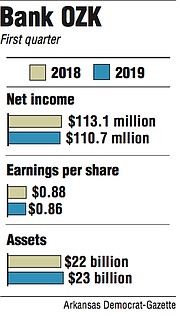

Bank OZK earned $110.7 million in the first quarter this year, a 2.2 percent decrease compared with net income of $113.1 million in the same period of 2018, the Little Rock bank said Wednesday.

Earnings per share were 86 cents, down 2 cents from 88 cents in the first quarter of 2018. That beat the 84 cents a share anticipated by 13 analysts who were surveyed by Thomson Reuters.

Bank OZK released its earnings after the market closed Wednesday. The bank's shares fell 21 cents Wednesday to close at $30.37 in trading on the Nasdaq exchange.

Executives at Bank OZK were pleased with the performance in the first quarter, said George Gleason, the bank's chairman and chief executive officer.

"Our team of industry and technology professionals is well-positioned to capitalize on opportunities throughout 2019 and beyond," Gleason said.

Bank OZK, formerly known as Bank of the Ozarks, had loans of $17.5 billion, deposits of $18.5 billion and assets of $23 billion for the quarter, making the bank the largest in Arkansas.

"The bank continues to control its overhead expenses with an efficiency ratio of 38.5 percent for the first quarter, which is very good," said Garland Binns, a Little Rock banking attorney.

The efficiency ratio means Bank of the Ozarks spends $38.50 to earn $100.

During the quarter, Bank OZK, had $1.9 billion of loan originations in its Real Estate Specialties Group, management said in 36 pages of comments on the first quarter provided by the bank.

The bank expects loan repayments in the Real Estate Specialties Group to continue at an elevated level for the rest of this year, top officials said.

"Such repayments for the full year will likely exceed the level of repayments in 2018, due to high levels of property sales, leasing and refinancing activity," officials said.

The bank's other lending include its recreational vehicle and boat business, and its community banking group.

"Our asset quality remains excellent," officials said. "For the quarter just ended, our annualized net charge-off ratio for non-purchased loans was 0.05 percent, well below the recent industry average."

Bank OZK has achieved record net interest income in 17 of the past 20 quarters, officials said.

Bank officials will conduct a conference call at 3 p.m. today. Participants can hear the call by dialing (844)-818-5110 and asking for the Bank OZK conference call.

Bank OZK has 254 offices in Arkansas, Georgia, Florida, North Carolina, Texas, Alabama, South Carolina, California, New York and Mississippi.

Business on 04/18/2019