Arkansas' general-revenue tax collections in November increased by $23 million, or 4.7%, over what the state took in for the same month a year ago to $515.2 million, largely as a result of surging individual income-tax receipts and rising sales and use tax collections.

Last month's collections beat the state's forecast by $7.6 million, or 1.5%, the state Department of Finance and Administration said Tuesday in its monthly revenue report.

November's total general revenue collection is a record for the month, exceeding the previous record of $492.2 million in November 2018, said Steve Wilkins, a tax analyst for the department.

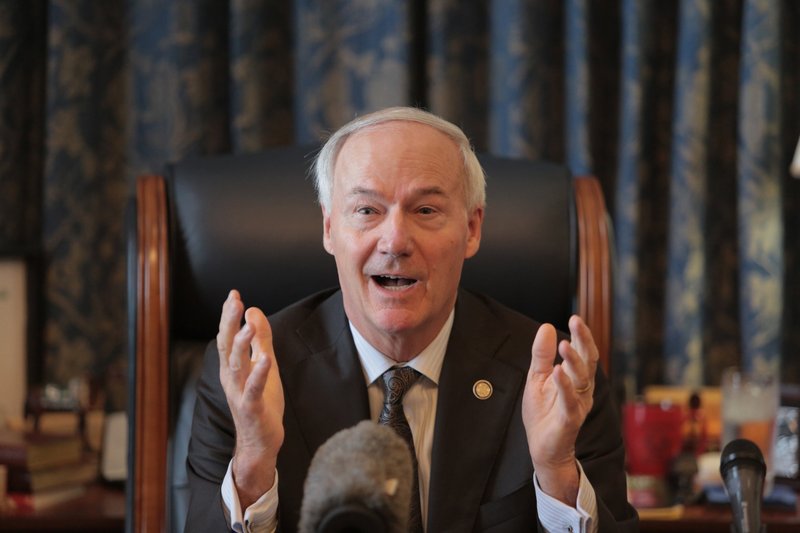

Gov. Asa Hutchinson said the November revenue report "is encouraging as we head into December."

"It shows that our monthly revenues continue to meet and exceed our budget projections," the Republican governor said in a written statement. "We are nearly halfway into the fiscal year, and we continue to be above forecast in individual income and sales tax collections."

Tax refunds and some special government expenditures come off the top of total general revenue, leaving an amount that state agencies are allowed to spend.

Last month's net general revenue increased by $24.7 million, or 6.1%, over November 2018 to $431.8 million and outdistanced the forecast by $15.3 million, or 3.7%, the finance department reported.

"The growth [in the total collections] has resulted in $15.3 million surplus for the month and $87 million surplus for the year to date," Hutchinson said. "With high employment and continued economic growth, our state is in an excellent position for the future."

November is the fifth month of fiscal 2020 that started July 1.

During the first five months of fiscal 2020, total general revenue increased by $104.2 million, or 3.9%, over the same period in fiscal 2019 and exceeded the forecast by $76.8 million, or 2.9%, the finance department reported.

Net general revenue increased by $103.1 million, or 4.5%, over the same period a year ago to $2.41 billion and exceeded the forecast by $87.5 million, or 3.8%.

This fiscal year's general revenue budget totals $5.75 billion, an increase of $124.1 million from fiscal 2019's budget, with most of the increase targeted for human services and education programs. The Republican-controlled Legislature and the governor enacted the budget earlier this year during the regular session.

They also approved Act 182 of 2019 to enact Hutchinson's plan to phase in cuts in the state's top individual income-tax rate from 6.9% to 6.6% on Jan. 1 and then to 5.9% on Jan. 1, 2021. State officials project it will reduce general revenue by $25.6 million in fiscal 2020; by $48.5 million more in fiscal 2021; and by $22.9 million more in fiscal 2022, to ultimately reduce revenue by $97 million a year.

In 2015, the Legislature enacted Hutchinson's plan to cut rates for people with taxable income between $21,000 and $75,000 a year, which state officials projected would reduce tax collections by about $100 million a year.

