At least two states that border Arkansas -- Missouri and Texas -- use revenue from state sales taxes to provide significant funding for road maintenance and construction.

The main source of revenue for Oklahoma highways, meanwhile, is state income taxes.

The survey of surrounding states underscores that Arkansas isn't alone in tapping other sources of revenue in addition to motor fuel taxes to pay for roadway upkeep.

Arkansas Gov. Asa Hutchinson has proposed asking voters to permanently extend the state's half-percent sales tax for highways as part of a $414 million funding plan for state, county and city road maintenance and construction.

The governor's proposal would direct $300 million to the Arkansas Department of Transportation. The remaining $114 million would be divided between cities and counties.

Extending the tax would raise almost half of the governor's proposed funding plan -- about $205 million -- but only if voters approve it as part of a constitutional amendment lawmakers will consider referring to voters in 2020. The tax was in an earlier amendment that was approved by voters in 2012, but the tax was to be in place for just 10 years, expiring in 2023.

The remaining $209 million in highway funding would be raised through several mechanisms outlined in Senate Bill 336.

SB336 passed the Senate last week and is set to be considered by the House Revenue and Taxation Committee today.

The bill would create a new wholesale sales tax on motor fuels that would raise an estimated $58 million annually. The new tax would be the equivalent of adding 3 cents per gallon of gas and 6 cents per gallon of diesel.

The proposal also includes at least $35 million from casino tax revenue or other state funds, including a restricted reserve fund or general revenue.

Finally, $1.9 million would come from increasing registration fees for hybrid and electric vehicles to make up for the lack of motor fuels taxes they pay.

The governor's proposal would augment revenue the Transportation Department and cities and counties already receive from motor fuel taxes, vehicle registration fees, natural gas severance taxes and other fees.

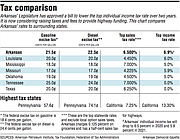

Hutchinson announced his highway funding plan while asking lawmakers to reduce the top individual income tax rate, now at 6.9 percent. The rate will be 5.9 percent in two years.

The states surrounding Arkansas have various methods of paying for their highway programs:

LOUISIANA

Louisiana levies a 20-cent tax on each gallon of motor fuel sold in the state, collecting more than $600 million annually, according to Brandie Richardson, spokesman for the Louisiana Department of Transportation and Development.

The tax hasn't increased since the 1980s, she said.

Richardson's agency received $481.5 million in motor fuel tax revenue in fiscal 2018, Richardson said. That is the equivalent of 16 cents per gallon.

The balance, about $120.4 million, was used to pay off bonds from the Transportation Infrastructure Model for Economic Development program, which focused improvements on 16 road projects totaling about 500 miles that voters approved in 1989.

The original price tag was $1.4 billion. A recent estimate put it at $5.2 billion, with two projects remaining to be completed. It began as a pay-as-you-go program, but delays and cost overruns prompted state officials to issue bonds to speed completion.

Interest payments are expected to continue through 2044 with some of the payments being made from the revenue generated by the 16 cents of the fuel tax going to the department, according to news accounts.

Other revenue the department received in fiscal 2018 included $51.7 million from vehicle registration fees, $31.8 million from interest, fees and fines on overweight truck permits and $36.1 million from the state highway improvement fund, which receives revenue from registration fees for trucks used on roads not eligible for federal funding.

Louisiana's sales tax rate is 4.45 percent and its top income tax rate is 6 percent, according to the Tax Foundation.

MISSISSIPPI

Mississippi relies primarily on revenue from motor fuel taxes to pay for the state's share of roadway maintenance, said Jason Scott, a spokesman for the Mississippi Department of Transportation.

The tax on gasoline and diesel is 18 cents a gallon. The department receives the equivalent of 15 cents per gallon with the rest going to other agencies.

The department's share of state revenue, which includes some revenue from overweight permits and other fees, accounts for $517 million annually. It amounts to about 54 percent of the department's combined state and federal revenue, which is $950 million annually, Scott said.

Mississippi's sales tax rate is 7 percent and its top income rate is 5 percent, according to the Tax Foundation.

MISSOURI

The Missouri Department of Transportation received $363 million in sales tax revenue in the most recent fiscal year, according to the agency. The figure represents the department's share of the amount of tax generated from the sale of new and used vehicles. The state sales tax is 4.225 cents.

