Arkansas' public universities have millions of dollars in student accounts receivable, which is money owed to them by current or former students for various expenses.

The schools commonly address the debt by withholding transcripts from students. Where schools differ is in how much debt they allow students to amass before denying those students course enrollments.

At Henderson State University, where a budget shortfall and news of as much as $10 million in accounts receivable drew concern from trustees and others this summer, students were allowed to each accumulate up to $4,800 in debt and continue to register for classes.

Such leeway is not the norm at the state's public universities, where schools sometimes prohibit students from registering if they have any past-due account balances.

Dealing with the debts can be tricky for a school that wants to recoup its expenses but not prevent students from completing their educations and later being able to pay them back.

"In higher education, we have to play a delicate balance of giving students access to education and trying to collect their debt during the school year," said Steve McClellan, vice chancellor for finance and administration at the University of Arkansas at Little Rock.

Critics of schools that withhold student transcripts contend such policies create Catch-22s for students, hamstringing them from getting certain jobs and earning salaries that would allow them to pay their debts. Accounts receivable are especially high at for-profit schools like the now-defunct ITT Technical Institute, they say.

For the universities, especially those facing financial constraints, accounts receivable crimp their bottom lines.

HSU, with about 4,000 students last year, has $9.9 million in accounts receivable -- $3.7 million of it incurred last school year. This spring, the school accepted a $6 million zero-interest loan from the state to help cover current and projected budget shortfalls.

Only $3.1 million of HSU's receivables are 5 years old or older. Another $3 million was incurred between two and four years ago. Students owe another $82,938.77 for the current school year, spokeswoman Tina Hall said. All of the debts belong to a total of 4,449 current and former students.

HSU's unpaid student accounts bubbled to the surface and received larger university oversight this spring when the then-chief financial officer told trustees that the school faced a multimillion-dollar budget shortfall.

University officials retooled the school's accounts receivable policies for new and returning students, outlining payment plan options and introducing caps on debt for students who wish to stay enrolled.

"We have to be very careful with students that have accrued debt," Julie Bates, executive vice president and chief financial officer for the Arkansas State University System, told trustees Aug. 9. ASU is helping HSU straighten out its finances. "We don't want to lose their enrollment, obviously," she said.

HSU acting President Elaine Kneebone told trustees that many of the students in debt had already accepted all of the loans and financial aid afforded them before amassing the debt.

STUDENTS WEIGH IN

The Arkansas Democrat-Gazette reached out to students about their experiences with account balances.

One, who attended a private college, said she did not know she had a balance until a few years after graduating, when she decided to apply to graduate schools and learned that she couldn't get a transcript. The debt was sent to collections, lowering her credit score, which remained low for several years.

She had the means to pay off the $106 she owed, but for some students, paying what they owe may affect their ability to continue attending school.

Some schools have seen the value in helping students pay off those debts.

At Wayne State University in Detroit, the school paid up to $1,500 to students who stopped going to classes because of their account balances, according to an Institute for Higher Education Policy report. They were able to enroll in the fall of 2018, and nine of the 56 who enrolled graduated shortly after. The school reported generating more than $200,000 in net revenue through this spring from the initiative.

At the University of Arkansas, Fayetteville, students who find themselves in life-changing or emergency circumstances may have their debt paid down using money set aside in Chancellor Joseph Steinmetz's office budget. The chancellor's student success committee, established last spring, approves use of those funds. Students do not formally apply for them. It's a pilot program that granted $121,000 to 42 students through July 31. Students received from $500 to $7,900.

"Advancing student success is a guiding priority of the University of Arkansas, and this program is one of the resources identified to support students in times of financial distress," spokesman Steve Voorhies wrote in an email.

The committee also works with campus officials and students to create "financial action plans" to help the students later on.

Student accounts receivable differ from student loans that make up the bulk of public discourse surrounding student finances.

Accounts receivable is owed to the university, rather than the lender. The numbers are much smaller for accounts receivable because loans are used to pay account balances, while the student still owes the lender.

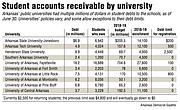

Public records requests sent to each of Arkansas' 10 brick-and-mortar public universities revealed that each had multiple millions of dollars in accounts receivable, ranging from $2.4 million at Southern Arkansas University to $16.2 million at UA in Fayetteville.

Schools often anticipate a certain amount of incurred student debt in their annual budgets.

HSU's debt had a more significant effect on its budget than other schools experience. The $3.7 million incurred ast year makes up 5.3% of the school's $69.7 million budget, if the budget were based on revenue projections of no new debt.

