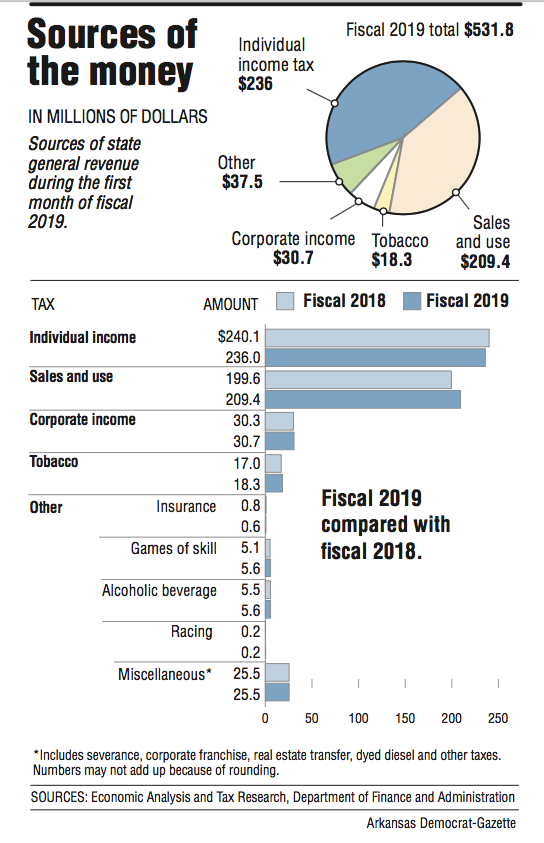

Buoyed by increasing sales and use tax collection, state general revenue increased in July by $7.7 million over the same period a year ago to a record $531.8 million for the month.

July's revenue was 1.5 percent over the same period a year ago and exceeded the state's forecast by $7.2 million or 1.4 percent, state Department of Finance and Administration officials said Thursday in their monthly revenue report.

The previous record collection for July was $524.1 million in 2017, said Whitney McLaughlin, a tax analyst for the department.

Gov. Asa Hutchinson said July revenue outperformed expectations and signals a strong start of the new fiscal year.

"The sales tax collection alone reveals a growing consumer confidence throughout the state and again suggests the economy is continuing to build on the momentum with which we closed out fiscal year 2018," the Republican governor said in a written statement.

"While this is good news, we will continue to monitor these numbers closely as the year progresses," Hutchinson said.

July is the first month of fiscal 2019, which ends June 30, 2019. Midway through, the sales tax on groceries is expected to be trimmed under a 2013 state law and individual income tax rates for Arkansans who make less than $21,000 a year in taxable income will be cut under a 2017 state law, according to state officials.

According to the finance department, July's general revenue included:

• A $9.8 million, or 4.9 percent, increase in sales and use tax collection over July a year ago to $209.4 million. That exceeded the forecast by $1.9 million or 0.9 percent.

The increase in sales and use tax collectios for both June and July have been driven by consumers, John Shelnutt, the state's chief economic forecaster, said. The tax collection from motor vehicle sales in July increased by 8.9 percent from a year ago from $24.4 million to $26.6 million, he said.

• A $4.1 million, or 1.7 percent, decline in individual income tax collection from July a year ago to $236 million, but the total exceeded the forecast by $900,000 or 0.4 percent.

Withholdings are the largest category of individual income tax collection. They declined by $4.8 million from a year ago to $223.6 million, in part because last month had one fewer Thursday payday than did July 2017, said Shelnutt. They exceeded the forecast by $200,000.

• A $400,000, or 1.4 percent, increase in corporate income tax collection compared with a year ago to $30.7 million. The collections in this category exceeded the state's forecast by $2 million, or 7 percent.

• A $1.3 million, or 7.5 percent, increase in tobacco tax collections from the same month a year ago to $18.3 million. The total exceeded the forecast by $1.3 million, or 7.6 percent.

An annual deposit to general revenue from unclaimed property by the auditor's office added $19.4 million to general revenue compared with $21.4 million a year ago. The drop had been expected, said Larry Walther, director of the finance department.

Tax refunds and some special government expenditures come off the top of total general revenue, leaving a net amount state agencies are allowed to spend.

Net available general revenue to state agencies in July increased by $14.9 million, or 3.3 percent, from a year ago to $469.3 million, exceeding the forecast by $9 million or 2 percent.

The Department of Finance and Administration projects 2019 general revenue will total $6.94 billion, which would be a $215.5 million increase over actual collections in 2018, according to department records.

Individual income tax collection are forecast at $3.42 billion, which would be a $69.2 million, or 2.1 percent, increase over actual collection in 2018.

Sales and use tax collection are projected at $2.48 billion, a $70.2 million, or 2.9 percent, increase over actual collection in fiscal 2018, department records show.

Corporate income tax collection are forecast at $482.3 million, a $75.6 million, or 18.6 percent, increase over actual collection a year ago.

For 2019, the state's general revenue budget is projected to increase by $172.8 million to $5.63 billion, over the 2018 budget. The Revenue Stabilization Act for 2019 also would set aside $48 million of what the governor considers surplus revenue for a restricted reserve fund that he said would set the stage for future tax cuts and also set aside $16 million to help match federal highway funds.

TAX CUTS

State officials said the sales tax on groceries is expected to drop from 1.5 percent to 0.125 percent, effective Jan. 1 based on savings from the end of desegregation payments to three Pulaski County school districts under a state law signed by Democratic Gov. Mike Beebe in 2013. The state paid $65.8 million in desegregation payments to these school districts in both fiscal 2017 and 2018, said McLaughlin, the tax analyst.

In addition, the individual income tax rates for Arkansans with less than $21,000 a year in taxable income will be cut, effective Jan. 1 under Hutchinson's tax-cut plan enacted by the Legislature in 2017. The state projects the tax cut will reduce revenue by $25 million in the last half of fiscal 2019 and then $50 million a year thereafter.

In 2015, the Legislature enacted Hutchinson's tax-cut plan to reduce individual income rates for Arkansans earning between $21,000 and $75,000 a year. The state projected that plan would ultimately reduce collection by $100 million a year, starting in fiscal 2017.

In February, Hutchinson signaled he wants lawmakers during the 2019 session to enact his plan to cut the top individual income rate from 6.9 percent to 6 percent, effective Jan. 1, 2020. The state projects that cut would reduce revenue by about $90 million in the last half of 2020 and then $180 million a year thereafter.

Hutchinson of Rogers is seeking re-election to a second four-year term against Democratic candidate Jared Henderson of Little Rock and Libertarian candidate Mark West of Batesville.

The Tax Reform and Relief Legislative Task Force, which has been reviewing the state's tax structure since May 2017, is required under a 2017 law to issue its recommendations to the governor and the Legislature in advance of the 2019 regular session starting Jan. 14.

The task force was created in part to placate some lawmakers who in 2017 favored larger individual income tax cuts, particularly for Arkansans with more than $75,000 in taxable income.

NW News on 08/03/2018