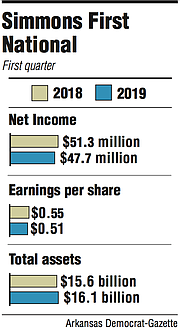

Simmons First National Corp. earned net income of $47.7 million in the first quarter this year, a 7 percent drop from $51.3 million in the same period last year, the Pine Bluff bank said Monday.

Earnings per share were 51 cents, down from 55 cents a share in the first quarter last year. It missed the 54 cents a share projected by seven analysts who were surveyed by Thomson Reuters.

Simmons shares fell 62 cents, or 2.4 percent, to close Monday at $24.85 in trading on the Nasdaq exchange. Simmons released its earnings after the market closed.

Simmons' operating results were affected by several significant items compared with the first quarter last year, George Makris Jr., Simmons' chairman and chief executive officer, said in a prepared statement.

Contributing to the decline was a drop in debit card interchange income, primarily as a result of regulatory requirements, and the gain on the sale of securities, Makris said.

Total loans for the first quarter were $11.7 billion, up from $11 billion in the same period last year. Total deposits were $12 billion for the quarter, up from $11.7 billion for the first quarter last year. Total assets were $16.1 billion for the first quarter, up from $15.6 billion for the same period last year.

Based on the current loan pipeline of potential loans for the bank, Makris estimated Simmons is likely to grow loans about 5 percent this year.

During the first quarter, Simmons identified loans specific to the Dallas market portfolio of Bank SNB, an acquisition of Simmons. The loans were poorly structured or poorly managed, and were primarily linked to one lender, Simmons said. As a result, Simmons made a provision for acquired loans of $2 million related to the Bank SNB loans.

"We have carefully reviewed these loans for potential losses and believe we have adequately identified any risk associated with the loans," Makris said.

Simmons continues to perform well even though net income was down $3.6 million and the efficiency ratio increased 3.6 percent compared with the first quarter last year, said Garland Binns, a Little Rock banking attorney.

Simmons' efficiency ratio was 56.76 percent in the first quarter, which means the bank spends $56.76 to earn $100.

Simmons has offices in Arkansas, Colorado, Kansas, Missouri, Oklahoma, Tennessee and Texas.

Management will conduct a conference call at 9 a.m. today to discuss the quarter. Interested persons can listen to the call by dialing (866) 298-7926 and asking for the Simmons conference call and providing conference identification 455-7809.

Business on 04/23/2019