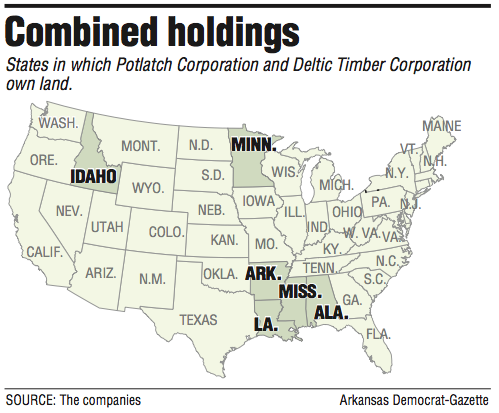

El Dorado-based Deltic Timber Corp. is being purchased by Potlatch Corp. in an all-stock deal that will establish a combined company controlling about 2 million acres of timber in the southern U.S., Idaho and Minnesota, the companies announced Monday.

The name of the merged company will be PotlatchDeltic Corp. The company will employ more than 1,500 people and will control both manufacturing and timberland portfolios. The company will be based in Spokane, Wash., and Deltic's El Dorado operation will become PotlatchDeltic's Southern operational headquarters.

Deltic shareholders will receive 1.8 common shares of Potlatch stock for each common share of Deltic they own, according to a news release. Based on stock prices on Friday, before the deal was announced, the total value of the combined company is about $4 billion, including approximately $700,000 in debt.

Mike Covey, the chairman and chief executive officer of Potlatch, said in a conference call Monday that uniting the two timber companies will increase value for shareholders. Covey said Potlatch approached Deltic Timber several months ago to discuss a possible deal. He said the move will allow for significant improvement in harvest levels on Deltic's property, will increase output from Deltic mills and will reduce corporate overhead.

John Enlow, Deltic Timber's president and CEO, said during the call that after coming on board as chief executive, he oversaw a robust effort to examine the company's options, including a sale. He said he's convinced that the sale to Potlatch is the best path for Deltic going forward.

Enlow took over Deltic Timber's top executive position in March. He had been a vice president at lumber giant Weyerhaeuser. Former President Ray Dillon retired in October 2016 after 13 years with the company.

Mark Benson, vice president of public affairs for Spokane-based Potlatch, said in an interview that the company is no stranger to Arkansas, noting that it has had substantial timber holdings in the state for half of the company's history. He said the two companies had geographic overlap, making the merger a good opportunity for Potlatch.

Shares of Deltic Timber rose $3.65, or a little more than 4 percent, to close Monday at $92.77 in trading on the New York Stock Exchange. Shares have traded as low as $53.21 and as high as $96.65 over the past year. Potlatch shares closed at $52.50, down 50 cents, or less than 1 percent, in trading on the Nasdaq. Shares have traded as low as $36.35 and as high as $56.35 over the past year.

Pete Stewart, president and CEO of the consulting firm Forest2Market, said the national lumber market has recovered slowly and methodically and that production has reached 2006 and 2007 levels, where it was before the housing bubble burst, ushering in a recession. He said today's lumber market is more diversified, with demand coming from steady growth in both the home construction and remodeling segments.

"In this economy, its a pretty good bet to own both trees and sawmills," Stewart said. "That's what Potlatch is thinking."

He said it's clear Potlatch was eager to purchase Deltic, paying a good price for the company, and that the deal shows Potlatch is committed to its operations in the south, particularly in Arkansas and Louisiana.

Both the Deltic Timber and the Potlatch boards of directors have approved the merger. The deal still must be endorsed by shareholders of both companies, meet all closing conditions and be approved by regulators.

PotlatchDeltic will operate six lumber mills, a medium-density fiber board manufacturing operation, and an industrial plywood mill. In total, the company will have the lumber capacity of 1.2 billion board feet, a lot of it highly desirable yellow pine.

It's predicted the combined company will save $50 million on operational improvements. Benson, of Potlatch, said it's too early to determine whether there will be any job losses in the merger but that the majority of workers will be unaffected.

The deal is expected to close during the first half of 2018. When the merger is completed, Deltic shareholders will own about 35 percent of the combined company while Potlatch shareholders will control 65 percent. PotlatchDeltic will trade on the Nasdaq with the ticker symbol PCH.

Founded in 1907 by C.H. Murphy Sr., Deltic Timber was transferred to El Dorado-based Murphy Oil in 1951 and made a subsidiary of the company in 1971, according to the company website. In 1996, Murphy Oil split off its timber assets into a separate company.

According to its 2016 annual report, Deltic Timber's segments include its woodlands division, which oversees the harvest and sale of timber; manufacturing, which includes the company sawmill operations; and its real estate division, which focuses on residential development with four real estate projects in central Arkansas -- including Chenal Valley in Little Rock.

In the report, Deltic Timber said it owned approximately 530,000 acres of timberland. Deltic Timber reported profit of $9.2 million, or 76 cents per share, on revenue of $43.6 million for fiscal 2016.

In February, Deltic Timber fired its chief financial officer, Kenneth Mann, after the board said it became aware that he had misappropriated company assets for personal use. The same month, Southeastern Asset Management Inc., Deltic Timber's largest shareholder with a 15 percent stake, said in a federal filing that there were parties interested in buying Deltic Timber.

Enlow will remain as the merged company's vice chairman and will oversee the combination of the two businesses. Covey will serve as chairman and CEO of PotlatchDeltic, and Eric Cremers, also with Potlatch, will serve as president and chief operations officer of the combined company. PotlatchDeltic's board of directors will be made up of eight directors from Potlatch and four directors from Deltic.

Founded in 1903, Potlatch is a real estate investment trust with about 1.4 million acres of timber in Alabama, Arkansas, Idaho, Minnesota and Mississippi. A real estate investment trust typically owns and often operates income-producing property.

As part of the deal, Deltic Timber must convert to a real estate investment trust structure by the closing date. The companies said this format is better for tax purposes. As part of this move, an estimated $250 million in accumulated profits from Deltic Timber will be distributed to shareholders of the combined company though an 80 percent stock, 20 percent cash dividend by the end of 2018.

Bank of America Merrill Lynch is the financial adviser and Perkins Coie LLP is the legal adviser for Potlatch. Deltic Timber's financial adviser is Goldman Sachs & Co., and Davis Polk and Wardwell LLP is the company's legal adviser on the deal.

A Section on 10/24/2017