WASHINGTON -- With the Social Security fund facing insolvency by 2035, it is crucial that Congress take steps now to shore up the system, members of the House Budget Committee said Thursday.

Otherwise, Social Security recipients face a 20% cut in benefits once the program's trust fund runs out, experts warned during a hearing titled, "Keeping Our Promise to America's Seniors -- Retirement Security in the 21st Century."

"We've all seen the data and read the headlines -- the program is in trouble," said U.S. Rep. Steve Womack, R-Ark. He's the committee's ranking member. "It's our responsibility in Congress to prevent these across-the-board benefit cuts and make sure this program can continue and work better for workers and retirees today and for generations to come."

Problems with the system are expected to accelerate as the nation's population ages.

There are roughly 49 million Americans ages 65 and over; that figure is expected to surpass 79 million by 2035, according to the Social Security Administration.

As the nation's elderly population rises, its birthrate is also in decline, according to the National Center for Health Statistics.

In the U.S., a nation with 327 million residents, only 3.79 million babies were born in 2018, government officials announced Wednesday. That's the lowest number since 1986, when the nation's population stood at 240 million. Fertility rates, meanwhile, are at historic lows, despite strong economic conditions.

By 2035, the nation is expected to have more senior citizens than children under the age of 18, U.S. Rep. John Yarmuth, D-Ky., noted.

Those figures, Yarmuth said, illustrate the challenges ahead.

"Meeting this fiscal challenge will require a clear-eyed acceptance of the demographic realities and a willingness to responsibly raise more revenue over time," he said.

Since it was established in 1935, Social Security has become one of the nation's biggest programs.

This year, more than $1 trillion will be paid out to retired and disabled workers, along with their dependents and survivors. Overall, 64 million Americans -- roughly 1 in 5 -- will be beneficiaries in 2019.

Nearly 90% of all Americans 65 and older are collecting Social Security benefits. For a majority of senior citizens, Social Security is their primary source of income.

In some cases, it is nearly their only source of revenue. According to the Social Security Administration, 21% of married couples receive 90% or more of their income from Social Security; 44% of unmarried couples are in this category.

Social Security has faced insolvency before. But crisis was averted in 1983, when President Ronald Reagan and Congress agreed to slowly raise the retirement age from 65 to 67 while also increasing withholding taxes.

This time, while agreeing that there's a problem, Republicans and Democrats haven't been able to agree on a solution.

The Social Security 2100 Act, co-sponsored by more than 200 Democrats, would attempt to solve the funding shortage by raising taxes.

Each year, between now and 2043, the Social Security tax would rise by 0.1%, slowly climbing from its current level -- 12.4% -- to 14.8%, with workers and employers continuing to split the cost.

Also, high earners would pay more. Currently, the tax is not levied on wages above $132,900. The Democratic plan, while exempting annual wages between $132,900 and $400,000, would collect Social Security taxes on income above $400,000.

The law would set the minimum Social Security retirement benefit at 125% of the poverty level, while increasing benefits for all others by about 2%.

The bill's sponsor, U.S. Rep. John Larson, D-Conn., said lawmakers can't afford to continue the status quo.

"This is our responsibility, at the end of the day," Larson said. "It's time for us to all come together and work collaboratively so that we save this program and enhance it the way it should be."

To find a solution, both sides will have to make tough choices, U.S. Rep. Chris Stewart, R-Utah, said. They may even have to consider tax increases, he added.

"I'm willing to concede that and accept that, and it's hard for me to do," he said. "I didn't come to Congress to raise taxes, but I recognize that's part of the equation. I think we also have to consider raising the retirement age, looking at [cost of living allowance] adjustments, looking at means testing. But if someone is not willing to consider all of those options, then they're not serious about fixing this and they're frankly part of the problem now."

In an interview shortly after the hearing, Womack said neither party can fix Social Security on its own.

"I think there was general consensus among the committee today that it's going to need to be bipartisan and it's going to involve some pretty tough decisions, whether it's revenue enhancements or slowing the growth of benefits or means testing or raising thresholds, those kinds of things," the lawmaker from Rogers said.

Making "appropriate changes" and bolstering the system now will lift a burden off millions of Americans, he said.

"There are a lot of people, a lot of vulnerable people, who only have Social Security as a source of income. And it's important, I think, that we provide them certainty [and] take the threat of insolvency off the table," he said. "They have enough stress already trying to make ends meet rather than be thinking about a 20 [%] or 25% cut."

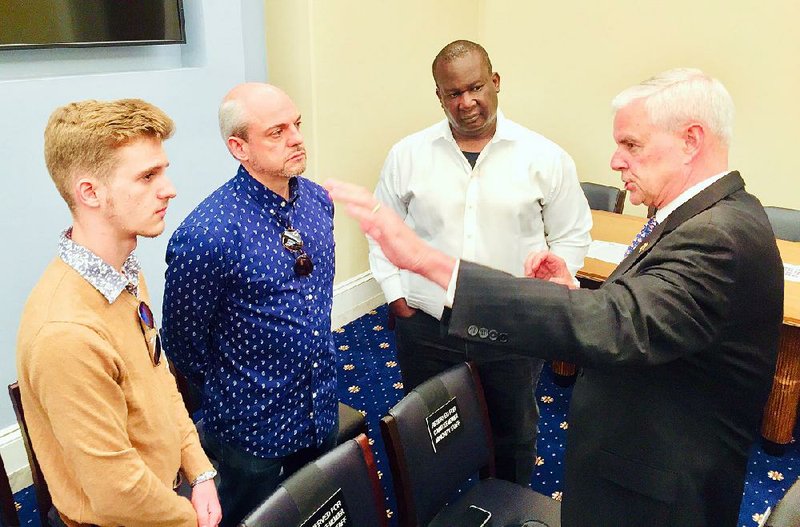

Before exiting the hearing room, Womack stopped to visit for several minutes with four constituents who were spectators at the hearing, 17-year-old Seth Dickson of Rogers and his father, Matthew Dickson, as well as Derrick Thomas and his wife, Robin Thomas, of Fayetteville.

Chatting with Seth Dickson, Womack stressed the importance of saving for retirement from an early age, noting how compound interest can make a big difference over the years.

Asked by a reporter how important Social Security is, Derrick Thomas said, "It's huge. ... It's something that everyone is counting on to be there, and I think it's our responsibility as U.S. citizens to do whatever we can to ensure that it is there for all U.S. citizens when we retire."

Matthew Dickson said he was glad to see Congress addressing Social Security.

"It's an important benefit that we need to figure out how to fix. Because it's obviously broken," he said.

Seth Dickson said he was pleasantly surprised by what he witnessed.

"I heard it was a budget hearing. I heard it was about Social Security. I was kind of like, 'Ah, this might be kind of boring.' But I walked in there, and it was actually a very interesting debate," he said.

Knowing now about the Social Security system's funding problems, "I don't want to rely on it," he added.

Metro on 05/16/2019