Beijing pledged Friday to respond if the U.S. insists on adding extra tariffs to the remainder of Chinese imports, as President Donald Trump's abrupt escalation of the trade war between the world's largest economies sent stocks tumbling across three continents.

Trump announced Thursday that he would impose a 10% tariff on a further $300 billion in Chinese imports, a move set to hit American consumers more directly than his other tariffs so far. The new duties, which Trump said could go "much higher," will be imposed beginning Sept. 1 on a long list of goods expected to include smartphones, laptop computers and children's clothing.

The U.S. Trade Representative's Office said it will release the final, official list of products to receive the higher taxes in the coming days.

"China has to do a lot of things to turn it around," Trump said at an event Friday. "Frankly if they don't do it I could always increase it very substantially."

[Video not showing up above? Click here to watch » https://www.youtube.com/watch?v=H8GpExnXB_k]

"If the U.S. is going to implement the additional tariffs, China will have to take necessary countermeasures," Foreign Ministry spokeswoman Hua Chunying said at a regular briefing in Beijing on Friday. She didn't elaborate on what the measures would be.

"China won't accept any maximum pressure, threat or blackmailing, and won't compromise at all on major principle matters," Hua said.

The S&P 500 Index fell for a fifth-straight day, recording the biggest weekly decline of the year. The Stoxx Europe 600 index also slumped, as did equity markets in Asia. The offshore yuan moved closer to a record low.

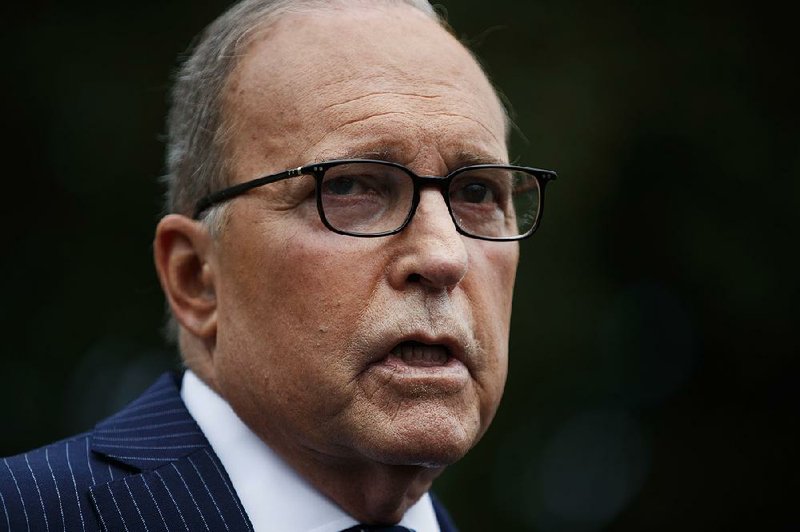

White House economic adviser Larry Kudlow, in an interview on Bloomberg Television, confirmed that the administration is planning to impose the 10% tariff on some Chinese imports on Sept. 1, but signaled that there's a chance it might not. "A lot of good things can happen in a month," he said.

By Friday, the proposed tariffs had triggered worries, especially among retailers, about the consequences. Retail stores, many of which have been struggling, would have to make the painful choice of either absorbing the higher costs from the new tariffs or imposing them on price-conscious customers.

Additionally, China has signaled the likelihood of imposing countertariffs on U.S. goods, which would hit American exporters.

For retailers already feeling pressure, the higher prices would hit hard just as the holiday shopping season gets underway.

Some companies are considering moving up their delivery of goods before the new tariffs take effect. Isaac Larian, CEO of Los Angeles-based MGA Entertainment, which makes the popular L.O.L. doll, said the company will be accelerating shipments from China to the U.S. ahead of the Sept. 1 deadline -- and will pay an extra $300 to $400 more per shipping container to do so.

He envisions having to raise prices 10% across his entire toy line.

"A lot of consumers can't afford it, and demand will go down," Larian said.

iPhone sales would also be hurt if consumers respond to the tariffs by keeping their existing devices to avoid higher prices. Wedbush Securities analyst Daniel Ives estimates that Apple will sell 6 million to 8 million fewer iPhones in the U.S. if it includes the tariff in the sale price.

In 2018, 42% of all U.S. sold apparel was made in China, according to the American Apparel & Footwear Association, a trade group. That number is 69% for footwear.

"This creates a cash crunch, a lot of confusion and uncertainty," said Steve Lamar, executive vice president of the trade group. "It couldn't come at a worse time."

The Trump administration has publicly denied that consumers would be significantly harmed by the tariffs.

"Any consumer impact is very, very small," Kudlow told reporters Friday.

But based on estimates from Oxford Economics, the planned tariffs would cost $200 per household. This would be in addition to the estimated $831 per household cost from the existing tariffs.

Taken together, the tariffs would more than wipe out the savings a middle-class household received from Trump's 2017 income tax cuts. The average tax filer earning between $50,000 and $75,000 paid $841 less in taxes last year, according to Congress' Joint Committee on Taxation.

Many economists forecast that the proposed tariffs would shave about 0.1% off economic growth but that the real risk is a further escalation and side effects that could be devastating.

Bureaucrats in Beijing were stunned by Trump's announcement, according to Chinese officials who've been involved in the trade talks.

Beijing accused Trump of violating his June agreement with President Xi Jinping to revive negotiations aimed at ending a costly fight over Beijing's trade surplus and technological ambitions.

China's new U.N. Ambassador Zhang Jun suggested that the new tariffs could halt negotiations that were expected to resume next month.

China's Foreign Minister Wang Yi made the first official response to Trump's escalation earlier Friday.

"Imposing new tariffs is absolutely not the right solution to trade frictions," he told a local Chinese television station while attending an Association of Southeast Asian Nations meeting in Bangkok.

The strained relationship between Washington and Beijing is showing up in economic data. Through the first six months of the year, China was the third-largest U.S. trading partner, trailing Mexico and Canada and slipping from the top spot it held in 2018. America's merchandise trade deficit with China widened in June to a five-month high despite Trump's effort to narrow it.

China's response is complicated by the fact that the Communist Party's top leadership is likely decamping this week to the seaside resort of Beidaihe for their annual two-week policy conclave. Officials from Xi and below disappear from public view as they privately debate policy.

"For the Chinese, Trump is losing his last bit of credibility here, and whether the talks can be held in September as scheduled has been put into question," said Zhou Xiaoming, a former Commerce Ministry official and diplomat. "Deal or no deal, China is prepared for the worst-case scenario."

China has insisted that it wants to see all tariffs lifted as part of a deal. But according to one person familiar with the discussions, Chinese negotiators in Shanghai insisted that levies would have to be lifted before they would deliver on any changes, something the U.S. has said it would not commit to.

Analysts said the decision to walk away from the Osaka truce indicated a level of desperation by an administration whose efforts to force China to commit to economic changes were going nowhere.

Trump's "trade war with China has failed, and he is doubling down on a failing strategy," said Edward Alden, a senior fellow at the Council on Foreign Relations. "The whole purpose of the tariffs was to force China to make structural changes to its economy. But the tariffs have failed to do that. China is prepared to live with the pain rather than make the changes the U.S. wants."

Information for this article was contributed by David Wainer, Mike Dorning, Jennifer A. Dlouhy, Mark Niquette, Justin Sink, Yinan Zhao, Natalie Lung, Dandan Li, Jenny Leonard, Matt Turner, Brendan Scott and Haze Fan of Bloomberg News; and by Josh Boak, Anne D'Innocenzio, Joe McDonald, Edith M. Lederer and Michael Liedtke of The Associated Press.

A Section on 08/03/2019