Trucking company P.A.M. Transportation Services Inc. reported lower net income and revenue for its 2019 third quarter, citing the ongoing General Motors strike as a major blow.

The United Auto Workers union strike began in mid-September, with GM workers walking out over concerns about pay, profit sharing, job security and health care benefits. The strike has slowed the automotive giant for more than a month, costing GM and its suppliers hundreds of millions of dollars daily, reports show.

The strike meant P.A.M.'s largest customer "essentially shut down operations without warning," P.A.M. President Daniel Cushman said in the company's earnings report.

P.A.M. found replacement freight for the approximately 400 drivers affected by the strike, Cushman said. Some of the replacements came from manufacturing and retail customers in Mexico, with help from the company's cross-border facility in Laredo, Texas. Given the challenges presented by the strike, "I am very pleased with our performance this quarter," Cushman said.

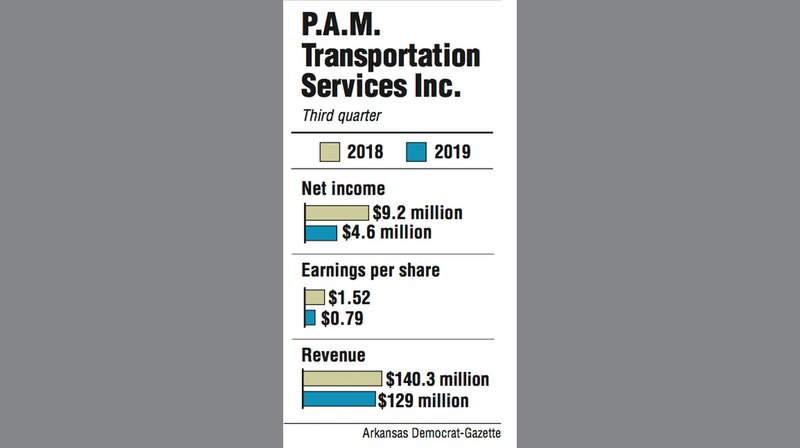

The trucking firm, based in Tontitown, reported net income of $4.6 million, or 79 cents per share, for the three months ending Sept. 30. That is down from $9.2 million, or $1.52 per share, a year ago.

Revenue, including fuel surcharges, was $129 million for the quarter, an 8% decline from $140.3 million last year. Factored into that was a 19% decline in fuel surcharge revenue because of cheaper gas prices.

The company's truckload operations reported total mileage of almost 54 million, down 3% from last year. Revenue per truck per week was $3,466. Revenue per truck per workday was $693.

Meanwhile, P.A.M.'s logistics group reported revenue of $18 million in the quarter, down from $24 million a year ago. Cushman said the division dealt with lower rates in the spot market and other head winds facing the industry. However, he said, things are looking up in two areas: P.A.M.'s customer base is growing, and its coordination between the logistics and trucking side is getting better.

"We expect this growth to be a major contributor to revenue when market conditions improve," Cushman said.

P.A.M. reported $121 million in quarterly costs and expenses, with rent and purchased transportation; operating supplies and expenses; and salaries, wages and benefits making up the bulk of it. This is less than the $127 million reported last year.

For the nine months ending Sept. 30, net income surpassed year-ago figures. P.A.M. reported a profit of $21 million, up from $18 million. Revenue was $391 million for the period, down from $395 million last year.

"The strike is not good for us, and we will not be at optimum performance levels for as long as it lasts," Cushman said. "We need the strike to end."

With the strike now in its fifth week, Bank of America analysts issued a research note on Tuesday estimating that the strike is costing GM about $100 million in lost earnings, before interest and taxes, per day.

The Center for Automotive Research estimated last week that production shutdowns are costing GM about $450 million per week.

"Even with these extreme challenges, our current profit model can adapt to changing circumstances and market conditions," Cushman said. "We have an extraordinary team. We found ways to make a difficult situation positive. We continue to add customers during this difficult phase and believe this will put us in a stronger position over the long run."

Company shares fell $10.94, or 16%, to close Tuesday at $57.06.

Business on 10/16/2019