United Airlines is the nation's second-biggest airline, but it trails the other three main carriers in market share at Bill and Hillary Clinton National Airport/Adams Field.

A top United executive sees its smaller presence at the state's largest airport as an opportunity.

"We have very low share here," said Mark Weithofer, domestic planning director for United. "I'm a glass-half-full kind of guy. It's an opportunity here. We're real excited."

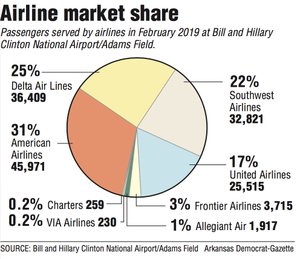

United carried 25,515 passengers, or 17.38 percent of the 146,837 passengers who traveled through Clinton National in February, according to airport data.

American Airlines topped all carriers at Clinton National with 45,971 passengers, which is 31.31 percent. Delta Airlines was next with 36,409 passengers, or 24.8 percent, followed by Southwest Airlines at 32,821, or 22.35 percent.

The airline's performance in February was 17.44 percent better than February 2018. Overall, passenger traffic at Clinton National increased 11.26 percent

Three other airlines serve Clinton National -- Frontier Airlines, Allegiant Air and Via Airlines -- but their presence accounts for less than 5 percent of total passenger traffic.

United began making its move last year. While total passenger traffic rose 5.5 percent, United led the four main carriers with an 11.36 percent increase in passengers.

The goal in 2019 is 12 percent, Weithofer said.

Weithofer spoke at an industry workshop held for the Little Rock Municipal Airport Commission to receive briefings from industry executives. Usually an annual event, the last workshop was held the fall of 2017. This workshop was held last week to accommodate Weithofer's appearance.

The commission also heard from Joseph Pickering, an air service development consultant with Mead & Hunt, which has a contract with the airport.

Clinton National and other small-hub airports are starting to share in the recent national increase in passenger traffic recorded by bigger airports, particularly major hubs, Pickering told the commission members.

Airport passenger arrivals and departures grew 5.5 percent last year. The 2.1 million passengers it handled in 2018 was the largest in five years.

"I'm excited about the options we have been able to work with the airlines to add and I'm really excited with how the people are responding to those options," said Ron Mathieu, the airport's top executive. "We'd like to think the better growth we've had is a result of some better choices and options that people have."

The growth came in a period that saw airport executives hold 18 one-on-one meetings with airline executives since the last workshop to make the case for more service, Pickering said.

While the airport added two airlines last year -- Frontier and Via -- and service to four destinations, including a daily American flight to and from Washington, D.C. -- it also saw airlines continue to move to bigger aircraft to serve the market, which means more seats are available for each departure, he said.

Shifting to a bigger aircraft in a market represents a significant investment for an airline, Pickering said.

Clinton National "continues to fill those seats at the same rate that [it] was filling the lower capacities so that tells me that the Little Rock market continues to grow and respond to that additional investment the airlines are making because that's what drives your success," he said. "If your existing markets are working, you can make the case" for new markets.

United hasn't made a significant investment in larger aircraft serving Clinton National yet. Weithofer said 77 percent of its departures are on single-cabin 50-seat regional jets, which lack amenities such as first-class cabins and in-flight Wi-Fi that business travelers demand.

By contrast, just 4 percent of American's flights departing Clinton National are on the single-cabin 50 seaters. Delta has none.

Many business travelers fly often enough to qualify for special status that make available amenities such as free upgrades. At Clinton National, such upgrades are rarely available for United customers.

"That benefit means nothing to me if the plane doesn't have the product," Weithofer said.

Not all the United 50-seat regional jets will go away, and some may be replaced with bigger 50-seat jets. Built as large as a 70-seater, the new CJR-550 United announced it would buy earlier this year would have more room for passengers and space for a first-class cabin and other amenities.

"We haven't announced route selection, but the criteria that we are using is places that we fly with a high-concentration of single-cabin airplanes that have a large business market," Weithofer said.

Weithofer wouldn't commit to adding direct flights beyond United service to its major hubs in Chicago, Denver and Houston, but he said the airline has other strategies to increase market share.

One is better service at its hubs. The airline re-engineering its flight schedule in Houston, its second-largest hub. The result is that incoming flights can make 53 connections, eight more than before the flight scheduled was re-engineered.

"We saw a big response," Weithofer told the commission.

Another strategy United employed is not removing a third daily flight to Chicago and Denver during the off-peak winter months.

"We're flying a summer scheduled in winter," he said.

Weithofer concedes the strategy to grow its market share involves a mix of poaching passengers from competitors and creating a climate to generate additional traffic.

"There's a little bit of both," he said. "Because of our schedule deficiencies, we didn't have the product consumers wanted or the time consumers wanted. That drove passengers to our competitors.

"Having more flights, more selection on airplanes that have the product will help us. As we grow, we'll stimulate demand, offering people ways to easily get to Hawaii and other trans-Pacific destination that business ties that will spawn economic growth that will generate additional traffic in Little Rock."

He also said he believes if United offers a better schedule at Clinton National, people who had elected to drive to another airport will be more inclined to use Clinton National.

Stacy Hurst, an airport commissioner, questioned Weithofer on the airline's commitment to leisure travelers, which account for 60 percent of the market at Clinton National, given his emphasis on making more amenities available to business travelers.

"Have you decided to cede the leisure traveler to the other airlines?" she asked.

Weithofer conceded that United's mix at Clinton National was "predominantly business."

"It could be because our hubs are in the larger business centers than some of our competitors," he said.

Another is the airline's aircraft are too small. When a 50-seat aircraft only has four seats available on Monday morning and 10 people want it, that will drive prices higher.

But if that aircraft is replaced with a Boeing 737, which has 179 seats, it will have more seats available and give all travelers, including leisure travelers, more options, he said. 'We're counting on a lot of incremental passengers and that is largely leisure passengers."

He also said the airline has seen passenger growth in its Florida connections and is the busiest airline on the Hawaii routes.

"Do you only want to fill seats with people willing to pay $1,000?" Weithofer said. "The answer is no. Leisure is definitely in the mix."

SundayMonday Business on 03/24/2019