of those towers is completed. The entire tower business will operate under the name Uniti Towers.

"This portfolio is a very attractive investment for our tower business with nearly 90 percent of the revenues from the major wireless carriers, and approximately 60 percent from existing CSAL customers," said Kenny Gunderman, president and chief executive officer, in a prepared statement.

"This portfolio further positions us to benefit from growth opportunities in Latin America as the wireless carriers continue to deploy mission critical communication infrastructure," he said.

Communications Sales & Leasing was created last year when Windstream Holdings Inc. spun off its copper and fiber networks into an independent, publicly traded real estate investment trust.

Shares of CS&L tumbled almost 5 percent to $24.34 Monday after the company reported a loss for the third quarter.

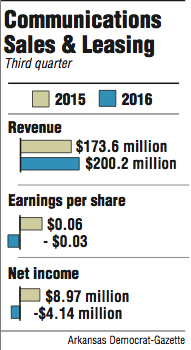

CS&L had a loss of 3 cents per share for the third quarter, compared with a profit of 6 cents per share during the same period a year ago.

The company said it had funds from operations of $99.7 million, or 65 cents per share, for the third quarter. CS&L had revenue of $200.2 million for the period ending Sept. 30, up from $173.6 million a year ago.

CS&L said that the acquisition of Network Management will bring in about $7.9 million in annual revenue and $4.4 million in annual cash flow.

"It certainly appears like it could provide some good opportunities," said Bob Williams, senior vice president and managing director of Simmons First Investment Group Inc. "It remains to be seen whether they can execute on another continent."

The purchase of Network Management comes after CS&L said earlier this year it would purchase Tower Cloud, a privately held data transport services company, in a $230 million deal. The company closed on that acquisition in August.

Business on 11/15/2016