In 2017, the Legislature approved the governor's plan to cut rates for people with taxable income below $21,000 a year, which state officials projected would reduce tax collections by $50 million a year, starting in fiscal 2020.

In this year's regular session, lawmakers enacted a measure to require out-of-state internet retailers to collect and remit sales taxes on in-state purchases; they also approved a law to phase in cuts in corporate income-tax rates over the new few years.

NOVEMBER DETAILS

According to the finance department, November's general revenue included:

• A $19.2 million, or 8.5%, increase in individual income tax collections from a year ago to $244.4 million, which is above the state's forecast by $4.4 million, or 1.8%.

Individual withholdings are the largest category of individual income-tax collections.

Withholdings increased by $17.9 million, or 8.5%, in November over the same month a year ago to $229.3 million and exceeded the forecast by $3.4 million.

John Shelnutt, the state's chief economic forecaster, said November had one more Thursday payroll than the same month a year ago, and that "was a small positive" that increased individual collections.

The increase in withholdings reflects more people working and more people working longer hours, Shelnutt said.

• A $9.1 million, or 4.5%, increase in sales and use tax collections from a year ago to $214 million, which beat the forecast by $3.2 million, or 1.5%.

The increased sales and use collections are "related to the state of the economy, the low unemployment rate and consumer confidence," Shelnutt said.

"We were actually down in motor-vehicle [sales tax revenue] after two big months so the 4.5% [increase in sales tax collections over a year ago] is with a negative in the motor-vehicle portion ... down 3.2%, or about $740,000," Shelnutt said.

Asked about sales-tax revenue from out-of-state internet retailers, he said, "It is probably running above our estimate, but we don't have a good number for it."

November is the fourth month that the state has been paid tax revenue under Act 822 of 2019 that requires out-of-state internet retailers to begin collecting and remitting taxes on in-state purchases. State officials have projected Act 822 will raise $21.8 million in general revenue in fiscal 2020.

• A $4.5 million, or 48.1%, decline in corporate income-tax collections from a year ago to $4.9 million, which fell behind the forecast by $2.8 million, or 36.6%. One-time payments contributed to the higher collections in November 2018.

The sales tax information in the revenue report doesn't reflect how holiday sales performed around Thanksgiving.

Scott Hardin, a spokesman for the finance department, said sales taxes paid in November will be included in December's figures and reported in January.

CASINOS, HIGHWAYS

Casino gambling revenue in November dropped by $2.4 million, or 46.7%, from a year ago to $2.8 million, but exceeded the forecast by about $700,000, or 31%.

November is the fourth month in which Oaklawn Racing Casino Resort in Hot Springs and Southland Casino Racing in West Memphis are paying a lower state tax rate under Amendment 100 to the Arkansas Constitution, approved by voters in November 2018.

Amendment 100 allows Oaklawn and South to operate as full-fledged casinos and authorizes new casinos in Jefferson and Pope counties, the latter with the approval of local officials. The Saracen Casino Annex, across the street from the Saracen Casino Resort under construction in Pine Bluff, started operations in late September.

State officials expect to take in $31.2 million in fiscal 2020 -- down from $69.7 million in fiscal 2019 -- but they also project that this tax revenue will grow to $55.9 million in fiscal 2021 and steadily increase to $81.8 million by fiscal 2028.

During the first five months of fiscal 2020, casino revenue dropped by $11 million, or 40.3%, to $16.3 million, but exceeded the state's forecast by $1.6 million. It was $27.3 million in the same period in fiscal 2019.

Under Act 416 of 2019, casino-related revenue above $31.2 million will be diverted to the state Department of Transportation, which will be guaranteed a minimum $35 million a year from casino revenue, a restricted reserve fund and other sources. Act 416 also instituted a new wholesale sales tax on fuel and raised registration fees, effective Oct. 1.

These taxes and fees are projected by state officials to raise about $95 million more for state roads and about $13 million a year apiece for cities and counties.

Metro on 12/04/2019