The Missouri nonprofit at the center of an ongoing federal investigation has filed a lawsuit against its former executives over what it describes as "a series of fraudulent acts, embezzlements, and improper self-serving transactions" amounting to millions of dollars.

The 48-page lawsuit, filed Sept. 28 in Greene County, Mo., came about four months after Preferred Family Healthcare told the IRS of several "excessive-benefit transactions" orchestrated by the former leaders, according to a newly obtained copy of its most recent tax filing.

Such dealings violate tax law and can result in the loss of tax-exempt status in extreme cases, according to attorneys.

Preferred Family, which operates in Arkansas and four other states, told the IRS that it was "considering all possible and appropriate legal avenues" to recover the money.

Preferred Family has repeatedly sought to distance itself from former executives who joined the firm as part of its merger with another nonprofit, Springfield, Mo.-based Alternative Opportunities, in 2015. Current leaders have said that the former executives were suspended, then fired, and that the nonprofit has cooperated with the federal investigation.

"This is one of many ongoing steps the company has and will continue to take to turn the page on the past misconduct of former Alternative Opportunities (AO) leaders and employees," attorney Jeff Morris said of the lawsuit in an emailed statement. Morris is a partner at the Kansas City, Mo., firm Berkowitz Oliver.

Arkansas in July suspended Preferred Family from receiving Medicaid reimbursement, prompting the nonprofit to begin selling off its network of 47 substance-abuse and mental-health clinics in the state.

Although the Preferred Family name survived the merger, former Alternative Opportunities executives assumed top leadership roles at the combined organization, which in fiscal 2017 was a $197.8 million enterprise operating in five states.

The federal investigation has resulted in guilty pleas from or charges against several former Preferred Family employees, including ex-Arkansas lobbyist Milton "Rusty" Cranford (bribery) and former state Rep. Eddie Cooper of Melbourne (conspiracy to embezzle).

Cooper, who worked for the nonprofit before and after he left public office, is one of six former Arkansas lawmakers to face federal charges since last year. Five of the six have pleaded guilty to charges or have been convicted by a jury.

Keith Noble, a top-level executive at Alternative Opportunities for years before joining Preferred Family, pleaded guilty last month to concealing a felony. His plea agreement accused other leaders of executing several ploys to steal from the nonprofit and enrich themselves.

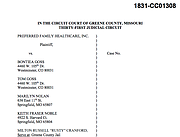

The lawsuit against the former Preferred Family executives names Noble, Cranford and Cranford's Arkansas-based lobbying firm. It also names former Chief Operating Officer Bontiea Goss, Chief Financial Officer Tom Goss, Chief Executive Officer Marilyn Nolan and two for-profit firms controlled by the former executives.

Another defendant is Lori Hayes of Springfield, Mo., both in her position as the executor of former internal auditor David Hayes' estate and as a private citizen accused of accepting embezzled money. She was married to David Hayes, who died from an apparent suicide after pleading guilty to a federal theft charge.

Bontiea Goss, Tom Goss, Nolan, and Lori Hayes have been described, but not named, in federal court filings. None have been charged with crimes. Preferred Family's lawsuit describes the Gosses -- who are married -- and Nolan as "target[s] of an ongoing federal grand jury investigation."

Emails sent Monday to attorneys representing Bontiea Goss, Tom Goss, Nolan, Noble and Cranford about the lawsuit were not returned. A voice mail left at a number listed for Lori Hayes was not returned.

Attorneys representing Bontiea Goss and Tom Goss previously released a joint statement after Noble's guilty plea last month.

"The accusations that Tom Goss or Bontiea Goss acted contrary to the interests of the healthcare organization that they helped found and which under their leadership provided award-winning services to thousands of people are simply false," it said in part.

Chris Plumlee of Rogers, who represents Tom Goss, has said his client "believes he has acted appropriately and lawfully in his duties at Preferred Family Healthcare."

Preferred Family's lawsuit and its tax filing for the fiscal year that ended June 30, 2017, taken together, mostly concern transactions that have been highlighted in federal court filings.

But the accusations also include new details and arrangements, including that the nonprofit paid more than $1 million to Cranford, the Gosses, Nolan and Noble in advanced legal fees dating back to at least February 2017.

Preferred Family committed in signed agreements that month to advance legal fees and costs for Tom Goss, Bontiea Goss and Nolan. Those agreements required repayment of the advanced money if the executives did not operate in the best interest of the nonprofit, did not act in good faith or "had any reason to believe their conduct was unlawful."

Preferred Family's board of directors in January 2018 terminated the agreements for all three of those reasons, according to the lawsuit. Noble's agreement began in November 2017 and was terminated Sept. 28, or more than two weeks after his plea agreement, according to the lawsuit.

The lawsuit does not address legal fees advanced to Cranford, but the nonprofit's tax filing says he received $556,000. The tax filing, or Form 990, says the nonprofit "intends to pursue reimbursement of all legal fees advanced for the executives listed above, plus interest."

Preferred Family's accusations also say Bontiea and Tom Goss from 2006 until 2017 "had no fewer than five personal assistants" on the nonprofit's payroll. The assistants were based in Boulder, Colo., where the family had a home, and did not perform any services for Preferred Family, the suit says.

Instead, they performed chores, provided care to a child, ran shopping errands and ferried family pets to the veterinarian and groomers, the suit says.

Top-level executives also hired family members and paid them more than they deserved for the services they provided, the suit says.

Bontiea Goss' daughter was paid to translate documents, which were often "either left uncompleted or outsourced to third parties," it says, and Nolan's sister received four years of "significant compensation" in exchange for providing food for monthly board of directors meetings.

The suit alleges breach of fiduciary duty, fraud, conversion, unjust enrichment, breach of contract and civil conspiracy.

Other specific accusations include using company time or space to boost for-profit companies owned by the defendants, restricting the flow of information to board members tasked with oversight, and facilitating real estate transactions that benefited executives at the expense of Preferred Family.

Under federal tax law, excess-benefit transactions concern deals in which "disqualified persons" receive compensation or other economic benefit in excess of the the value received by the tax-exempt company.

So-called disqualified persons is a category that includes major donors, nonprofit employees with influence over operations, or for-profit firms owned by disqualified persons.

Tax attorney Stephen Fishman in a 2013 blog post said tax-exempt organizations must "make good faith efforts to correct" those transactions.

"To do this, you must have the disqualified person repay or return the excess benefit, plus interest, and then adopt measures to make sure the same situation doesn't occur again," he wrote on nolo.com. "The IRS will take into account these efforts in deciding what penalties to impose and especially whether to revoke the nonprofit's tax exemption."

Preferred Family did not disclose any excess-benefit transactions on its filing for the fiscal year ending June 30, 2016. The company provided its most recent filing to the Arkansas Democrat-Gazette in response to a request. It has not yet been published in public databases.

"The most recent [Preferred Family tax filing] is one of many efforts undertaken by current PFH leadership to ensure full compliance with our reporting requirements, which includes providing information about activities that occurred prior to former AO leaders' termination," said Morris, the nonprofit's attorney.

A Section on 10/09/2018