At UALR, McClellan anticipates a million dollars or so in new debts his school, which had an enrollment of about 10,500 last year, more than twice HSU's enrollment.

For the fiscal year that ended June 30, students did not pay the $1.1 million owed, McClellan said. Overall, the school has about $7.5 million in accounts receivable, owed collectively by 4,131 students. About $4.4 million of that has been incurred in the past two years.

The school's budget is much higher than HSU's -- more than $170 million last year, but the $3.3 million not collected during the 2017-18 school year represents about 1.9% of the $169.4 million budgeted that year.

University of Arkansas System trustees questioned UALR officials at their March meeting about the school's accounts receivable. Some questioned whether withholding transcripts made much difference to students in debt, particularly students who had no intention of returning to school.

McClellan noted that after further investigation the figure that trustees had at the time on the UALR accounts receivable -- which was not presented in an agenda packet because it was not an agenda item -- was higher than the actual figure.

The Fayetteville campus of UA collected all but $9.6 million during fiscal 2018, the latest fiscal year for which officials said data were available. That represented about 2.4% of the $399.2 million in tuition owed, according to a spokesman. That year, the school had a $704.6 million total budget and about 27,600 students.

Over all years, UA had $16.2 million in accounts receivable at the end of June 30, 2018. That was owed by 16,689 current and former students.

Most of the debt at SAU at Magnolia is from former students, spokeswoman Caleigh Moyer said. SAU had about $2.4 million in accounts receivable from 1,260 students as of June 30. Of that, $327,739.27 is owed by 336 current students, and $2,045,780.41 is owed by 924 former students. The university enrolled about 4,500 students last year and had a budget of $70.7 million.

Moyer said SAU has a work study program that many students use during the summer to pay off their remaining balances. The university spends more money on its work study than most schools, Moyer said, providing a 76% match to federal funds, compared with the traditional match of 25%. The school also has a paint crew and work crew that employs students, she said.

SAU does not allow students to register for classes if they have any account balances.

Other schools have shied away from the zero-balance threshold and allow students to register if smaller amounts of debt are owed.

POLICIES VARY

The most common ways of reining in indebted students are by restricting registration and withholding transcripts.

McClellan said withholding transcripts has been a policy at all of the three campuses where he's worked.

"I have been in this business 30-something years, and it was in practice when I started," he said.

While withholding transcripts is not a directive from the state or federal governments, it's been supported by government. In a 1998 letter concerning the former need-based federal Perkins Loan Program, the U.S. Department of Education encouraged schools to withhold transcripts of students in debt.

"The withholding of academic transcripts is solely an institutional decision," the letter reads, "but has resulted in numerous loan repayments."

All of the schools that responded to the newspaper's records request indicated that transcripts are withheld if any money is owed.

Like SAU, the University of Arkansas at Pine Bluff and the University of Arkansas at Monticello do not allow students with account balances to register for courses in a coming semester.

UAPB and UAM have higher accounts receivable-to-budget ratios than most of the state's public universities -- $6.8 million in accounts receivable to a $65.2 million budget at UAPB, and $6.2 million in accounts receivable to a $50.1 million budget at UAM.

UAM will waive debts of $20 or below, with Arkansas Department of Finance and Administration permission, if students are no longer enrolled. That $20 is a level at which the cost of collection would outweigh the potential revenue, according to the university. That waiver would allow the former student, if desired, to receive a transcript or register for classes.

The University of Central Arkansas at Conway does not allow students with debt to register without first establishing a university-approved payment plan.

UA at Fayetteville "may" withhold course registration if an account balance is more than 30 days old and more than $100, according to its registration policy.

At Arkansas State University in Jonesboro, students can register for classes only if they owe less than $200.

At UALR, that ceiling used to be $200 but is now $800.

"There were too many students that were struggling," said McClellan, adding that the limit can't be too high.

"If you put your threshold too high, you end up not collecting your money," he said.

Arkansas Tech University at Russellville places a hold on a student's registration when account balances get above $500.

The University of Arkansas at Fort Smith "may" remove students from courses if they have outstanding balances, according to the university's course registration form and undergraduate catalog. The school does not have a more formal policy.

HSU's new policy for this year's incoming students doesn't allow any debts to carry over from previous terms for students who wish to register for classes. The university has a different policy now for returning students, but the eventual requirement will be a zero-account balance in order to register for classes.

Under the new policy, returning students with debt must pay their balances down to no more than $2,500 to enroll this fall. That ceiling lowers each semester until January 2021, when the debt must be fully paid.

Previously, HSU students could register if they had up to $4,800 in debt. Often, students owing more than that received waivers that allowed them to continue registering, university officials have said.

Metro on 08/25/2019