The state also collects motor fuel taxes. Gasoline is taxed at a rate of 17 cents per gallon. Diesel is taxed at the same rate. The Transportation Department receives 12.45 cents, or about $350 million annually with the balance -- $126 million -- going to local governments. The department also receives about $4.2 million in driver's license fees and $5.4 million in vehicle registration fees each year, according to Bob Brendel, an agency spokesman.

In November, Missouri voters rejected a proposed 10-cent increase in the gas tax that would have been phased in over four years. The increase was projected to generate $288 million for the Missouri Highway Patrol and $123 million for municipal street construction.

Last month, Missouri Gov. Mike Parson, a Republican, proposed issuing $351 million in bonds to repair or replace 250 bridges around the state. The bonds would be paid back with about $30 million in general revenue annually for 15 years.

A bill also has been introduced in the Missouri Legislature to raise fuel taxes 10 cents over five years.

"We're really early in the session," Brendel said. "We just had a fuel tax increase fail at the ballot. A lot of legislators are reluctant to try anything else after the voters spoke."

The top income tax rate is 5.9 percent, according to the Tax Foundation. Arkansas' top rate will reach that level in two years.

OKLAHOMA

The largest source of revenue for the Oklahoma Department of Transportation is state income taxes. The agency received $476.7 million in income tax revenue in the last fiscal year. The department has received a graduated increasing amount since 2005. The maximum the agency can receive is $575 million, according Cody Boyd, an agency spokesman.

The state charges 19 cents a gallon excise tax on both gas and diesel. The department has typically received $200 million annually in motor fuel tax revenue. But governmentwide budget cuts has reduced that amount in recent years.

The Oklahoma Turnpike Authority is separate from the Transportation Department. It operates Oklahoma's 600 miles of toll roads, second only to Florida. The authority raises about $300 million annually. Its annual maintenance and operating costs totaled $90 million in fiscal 2017, according to the authority website. It set aside $113 million for capital expenses and $108 million for debt service.

Oklahoma's sales tax is 4.5 percent and its top income tax rate is 5 percent.

TENNESSEE

Tennessee is among three surrounding states that rely primarily on motor fuel taxes to raise money to pay for highway maintenance.

The tax on gasoline is now at 25 cents per gallon. The rate for diesel is 24 cents a gallon. Both are scheduled to rise beginning July 1, 2019, as part of a package the Tennessee Legislature enacted in 2017 when the tax rates were 20 cents a gallon for gasoline and 17 cents a gallon for diesel. The gasoline rate will go to 26 cents and the diesel rate will go to 27, according to B.J. Doughty, an agency spokesman.

The gas tax raised $483 million in the fiscal year ending June 30, 2018, she said. The diesel tax raised $159 million in the same period, she said.

The other main source of revenue for Tennessee roads is vehicle registration, which raised $272 million in fiscal 2018, Doughty said. The 2017 tax package, which included cuts to the sales tax on food and phasing out a tax on interest and dividend income, also raised the vehicle registration fee $5.

Tennessee also has a special petroleum tax of four-tenths of a cent on all petroleum products and volatile fuels that raises about $37 million annually for the regulation of underground storage tanks, Doughty said. A beer and bottle tax raises $6 million annually for anti-litter efforts, she said.

While no state sales tax revenue is regularly allocated to the department, Doughty said the department periodically receives some. The state sales tax is 7 percent. Tennessee has no income tax.

"Occasionally the Legislature will give TDOT general fund money for a specific purpose but this is not a routine event," she said.

TEXAS

The State Highway Fund can receive sales tax revenue of up to $2.5 billion annually any time sales tax collections exceed $28 billion in a fiscal year. It received $2.5 billion in fiscal 2018, according to a spokesman for the Texas comptroller's office.

The state sales tax rate in Texas is 6.25 percent. Texas, like Tennessee, has no income tax.

In Texas, the tax on gasoline and diesel is set at 20 cents per gallon. Texas Comptroller Glenn Hegar projects the state will collect $3.7 billion in fuel taxes in fiscal 2019. Of that amount, $2.7 billion will be allocated to the State Highway Fund.

The Texas Transportation Department is forecast to receive more than $3 billion in other revenue in fiscal 2019, including $1.6 billion in vehicle registration fees and $1.4 billion in severance taxes.

A Section on 02/26/2019